Are you a taxpayer? Do you know how to fill the tax filing form? It is the responsibility of every Indian to know the format of filing up the ITR form. You have to fill up the form for verification purpose. When you get the ITR form, go through it.

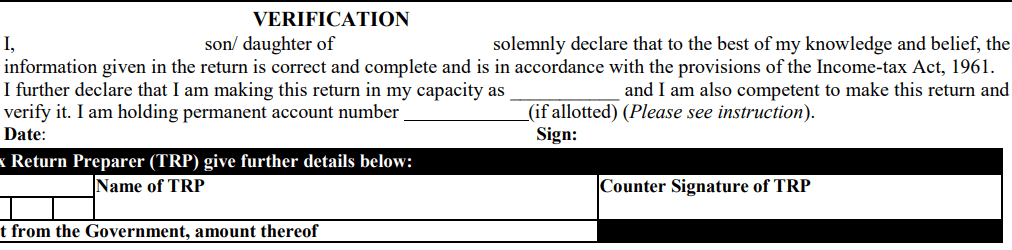

I, (full name in block letters), ____ son/daughter of _____ solemnly declare that to the best of my knowledge and belief, the information given in the return and the schedules thereto is correct and complete and is in accordance with the provisions of the income-tax act, 1961.

I further declare that I am making returns in my capacity as ____ and I am also competent to make this return and verify it.

The taxpayers get confused what to fill in the blank space in the statement “I further declare that I am making returns in my capacity as ____ and I am also competent to make this return and verify it”.

The taxpayers need to mention their position or relation which depends on your relationship with the person. You need to select one of the below-mentioned relations/designations.

- If you are an individual taxpayer- Self

- If you are Hindu Undivided Family (HUF)- Karta

- If you are filing the ITR form for a deceased person- Legal Heir

- If you are filling the form as a partnership firm/LLP- Partner or Designated Partner

- If you are filling the form for your company- Managing Director

- If you are filling the form for your Trust- Managing Trustee or Trustee or Designated Person of the Trust

- If you are filling the ITR form as a POA Holder- Power of Attorney Holder or Authorized Signatory

Make sure to select one of the options appropriately and put your signature at the end of the form.

Be the first to comment