Filing of an income tax return is prepared by the assessee under section 139 or section 142(1), as per the demand made by the income tax department. When a return is submitted to the Income Tax Department, the department applies different types of checks through computerized software as a part of its review procedure.

When the income tax department processes the return, an intimation order from them will be sent to the assessee under section 143(1). Also, the assessee will receive the intimation notice at their registered email address.

If you are an income tax assessee and receive an income tax intimation notice under section 143(1), then you should know what is the income tax intimation order password.

What Is the Income Tax Intimation Order Password?

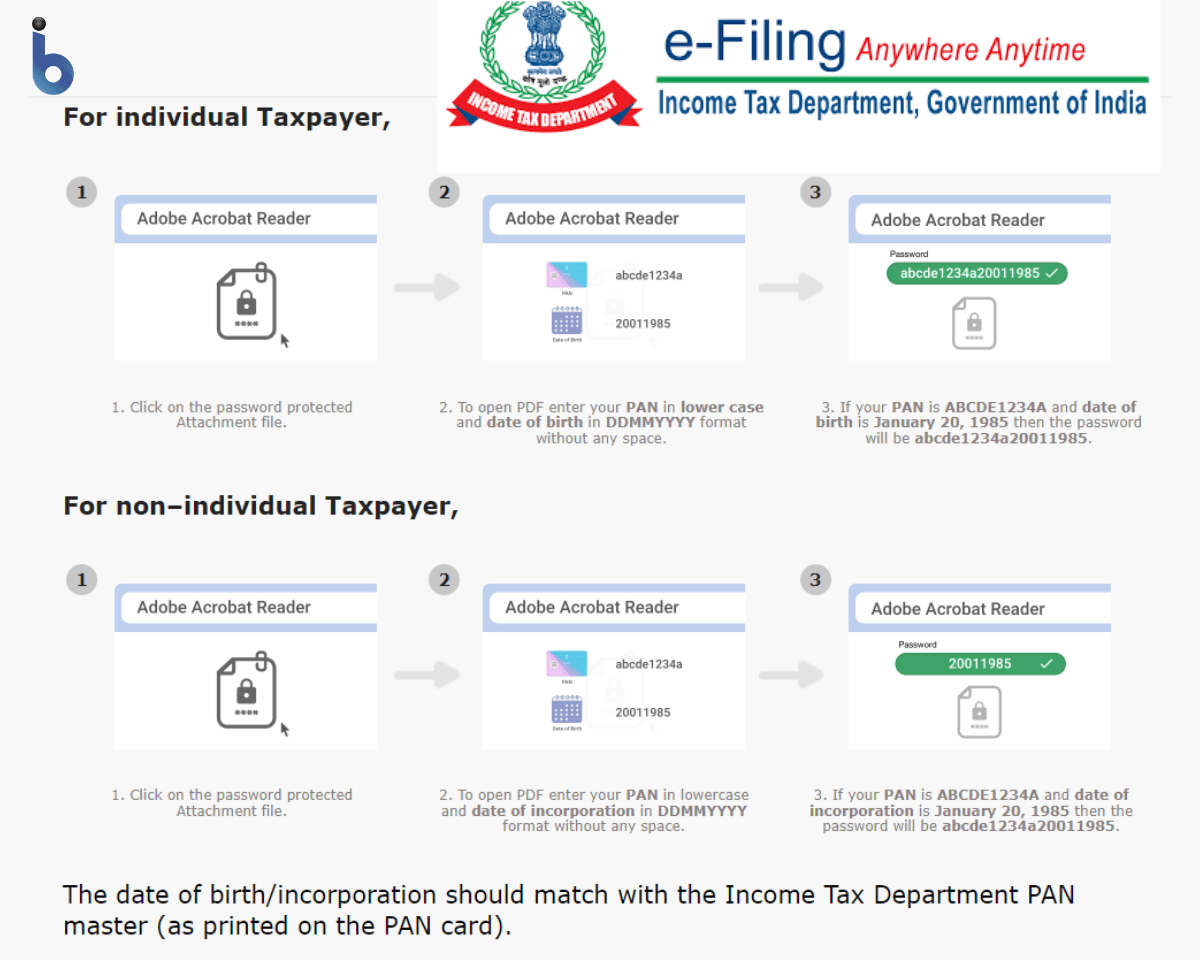

When you receive the income tax intimation order u/s 143 (1) via your registered email, you can not open it directly because the received intimation notice will be a password-protected file. You should follow the below given simple steps to read and take necessary action in this regard, such as:

Step 1: Open Income Tax Intimation order password

Please note that the required password will be your PAN number in lowercase, followed by your date of birth. For example, if your PAN is ABCDE1234G and your date of birth is 27th December 1989, your password will be abcde1234g27121989.

Income Tax Intimation Order Password Example:

| PAN NUMBER | DATE OF BIRTH OR INCORPORATION | INTIMATION ORDER PASSWORD FORMAT |

|---|---|---|

| ADBEF3452C | 15 January 1980 | adbef3452c15011980 |

| HEFTE3245G | 20 December 1990 | hefte3245g20121990 |

| BKTHT4563H | 2 February 2000 | bktht4563h02022000 |

| UFKEG7832D | 13 May 1995 | ufkeg7832d13051995 |

Step 2: You must verify the details as mentioned in the intimation order u/s 143 (1).

Next, as mentioned in the intimation order, you should check that your personal details are correct. Therefore, you should carefully review the name, PAN, and address as they appeared there.

Step 3: You should Check all the calculations as shown in the Income Tax intimation order.

After you make sure that all the details as filed in your income tax return are correct, you are required to compare your income tax computation with that of the Income Tax department. In their intimation order, they will provide you with a table where they produce their calculations next to the calculations provided by you.

