Before we start, we should know about the third-party transfer system. It is a business deal money transaction that involves another party other than the main participants. In this state, third-party involvement can differ as per the business transactions. With the HDFC bank, this transaction needs a beneficiary to add on.

In HDFC Bank, transfer within the same bank is easy. Since you got here to increase the transfer limit of third-party in HDFC, let’s know the initial prerequisite of it. Usually, the third-party transfer limit increase helps to cover the payment process done in seconds. Other than that, the third-party transfer limit increase with HDFC Bank facilitates its customers to leverage the outcomes of a business.

Steps to Increase HDFC Bank Transfer Limit Online

In HDFC Bank, the third-party transfer limit for any amount is from Rs. 1000 to Rs. 50,000,00 for customers’ accounts. Customers have the freedom to set the limit in HDFC Bank online instantly. Besides, they are at liberty to increase or decrease the TPT limit as often as they want. In HDFC Bank, the amount in the Third-party Transfer limit is Rs. 2,000,00. We know as a customer, you’re here for the TPT limit-increasing process, so here we are.

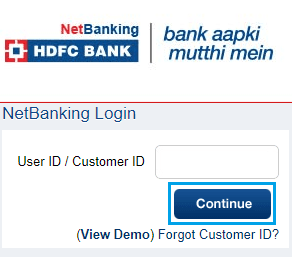

Step 1: First, you must search for HDFC bank net banking. Apart from that, you can simply get into HDFC’s official website and click on the Login option right-hand side above the page. After clicking the option, you can see the net banking option in it.

After entering the Net Banking option, you should log in first with your Customer Id and Password. Put your Customer Id and then click on continue. Then again, you have to put your Customer Id or User Id here and Password accordingly.

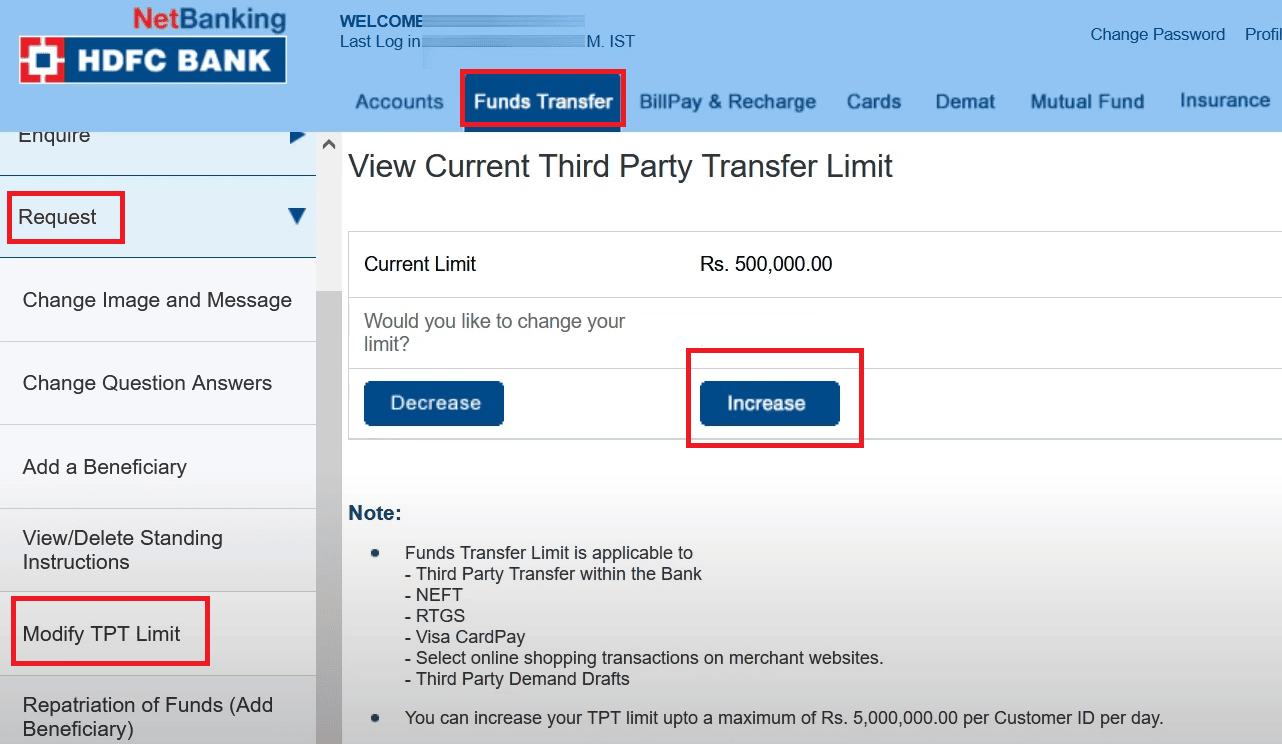

Step 2: Verify secure access id with the given captcha by clicking on the empty box. Click the Login button again on the blue mark. Here, you will enter your net banking account and see several options like Accounts, BillPay & Recharge, Cards, Demat, Insurance, Mutual Fund, Fund Transfer, etc.

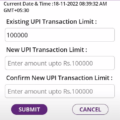

Click the Fund Transfer option to get three more options here, from which you must select Request and then click Modify TPT Limit. After entering View Current Third Party Transfer Limit, you’ll see two options, Increase and Decrease, to adjust your TPT limit in HDFC Bank. Click on the Increase button since you want to increase the limit.

