When we talk about the TAN or the Tax Deduction and Collection Account Number of SBI then there is no doubt about the fact that it is one of the most important discussions to have. However, it comes off as a very big surprise when some people don’t yet know what the TAN number is.

Well, the TAN is something that people need when they have to deduct or collect some tax at the source. Those who fail to quote their TAN number have to pay a certain penalty that goes up to about rupees 10000 in total. For those who are paying some sort of commission or salary, it is essential that they have the TAN with them.

What Exactly Is TAN?

Well, if you want to know the definition of TAN, then all you have to do is read this article. Well, TAN can be defined as the Tax Deduction and Collection Account Number. It is basically a 10-digit number that consists of alphabets as well as some numerals.

For those who find themselves being accountable for deducting or collecting the tax at some source, they need to have the TAN with them. It is essential that the users quote their TAN in the TCS and TDS return, certificates, payments, Annual Information Return, and some other essential documents as well.

For those people who have their taxes deducted or collected at source, they need to obtain their TAN number from SBI otherwise they have to pay a certain penalty to let us be honest here, no one likes to pay penalties, right?

It is also very important to note that it will not be accepted if you put your own PAN number in the exact field that requires the TAN number and that is because both the numbers here have different functions that people need to know about.

The TAN number is basically used for unique identification and is exclusively for those who have tax collection or deduction aspects. However, the PAN number is provided to individuals as well as companies as well.

Who Will Be Able To Apply For The TAN Number?

Well, there is no doubt about the fact that most people require the TAN number. However, this number is specifically for those people who are actually trying to pay some sort of salary or some commission to another person.

If you consider yourself to be one of them, then it is recommended that you get the TAN number immediately. There are several state government and local authorities that use the TAN. Also, there are several companies and their divisions that also make use of the number. Apart from that, there are firms and other joints that use the number as well.

There is not a single speck of doubt about the fact that the TAN number is really important for the people who need it. It helps in providing identification. So, it is recommended that those who have requirements for the TAN number, should start applying with the right documents. If you want to search own or any other company’s number, then follow the instruction given below.

How to Find the TAN Number Of the State Bank of India Branch

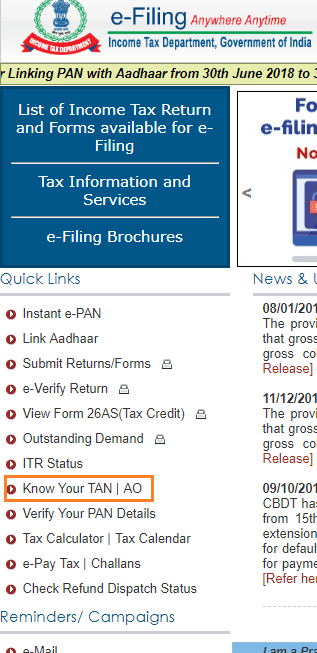

Step 1: First visit the Income-tax Department, Government of India Official website https://www.incometax.gov.in/ and click on the ‘know your Tan‘ link.

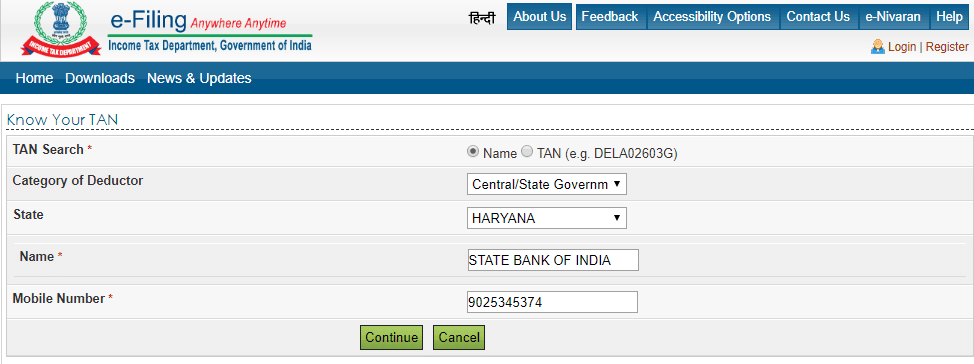

Step 2: Now select tan search by name, the first option in the category, State belongs to SBI branch, type State Bank of India in Name field, Enter your own mobile number, and click the ‘Continue‘ button.

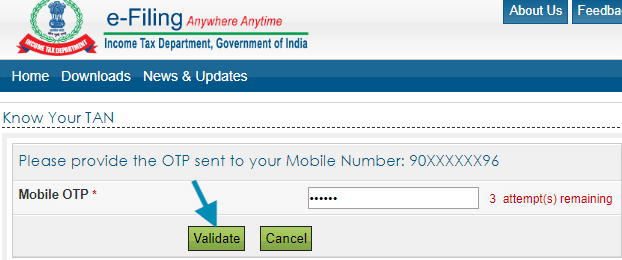

Step 3: Now 6 Digit mobile PIN will be sent to your mobile number by the Income-tax Department. Enter your mobile PIN and click the Validate Button.

