Credit cards are allowed to few customers after verifying CIBIL score, IT returns, and the relationship of the customer with the bank. Credit cards work as a postpaid service. It can be convenient when you have a low balance in your savings account and need money in a pinch.

There any many other benefits for credit cards, such as reward points, cash backs, or discounts on purchases at E-commerce websites, and you can also buy products on low-cost EMI.

But transferring money from a credit card to a bank account can charge you with a fee, but unusual to common belief, you can transfer the funds without any cost by using simple methods.

Three Ways to Transfer Money From Credit Card to Bank Account

1. Online payment tools such as Moneygram and Western Union

Yes, you can use online tools to transfer funds from your credit card to your bank account. However, some online portals can charge you money, or they can charge interest in the fund transfer. MoneyGram and Western Union are two reliable online payment tool you can use to avoid charges.

Although there are some factors you need to consider before using them. You need to consider the amount you want to transfer, which country your bank account exists, and it’s bank regulations and the currency. If the transferring is happening between currencies, the foreign exchange rate would be applied on the transferring, and it also can take up to one to five business days.

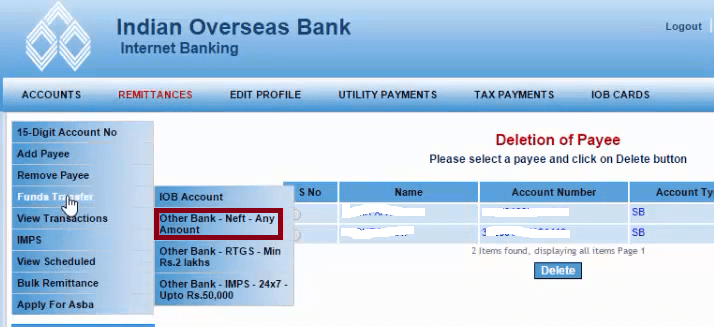

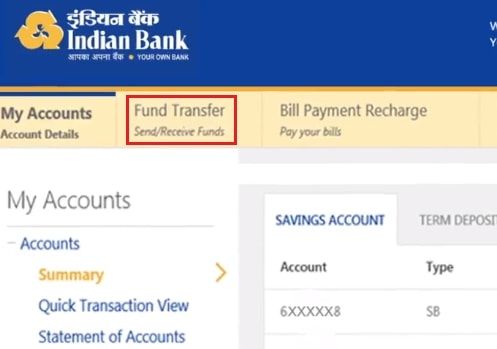

2. Through Bank portals

There are some banks, such as the state bank of India, ICICI Bank, and Axis Bank, offer their customer the option to transfer funds to their bank account.

State Bank of India

You need to use SBI Card’s official account to transfer money from your credit card to your bank account, or you can send an SMS to request the transfer. Even though the funds can be repaid within a period of two to six months after every transfer, you have to pay an interest of 1.7% for every month if the case is not paid in six months.

Axis Bank

Axis Bank provides an easy portal for internet banking. You can easily transfer money from your credit card to your bank account through Axis Bank Internet Banking. Five hundred is the minimum amount that can be transferred without any charges. You can use this free transfer every three months. If you transfer any fund in this interval, you will be charged.

3. Using E-wallets

E-wallets such as Paytm, FreeCharge, and Mobiwik are most popular for transferring funds from credit card to bank account.

Paytm

All you need to do is open an account in your Paytm wallet to transfer money. First, transfer the money from your credit card to your Paytm wallet, then go to your Passbook and choose the option ‘Transfer‘. Now, you just need to fill up your bank account details to transfer the money to your bank account.

FreeCharge

Just like Paytm, add money to your FreeCharge wallet from your credit card. However, you need to use the website to withdraw the money from your wallet to your bank account. Try not to use a mobile to browse the website.

Try to avoid using illegal tricks since the bank and the online transaction service providers keep track of all your actions. Always use legal ways to transfer fund from credit card to bank account.

What interest does Apple Card charge for withdrawing on the card?