There are many different ways through which people are able to transfer money from one account to the other one. However, we are going to discuss one such method right here. IMPS or the Immediate Payment Service is one of the fastest and the easiest ways through which people are able to easily transfer money.

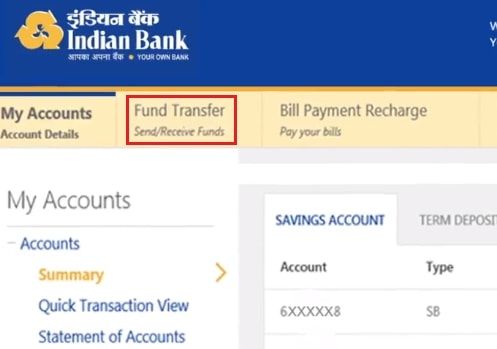

This option of fund transfer is very easy to use and it works in real-time as well and hence, the beneficiary is able to receive the amount in just 30 minutes of the transfer. The Indian Bank is one of the banks which is currently using the fund transfer method and is offering benefits to the people who have their accounts in the bank.

However, there are some fund transfer charges that the account holder needs to pay in order to avail the service of IMPS in the best way. Here we are going to mention these charges.

What are Indian Bank IMPS Charges

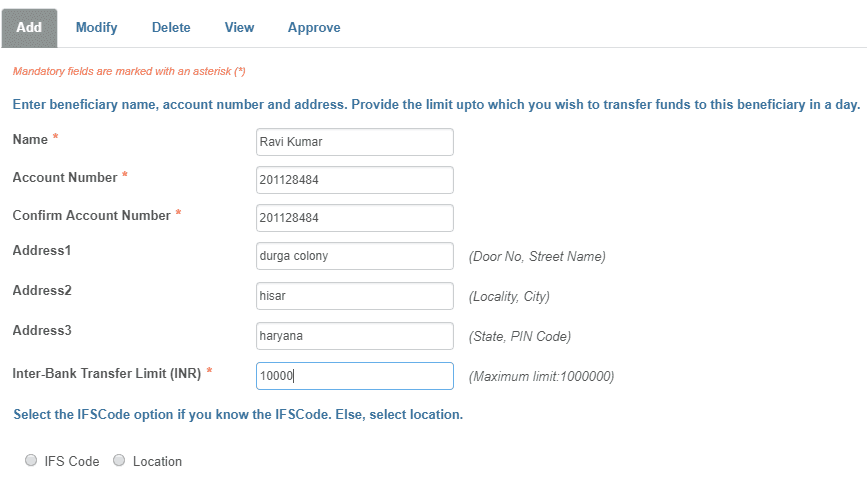

There are certain charges which are associated with the transfers that happen through the IMPS method. The charges that we are talking about in here are completely standardized and then applied according to the amount that you are willing to transfer to the account of the beneficiary.

It is important to know about these charges because you will be paying that amount and it will help you in deciding the amount that you want to transfer to the account of the beneficiary in the best way. So, here are the charges that one has to pay for the IMPS Fund transfer in the Indian Bank.

| Amount | Charges |

|---|---|

| Financial transactions which are up to Rs. 25000 | NIL |

| Financial transactions which are above Rs. 25000 and go up to Rs. 2 lakh | Rs. 6 and the GST tax |

| Non Financial Transactions | NIL |

Understanding The Benefits Of The IMPS Services

There are certain benefits that the account holders can get when they are using the IMPS method of fund transfer in the Indian Bank. So, here we are going to provide a list of some of the benefits that you might get when you are using this service for transferring your funds from your account to the account of the beneficiary.

- The service is available for the people who have an account in the Indian bank. It doesn’t really matter what account they have. They will be able to use the service regardless.

- The fund transfer method of IMPS is available 24×7 and that means the people who have their accounts in the Indian Bank will be able to transfer their fund anytime they want.

- The account holders will be able to transfer the amount which goes up to Rs. 2 lakh in total and that too in a single day for sure.

- The service doesn’t stop being available to the people on Sundays as well as the holidays.

- This service can be easily used in order to pay the credit card bills and also to make some online purchases as well.

So, that is all you need to know about the Indian Bank IMPS Fund transfer charges that people have to pay in order to make use of the service in the Indian Bank.

WHY AMOUNT TRANSFERRED THRO IMPS IS RETURNED?