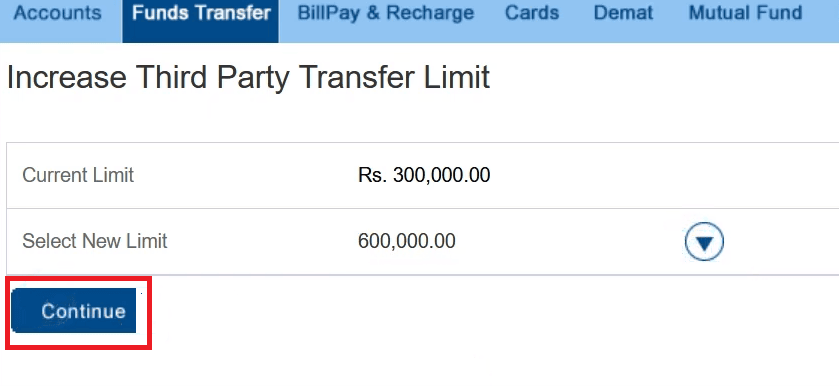

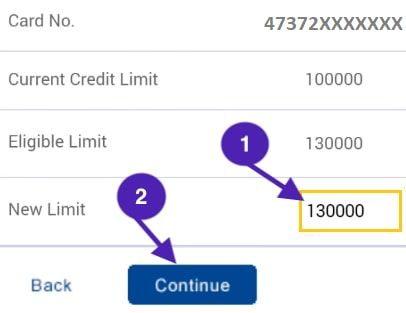

Step 3: In increasing genre, you must choose the amount you want, copious than the current amount. You will allow to see both the previous amount and the new amount you’re putting in. Now click on the Continue button to get into the next step. Here, mark a tick on the empty box to agree with the terms and conditions, and click on the Continue button.

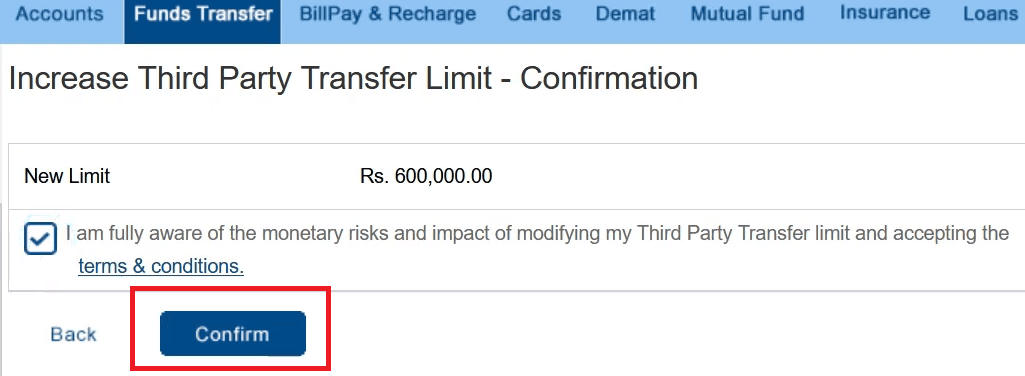

Step 4: The next page will appear with authentication to perform the process of increasing the limit. The HDFC Bank will ask for more authentication to process the transaction. Here, you have to read the processing rules and follow the instruction. Click on the Confirm button to get into a new interface.

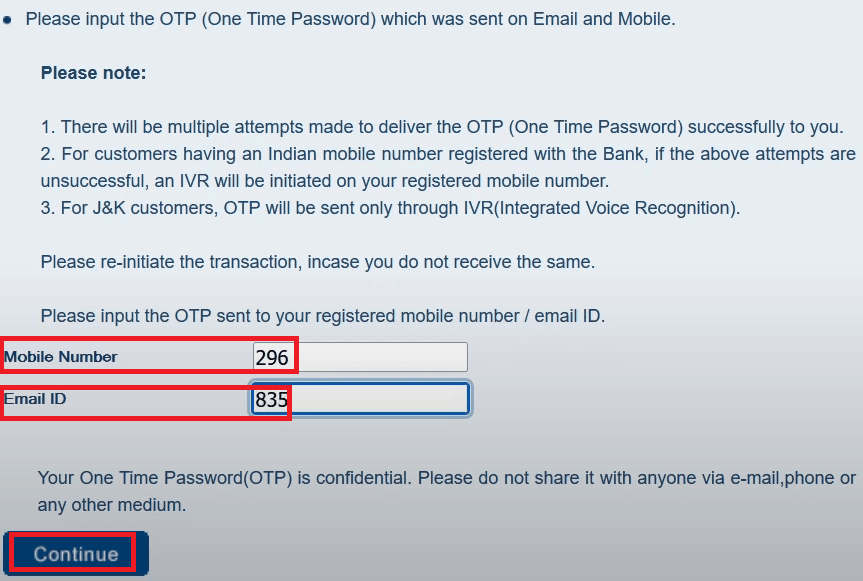

Step 5: You’ll get two different OTPs here, one in your registered mail id and another in your registered phone number. Quell down them in appropriate places and click Continue. Your process will be successful.

Conclusion

HDFC Bank offers all kinds of banking facilities through its official website. You don’t have to go to the bank branch for every little purpose. The website will help you with loans, FD, RD, NRI banking, insurance, and more. You can also visit your nearest HDFC Bank branch with a valid photo ID proof in case you feel inadequate to increase your transfer limit online.

In the HDFC Bank branch, you’ll have to submit the TPT limit increase form. In the banking area, some simple steps can solve your bank problems. So try to read all the steps till the end and follow them.

Be the first to comment