SBI or more commonly known as the State Bank of India is one of the best and the most renowned public sector banks which are owned by the Government of India. After the merger happening between the SBI as well as the Associate Banks of SBI, it is now known to be amongst the list of the top 50 global banks in the world.

With the technological services in SBI, the bank has always provided some amazing services to the people ever since its existence. Some of these services include mobile banking, internet banking, and various others.

There are also some amazing apps for the bank which operate in iOS, Windows, and Android phones as well. SBI is also known to be one of the first 4 banks which offered the IMPS services to the people for fund transfer.

Here we are going to discuss a little bit about IMPS and the IMPS Transfer charges. First of all, one needs to know that all the SBI account holders will be eligible to make use of the IMPS service in SBI. With the help of this service of IMPS, people can transfer the funds with the help of their mobile devices very easily.

Providing A Brief Synopsis Of IMPS in SBI

IMPS or Immediate Payment Transfer Service is one of the best and the most amazing fund transfer services which are used by the banks all over the country. This interbank system of fund transfer is not like the other platforms of transferring the funds. With this system, the users will be able to make their payments and transfer the funds any day they want.

SBI IMPS Timing – IMPS Fund Transfer Timing in SBI

Also, the service is available to them throughout the year no matter whether there is a public holiday or not. Apart from that, the customers don’t really have to worry about visiting the bank in order to avail the benefits. This service of fund transfer through IMPS is available for 24 hours in a single day.

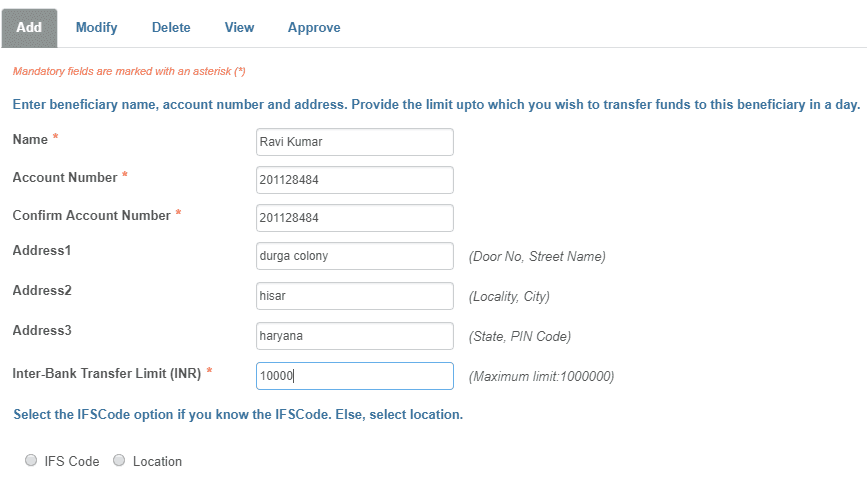

Users will be able to transfer the funds with the help of net banking as well as mobile banking too.

IMPS Charges in SBI 2019

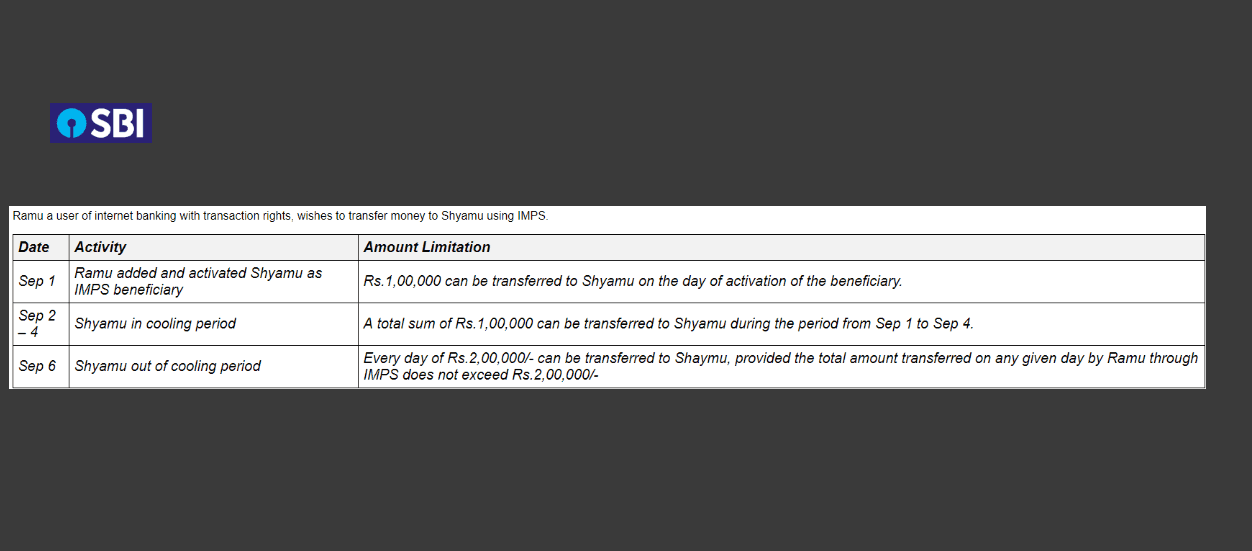

The transaction limit for the IMPS services is determined according to the participating bank and the rules that it has. In the case of the SBI users and account holders, the amount that is available for transfer is up to 2 lakh rupees in a single day.

This can be done using the IMPS fund transfer services to different beneficiaries or a single one. However, there are some charges which might come to effect when the users need to transfer the funds.

Here we are going to provide the details about this particular transfer so that the people can have a fair idea of what to expect. Amount To Be Transferred IMPS Charges/ Transaction (Excluding GST).

IMPS Fund Transfer Charges Through Branch

| Amount to be transferred | IMPS charges |

|---|---|

| Up to Rs. 1,000 | Nil |

| Rs. 1,000 – Rs. 10000 | Rs. 1 |

| Rs. 1,0001 – Rs. 1 lakh | Rs. 2 |

| Rs. 1 lakh – Rs. 2 lakh | Rs. 3 |

IMPS Funs Transfer Charges Through Internet and Mobile Banking

| Amount | IMPS charges |

|---|---|

| Up to Rs. 1,000 | Nil |

| Rs. 1,000- Rs. 1 lakh | Rs. 5 + GST |

| Rs. 1 lakh- Rs. 2 lakh | Rs. 15 + GST |

One of the most important things to remember about the SBI IMPS charges is that there is no particular subscription fee taken from the users. Also, the installation of the SBI Anywhere Personal App in order to use the IMPS service is also free. The charges are only effective if there is an IMPS Fund Transfer.

Be the first to comment