Personal loans are quite popular today for many different reasons. Personal loans are the best remedy to overcome any unforeseen costs at an interest rate lower than that of a Credit Card. For homeowners, these loans can come handy to build the property value while it may also be worthy to enjoy a long vacation with your loved one or shower your loved one with a high priced gift. In emergency situations or some urgent fund requirements, personal loans are always considered as the better alternative compared to credit cards.

But getting a personal loan is not as easy as you think. Although it is an unsecured loan, there are chances that you might be turned down for a personal loan for different reasons. Being an unsecured loan, financial institutions have restricted the credit criteria which makes it difficult for many individuals to qualify for the loan.

Hence, the chances of getting a personal loan from any financial institution are quite moderate and only those candidates who fit into the credit criteria designed by any financial institution are eligible for a loan. Before discussing your probability of getting a personal loan, you must understand the basic difference between Secured and Unsecured loans.

Also Read: 5 Popular Reasons Why Someone Would Opt For Personal Loans

The Difference Between Secured and Unsecured Loans

As discussed before, a personal loan is classified as an unsecured loan which implies that there’s no collateral necessary to apply for the loan and the approval of your loan solely depends on the bank analysis about your repaying capability. Whereas, in case of secured loans such as car loan or home loan, the bank has the security in terms of the vehicle or house for which you have applied the loan for. To assure repayment and manage the high risk of personal loans, the banks and other financial institutions rely only on individuals with high credit score.

Reasons for Personal Loan Denials:

There are several reasons that can lead to disapproving your personal loan applications from banks or other financial institutions. Most of the reasons are based on a checklist that covers the basic necessities required to be eligible for a personal loan such as having a stable job, steady income and financial stability.

However, there are 3 basic reasons why most of the personal loans application get rejected:

1. Bad Credit History:

The major reason why personal loan applications are denied is bad credit history. If you already have so many debts to repay and if your credit history shows delayed or missed repayments, then, of course, it can work as a red signal for your loan application. When you’re applying for a personal loan to consolidate other debts, the banks or financial institutions are on the back foot as they are concerned that you may get into debt again.

2. No Credits or Savings:

Personal loan applications are analysed on the basis of the individual’s income and financial stability. Having a decent job and a stable income doesn’t make you eligible for personal loans unless you establish your credit with proper savings. It is always considered a smart option to apply for a personal loan from the same bank where you have a savings account. Banks can analyse your financial stability by going through your past year’s statements and hence it is important to build your savings on a regular basis.

3. Low Credit Score:

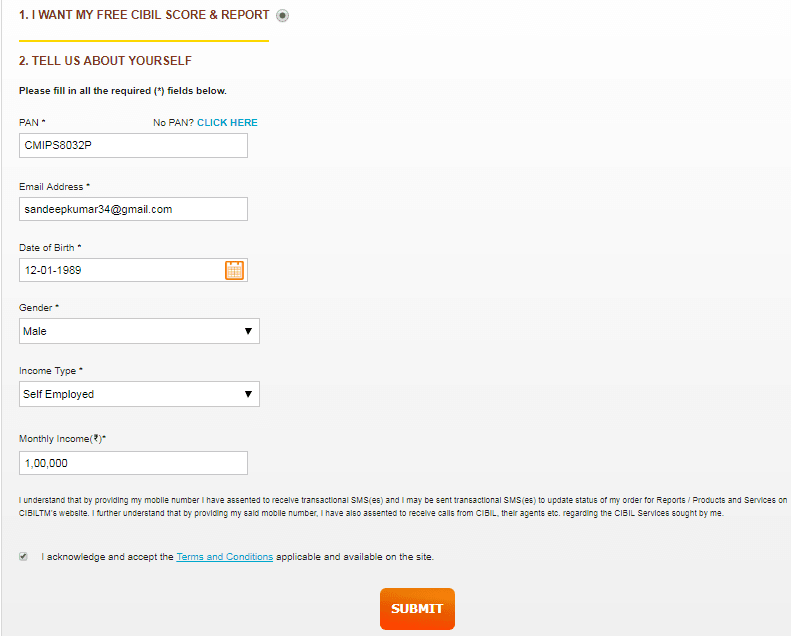

Last but not the least, your loan application can be rejected because of low credit score. Today, you can get a credit score from CIBIL which is accepted by many banks and financial institutions in India. CIBIL allots you a score between 300 – 900 and a score between 700 – 900 is considered to be good credit score whereas a score between 300 – 500 is considered to be a bad credit score. Banks will decide on the basis of your credit score whether you qualify for a personal loan or not.

Also Read: CIBIL Credit Score – How to Improve Your Credit Score?

From now, take the above factors into consideration and make sure you don’t fall at the opposite end of the reasons given above while applying for a personal loan. Besides that, if your personal loan application was rejected for any other reason, please feel free to share your experience with us using the comment form below.

Personal loan application may be because of any of the above-mentioned reasons, but apart from bank there are lot more sources from where you can take a loan. But a good credit history is a must.