As per RBI guidelines, both public and private sector banks in India are now providing Basic Savings Bank Deposit Accounts, commonly known as BSBD accounts, for unbanked people to facilitate them with various customer-friendly banking services.

In this article blog post, we will extensively discuss the detailed information on what is a BSBD account, its features, and its benefits in Bank of Baroda. We will also walk you through what the BSBD Wdl Txn Chg is in Bank of Baroda or Basic Savings Bank Deposit Withdrawal Transaction Charge in BOB.

Just stick around and stay tuned with us to explore more critical information on the above subjects. So, without wasting any time, we must now quickly delve deeper into the complete post ahead.

What Is a BSBD Account?

A BSBD account has some distinctive characteristics, such as Zero balance, free transactions, free cash deposits, and free withdrawals up to a fixed limit. So, anyone can easily operate this type of account without maintaining a specific balance. More importantly, users can not only deposit cash for free but also make fund transfers without having to pay for the same.

BSBD Account Features and Benefits in Bank of Baroda

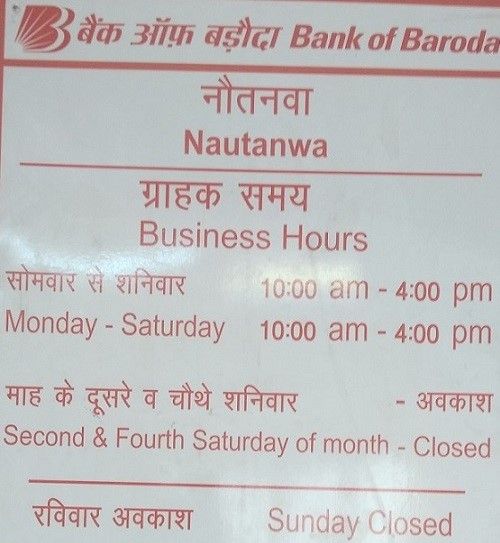

Bank of Baroda Bank, commonly known as BoB Bank, offers BSBD accounts to its customers with some essential features and benefits such as no minimum balance required, Debit card/ATM Card and Net Banking facilities available, no restriction on deposits is applicable, no charges on cash withdrawals are levied at base branches or local branches, and non-base branches as well as outstation branches, and much more.

However, only resident Indians are allowed to open a BSBD account with BOB. In addition, you are not allowed to make more than four withdrawals in a month. This account is not allowed with any other savings account with the Bank of Baroda. If you do have such an account, it must be closed within 30 days of opening a BSBD account.