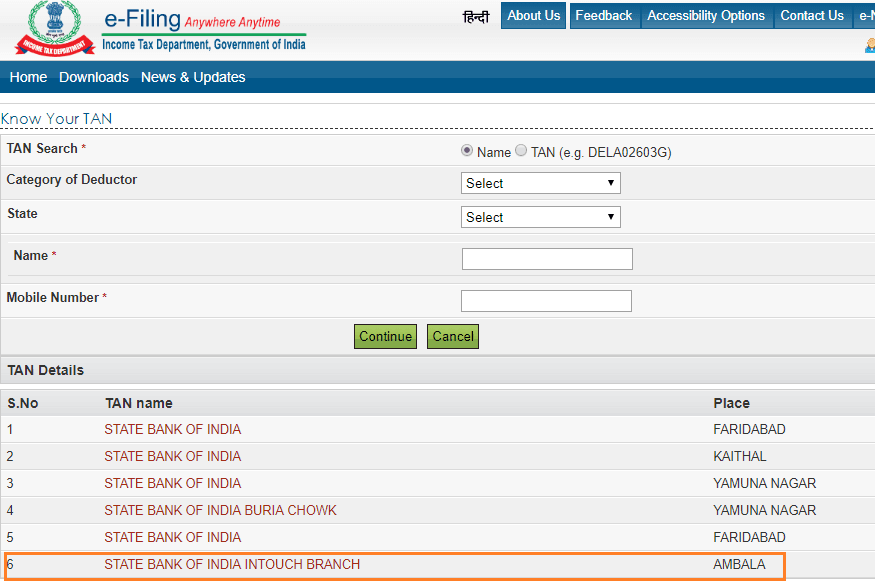

Step 4: Now you will get a list of SBI branches for your State Bank. To know the Tan number, click on the branch name of your choice.

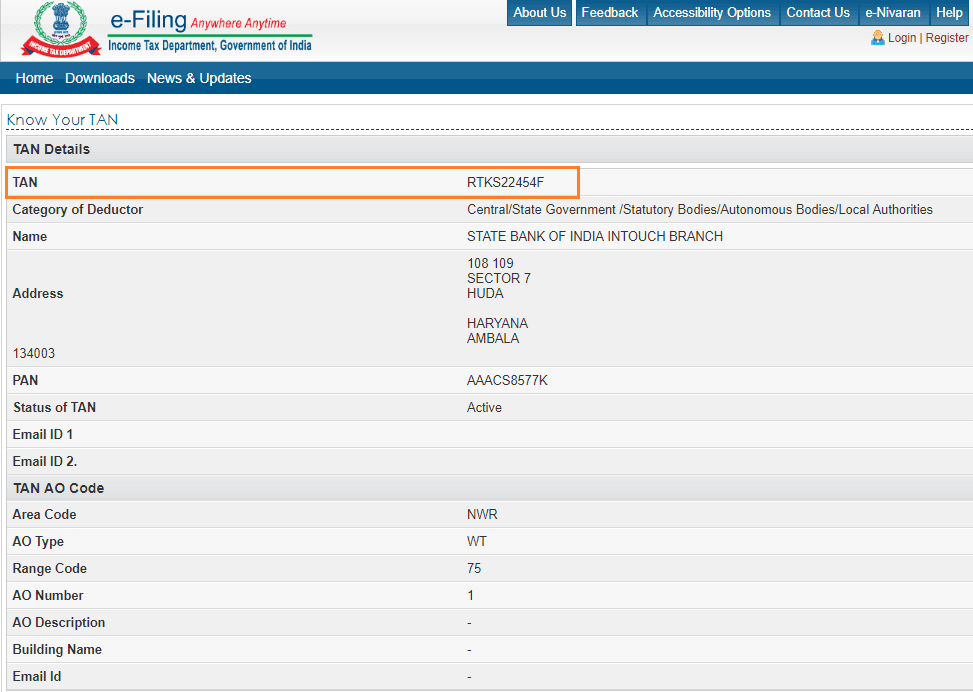

TAN for your SBI branch and many other details will be displayed on the screen.

You can use the above method to know the TAN number of Any banks as well as companies in India. Let us know via a comment if you are facing any problems regarding the TAN number.

How to find bank branch from TAN number

please provide me

Tan of State Bank of India Ratu (14341) Ranchi Jharkhand

THIS IS NOT WORKING. IT IS NOT FUNCTIONAL.. NOTE WORTHY

This does not work. they never checked what they have built. slap needed for the IT manager of this site.

I do not think TAN No is some secret code. If that is the case why can’t SBI or for that matter all other Banks declare in their web site or somewhere else instead of such zig-zag ways to find such simple information, if the same is not shown in 26 AS

The problem is this system does not allow a non-Indian (e.g., US-based) mobile number to receive the PIN. So how does it work for an NRI/ foreign citizen who still has to file IT return in India?

I am drawing Central Govt pension through SBI, Mahesh, Hooghly, W.B. My TRS return filed by SBI Mumbai TAN MUMS89587B. Form ITR -2 wants details of address od a/s SBI. How to find the said details of SBI Br. with said TAN. I tried above process but they are displaying details of SBI, West Bengal only. How to find the details of Mumbai SBI which filed my TDS return. Help me please.

The SBI Namakkal Branch, Dr. Sankaran Road is not shown. out of 20 pages displayed in site, none of the pages contains the detail of the same.