The Indian economy is booming and so are the daily expenses. Whether it’s your house rent or other commodities that you need daily, the prices are soaring high every day. If that’s not enough, the Income Tax would consume a part of your income.

Gone are those days when only the man used to earn for the family while the woman took care of the home and kids. It has become the topmost priority where the couple has to work in order to cover their expenses and nurture a healthy lifestyle for their family. Irrespective of that, the couple still has to pay the income tax individually every year which takes away a good share of their income.

Today, I would provide you with some effective tips which would help you save Income Tax along with your spouse.

Smart & Effective Tips for Working Couples to save Income Tax:

1) Make investments under the name of any one of you who falls under the lower tax bracket.

Opting for investments for a secured future is must nowadays. Many couples also favour this and make investments on a regular basis but one of the biggest mistakes they make is that they either invest under the husband’s or wife’s name without considering anything regarding income tax. Yes, all the investments you make are bound to generate some income for you and such income is taxable too. Although many banks today offer tax-free investment schemes, not each one of those investment schemes such as bank fixed deposits, recurring deposits, non-convertible debentures, etc. are completely tax-free. Hence, the best alternative to save income tax is to invest under the spouse who falls in the low tax bracket.

2) Make investments under the name of your spouse in tax-free investment options.

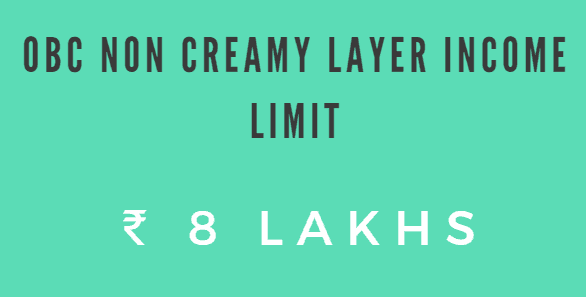

Another smart option to save income tax as a couple is to gift money to your spouse using tax-free investment options like PPF, Tax-free bonds, etc. The income generated from these investment options would be considered as your spouse’s income which will be tax-free. Also, all the further investments of such amount would be considered as your spouse income and you will end up paying less income tax based on the tax bracket of your spouse.

3) Apply for a Home Loan together.

Getting a home of your own is everybody’s dream. With the real estate prices soaring at a new high year after year, it is difficult for an individual to buy a new house. On the other hand, working couples can get a home together by opting for a joint home loan and save huge income tax along the way. You can save tax by opting for the scheme of income tax exemption on the interest on the home loan which is up to an extent of Rs. 2 lakhs per member per annum. In addition, you can also get an 80C exemption on the principal home loan amount of Rs 1.5 Lakhs per member per annum. If planned smartly, the couple can save income tax up to Rs. 7 lakhs of taxable income.

4) Leave Travel Concession (LTA) exemption

Most couples believe that LTA can only be claimed twice within a span of 4 years and only one of them could apply for it. However, it’s not true. With proper planning and a strategic approach, as a couple, you can claim LTA for 4 times in a span of 4 years (Twice by Husband and Twice by Wife) every alternate year. With this approach, you can enjoy a vacation every year. LTA exemption is only valid for travel fare or travelling cost alone. Hotel expenses, food etc. are not included for exemption.

Conclusion:

In the end, it all depends on the couple and their mutual understanding. If you adapt to these smart ways at the beginning of the financial year, you can save maximum income during the year as a couple.

Let us know any trick or tips in the comments below which you have effectively applied to save income tax as a working couple.

Also, don’t forget to share this article with your friends on Facebook or Twitter to help your friends save income tax in the future.

Be the first to comment