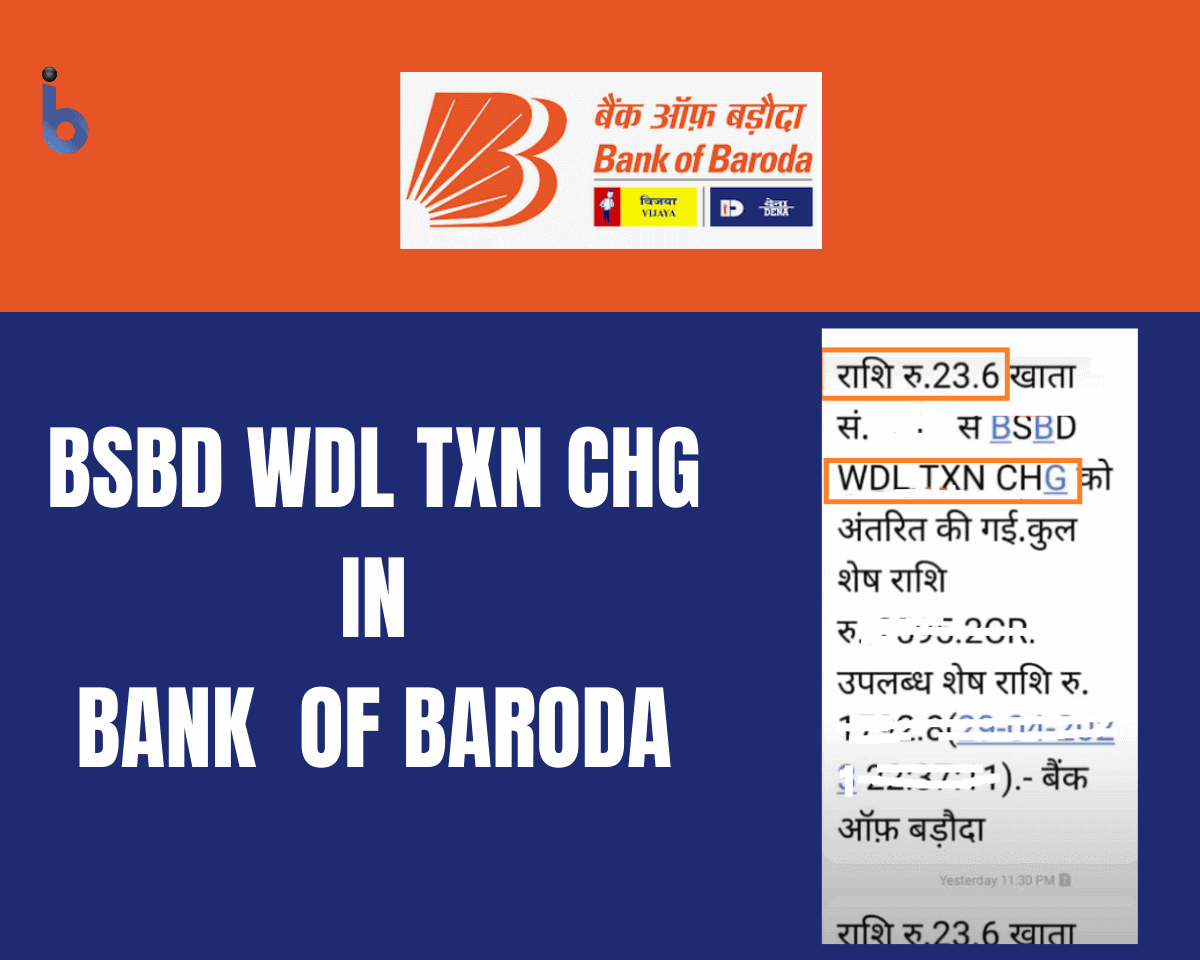

What Is BSBD Wdl Txn Chg In Bank of Baroda?

Suppose you have a BSBD account with the Bank of Baroda, and Rs. 23.60 has been deducted after making a withdrawal from that account. Here, we will let you know why this amount is being deducted and how you can avoid it.

1. Why is Rs. 23.60 Deducted from the BSBD Account?

You should know that BOB has started charging the BSBD WDL TXN CHG on its zero balance BSBD accounts for Rs. 20 + 18% GST = Rs. 23.60 from the month of April 2023. If you have a zero balance Jan Dhan account or any BSBD account, you can withdraw money from it only four times a month for free.

However, for the fifth time and after that, when you withdraw money through Aadhaar, ATM, or Bank Mitra, or transfer funds through IMPS, NEFT, or RTGS, each time you will have to pay a transaction charge for Rs. 23.60 in that month.

2. How Can You Avoid BSBD Wdl Txn Chg?

If you want to avoid paying the BSBD Wdl Txn Chg, you should get your BSBD account converted into a general savings bank account, wherein you will have to maintain a minimum balance of Rs 1000 or 2000 in your bank account as per your bank branch category. After that, BSBD Wdl Txn Chg will not be applicable to you.

The Bottom Line

BSBD is a provision the Bank of Baroda, in compliance with the guidelines of the RBI, provides to unbanked people with various distinctive features. Any resident Indian person can open a BSBD account at the Bank of Baroda with a zero balance. We have already discussed what BSBD is, its features, and its benefits to the account holders. However, if you are interested in opening a BSBD account, ensure you check your eligibility to proceed with your actions.

sir or mam phone pe per charge hoga kya