For the different account holders who have their accounts in SBI, there is a very specific and easy method of transferring the funds with the help of the mobile devices and it is known as IMPS or Immediate Payment Service. This service is basically an electronic one which helps in the fund transfer in the easiest and the best way.

The account holder will be able to use this service through internet banking and ATM as well. There are multiple benefits to the fund transfer system and that is one of the main reasons why it is so popular amongst the people these days.

The facility is provided to all the customers who have already made their registration with the Online Banking in SBI along with all the transactions right for a particular one or different accounts. Here we are going to discuss one such important aspect of the IMPS service which is provided in SBI for the users. We are talking about the SBI IMPS Limit.

What Exactly Is The SBI IMPS Limit?

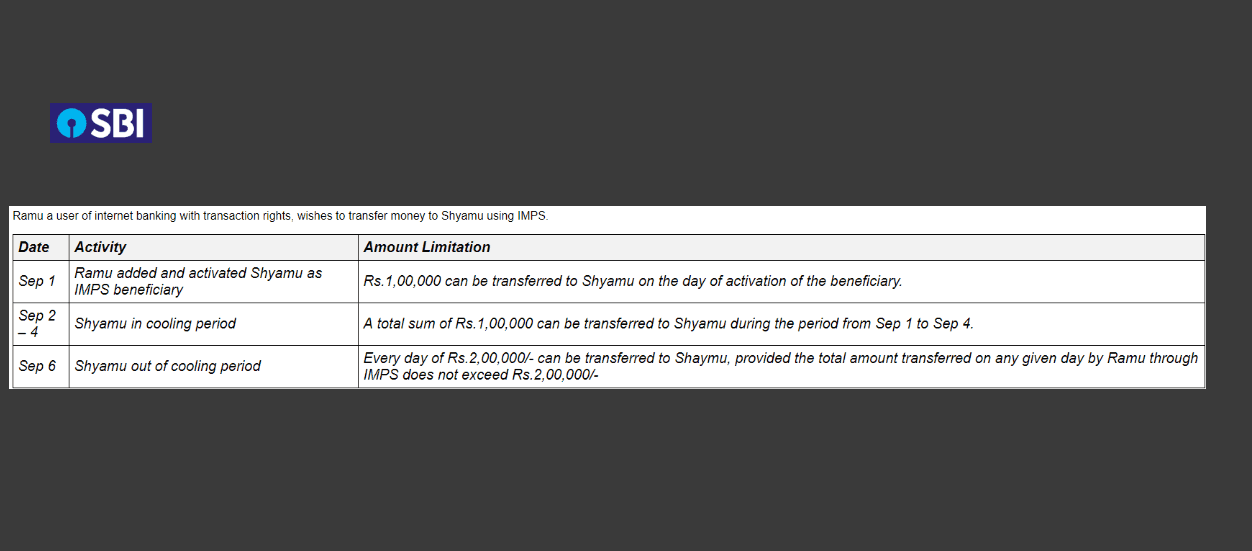

The SBI IMPS Limit is basically subject to the initiation date or the registration date of the beneficiary. This means that the transactions can take place only after the beneficiary has been added to the particular account of a user. Here we are going to provide the details about the IMPS Fund transfer Limit right from the day this registration happens.

- On The Registration Day Of The Beneficiary: A particular amount of about Rs.1 Lakh is transferable to beneficiary

- The cooling period which is the second day to the fourth day: A particular amount of Rs. 1 lakh will be easily transferable to the beneficiary in this particular time period

- After the ending of the cooling period: The user will be able to transfer a total of about Rs. 2 lakh to their beneficiary after the cooling period has properly ended. This is only the case when the amount to be transferred to the beneficiary doesn’t really exceed the limit of 2 lakh rupees.

Transferring Funds With SBI IMPS Services

After the beneficiary has been added to the account, the user will be able to make the transfers. However, in order to do that, one needs to know all about the transferring process of the funds.

- Visit the official website of SBI and then log in with the password and other details.

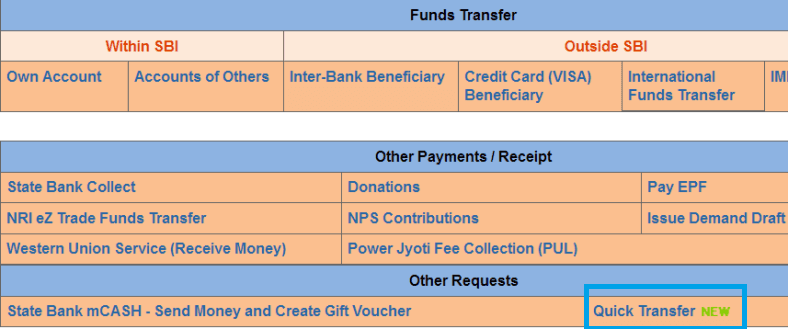

- Then choose the Payment/Transfer option and then select the option that says IMPS Fund transfer

- Choose the option between Person to person and Person to Account on the basis of the beneficiary that you have added

- The amount needs to be entered correctly for the transfer to happen successfully

- After the entering of the amount, the transaction will get completed once you add the OTP or the One Time Password which is sent to the mobile number of yours that is registered into the account

So, that is all you need to know about the SBI IMPS Limit. We hope this article provided you with enough knowledge on the IMPS Transfer Limit in SBI.

Be the first to comment