You may have made a payment by cheque to someone, and you are astonished to see that there is a cheque bounce charge being cut from your account. There are various reasons for which such an instance of the cheque being bounced or Returned can happen. Let us know the reasons first, and then we will also make us aware of the Bounce charges in sbi that need to be paid.

Reasons that lead to cheque to be bounced

There are certain reasons when a cheque given by you may be dishonored by your State Bank of India. Let us have a look at the reasons.

Insufficient funds: This is the most common reason for a cheque being dishonored. Let us make us clear with an example. Suppose you have Rs. 10,000.00 in your SBI account.

Now, if you provide a cheque to someone of value Rs. 15,000.00 then the cheque will be dishonored by your bank. The reason for such non-refusal to pay the cheque is not having sufficient fund in your SBI account.

Technical reasons: There may be some technical reasons also which may lead to cheque being not paid by SBI. The technical reasons may be:

- Mismatch of the signature that you have made in the cheque with the signature that is provided by you while opening the account in SBI.

- Not providing any date on the cheque.

- If the cheque is deposited before the date that is mentioned in the cheque. This type of a cheque is called post-dated cheque.

Other reasons: There may be other reasons also which may lead to a cheque being bounced. There may be a failure in the cheque transaction link or power failure. These reasons do not have your immediate involvement as some other reasons may be the cause of such incidents to happen.

So, we can see that all the reasons are not directly linked to you. There are other reasons as seen which do not have your control to be made right.

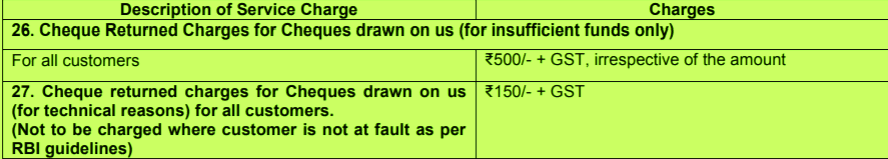

The Bounce charges that have to be paid

There are certain charges that you need to pay when a cheque given by you bounces. As all the reasons are not dependent on you, you do not need to pay the penalties for every cheque that bounce. Let us see the charges in detail:

- If the Cheque bounces for insufficient funds, then you have to pay Rs. 500.00 +GST.

- If the cheque bounces for other technical reasons, then you have to pay Rs. 150.00 +GST.

- If it is seen that you are not at fault according to the RBI guidelines layout, then you do not have to pay any charges.

So, you are now aware of the cheque bouncing charges. Bouncing of cheque due to insufficient funds does not only draw in financial penalties but may even lead to legal actions being taken against you due to fraudulent activity.

So, avoid making a cheque of yours to return due to insufficient funds and avoid such untoward incidents.

the cheque was presented on 2nd August and cheque date was 4th August, why sbi accepted, PDC? why they charged a penalty of Rs 590?

my one cheque is about to clear on 4.8.18

it is a mistake of sbi, airoli branch, they should not have accepted the PDC first and if they find their error, then they should not charge a penalty, Rs 590. SBI-Airoli, to look into this matter, before

If the depositor deposits the cheque late means for an example cheque date is suppose 10th April 2018 but the depositor deposit the cheque on 20th April 2018. Now the account holder who has given the cheque with a mindset for a cheque hit in his account on 10th and for that the amount has kept in the account but the cheque has not deposited in time. Maybe due to any reason the cheque Donner forgot and deposit after 10 days without notice to the cheque donner and ultimately cheque has got bounced due to insufficient fund without any intention of the cheque donner. If Bank can hold and information through electronic media for the information regarding the insufficient fund for clearing the cheque and account with a notice time at least 24 hours. If the account holder’s intention clear about honor the cheque then bank expenditure may be utilized. if the account holder does not turn up to honor the cheque then the penalty must be deducted as per norms.

Those are having the bank account in any specific bank then it is equally a responsibility for the specific bank to help his customer and protect the customer’s money instead of making trouble to his customer. Bank can earn money in other ways but not to make his customers fool.

Please let me reply if (any) bank thinks about his customers.

if bank national holiday and cheque present on my account , and cheque is return

where is our falut

and we deposit our cheque for clearing and my cheque not present other bank why