In this way, they show your income details along with the details of any tax-saving deductions that you have claimed. Moreover, the intimation order will let you know your tax liability or any tax relief that you have claimed under sections 234A, 234B, and 234C. It will also let you know of any late filing fees that you may need to pay or have already paid under section 234F.

In addition, you can notice a discrepancy in your ITR and the department’s written calculations if there’s any calculation mistake or wrong deduction claimed. In this way, you can know if you are required to pay any more tax or if you have to receive a due refund.

If, in any case, a refund is due to you, the due amount will be credited directly to your bank account. After the due amount is credited to your account, the Income Tax department will notify you of the same.

When Will You Receive the Income Tax Intimation Order

Suppose you’ve filed your return but have yet to receive an intimation notice from the Department of Income Tax in a month or two. You need not worry about that. Because according to the current income tax laws, they have an entire financial year, from the end of the year, during which you have filed the return to process your return.

For example, for the financial year 2019-2020, you would have filed your return by 31st August 2021. The financial year during which you filed the return is 2020-2021. It means that the Income Tax Department has until 31st March 2022 to process your return and send you any notice under Section 143 (1).

In case the deadline of 31st March 2022 passes, and you don’t receive any intimation till then, you should understand the following:

- Your ITR may have been processed correctly, but there could have been an issue while sending the intimation. The e-mail address may have been recorded incorrectly, or a particular system may have failed. In such a case, you can easily raise a service request for the notice under Section 143 (1) via the e-filing website.

- Some paperwork may have gone amiss, and the Income Tax department may not have processed your ITR for some reason. If your paperwork still needs to be processed, you can file a grievance with the department directly on the e-filing website.

So this way, you can quickly learn what is the income tax intimation order password.

Conclusion

Income tax intimation notice is undoubtedly crucial for any assessee, and a password backs it up for security purposes. However, if you were looking forward to knowing more about income tax intimation order Password, we have covered you with the same in this post.

Moreover, we have also let you know when you will receive the Income tax intimation order so that you can be alert.

Be the first to comment