In banking terms, the cheque is a document that promises to make a payment for a specified amount upon submitting it to the banker. It is also called a negotiable instrument.

Usually, a cheque represents the name of such a person or a beneficiary to whom a specific amount is to be paid. That is known as the payee, the bank that will pay is known as the drawee, and the cheque-drawing person is known as the drawer.

There are different types of cheque that can be used in different situations. However, the Bearer Cheque is the most common type of cheque. If you are issuing a bearer cheque, then you should know the meaning of a bearer cheque.

Bearer Cheque Meaning

A person who submits a bearer cheque to the bank is entitled to withdraw the money. However, A bearer cheque simply means that any such person who is bearing the cheque, or we can say it in a different way that the person who is carrying the cheque, has the legal payment rights at the bank to withdraw the money.

A bearer type of cheque doesn’t include a name. For this reason, the person presenting the cheque at the bank can receive the payment. And there is no need for formal verification of the account holder before making the payment to the person who is carrying the cheque.

A bearer cheque may also be referred to as a ‘carrier cheque,’ for which not any identification as such is required at the bank. However, suppose the bearer cheque is presented to withdraw Rs. 50,000 or more. In such a case, the bank may ask for identification and verify the identity of the individual in whose name the cheque was issued.

Essential Features of a Bearer Cheque

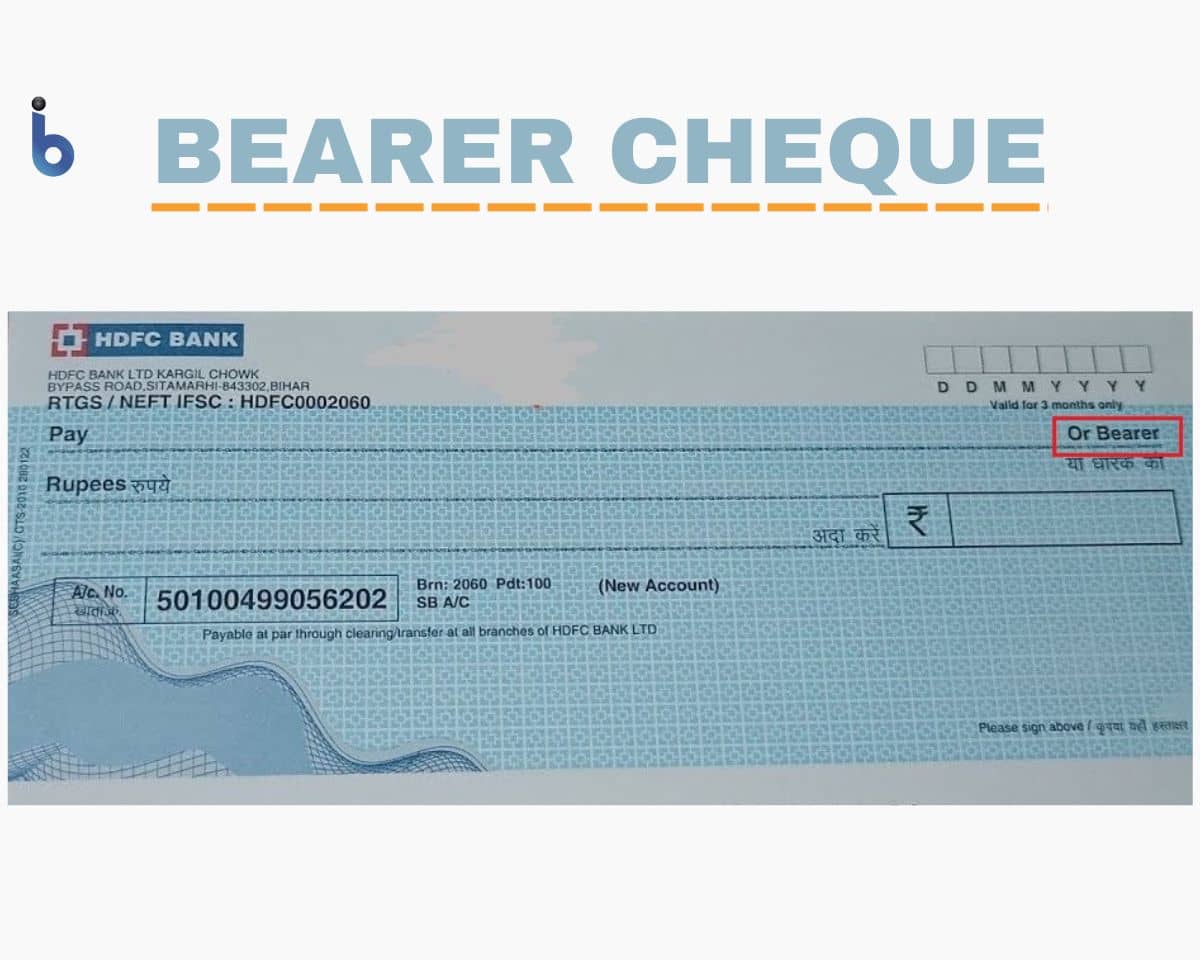

When you see the words such as: ‘Or bearer‘ printed on a cheque, you can quickly know it is a bearer cheque. The bearer cheque doesn’t need you to mention the word “bearer” in the cheque. It has a great feature that you can convert a bearer cheque into an order cheque, and a bearer cheque is transferable only by delivery.

The person who presents a bearer cheque to the bank for withdrawal of the payment does not necessarily have to be a bank account holder. Even the bearer cheque permits you to withdraw money in favor of an individual or a business, as similar to any other cheque.

Benefits of a Bearer Cheque

You should know that a bearer cheque is the most convenient type of cheque to receive payment at the bank counter. It is very helpful to deal in small amounts. And its negotiation is easy for the reason that there is not any permission required from the owner of the cheque.

This type of cheque can also be helpful to those who don’t have a bank account. And they can easily withdraw the payment by cheque from the bank without the need for the signature verification of the payee person.

Risk Involved With A Bearer Cheque

As a matter of precaution, you should add a slash (/) and dash (-) after writing the amount in numbers, such as, for example: “25,000/-.” Also, write ‘only’ after mentioning the amount in words like “Twenty-five thousand only.”

Because as you are well aware of the fact that in case, if the bearer cheque is lost or stolen, then any unauthorized person can not only withdraw your money but also can withdraw more money. For example, words like “Five Lakhs” and numbers like “5” can be easily added to the amount of the cheque. After that, Rs.” Five Lakhs Twenty five thousand” or Rs. “5,25,000” can be withdrawn from your bank account in place of only Rs. Twenty-five thousand or 25,000.

The Concluding Comments

So this way, you can quickly learn all information related bearer cheque. In this post, we have provided you with the basic information about the bearer cheque. Therefore, if you are looking for some guidelines or trying to find an idea on this subject can refer to this article.

Be the first to comment