Bank of Baroda is one of the major banks in India with more than 150 million customers. Guess the bank name in terms of capacity, that comes right after the State Bank of India – it’s Bank of Baroda (BOB). As a customer of this bank, completing your KYC without any delay is important.

Video KYC will help to identify and validate the customer details as required. According to the RBI guidelines, checking a customer’s credentials in an interval of time is mandatory. So, even if you attempted a video KYC earlier, you can be asked for a re-KYC. The interval generally depends on the severity of the account.

By cooperating, you will secure your account and transactions with the Bank of Baroda. Now, it is even simpler with quick online mode. Here’s how you’ll do it in no time.

Mandatory Things Required to Update BOB Video KYC Online

- To take a video re KYC, one should be an individual resident customer, aged more than 18 years.

- An original Aadhaar card is mandatory when you start the process of video KYC.

- Your original PAN card should be with you during the video KYC. Photocopies of these identity cards cannot be an alternative during KYC.

- Make sure to activate the registered phone number (same number for the Aadhaar card and BOB account) and keep it with you.

- Keep your customer id with you as well. It will be present on the first page of your bank passbook.

- You need to keep a blank white paper and a black/blue pen when you start video KYC.

- Also, check your internet connectivity for an uninterpreted process. As suggested by the Bank of Baroda, using Google Chrome on Android devices (or on Windows) and Safari on iOS devices will provide the best experience.

Steps to Update Bank of Baroda Video KYC Online

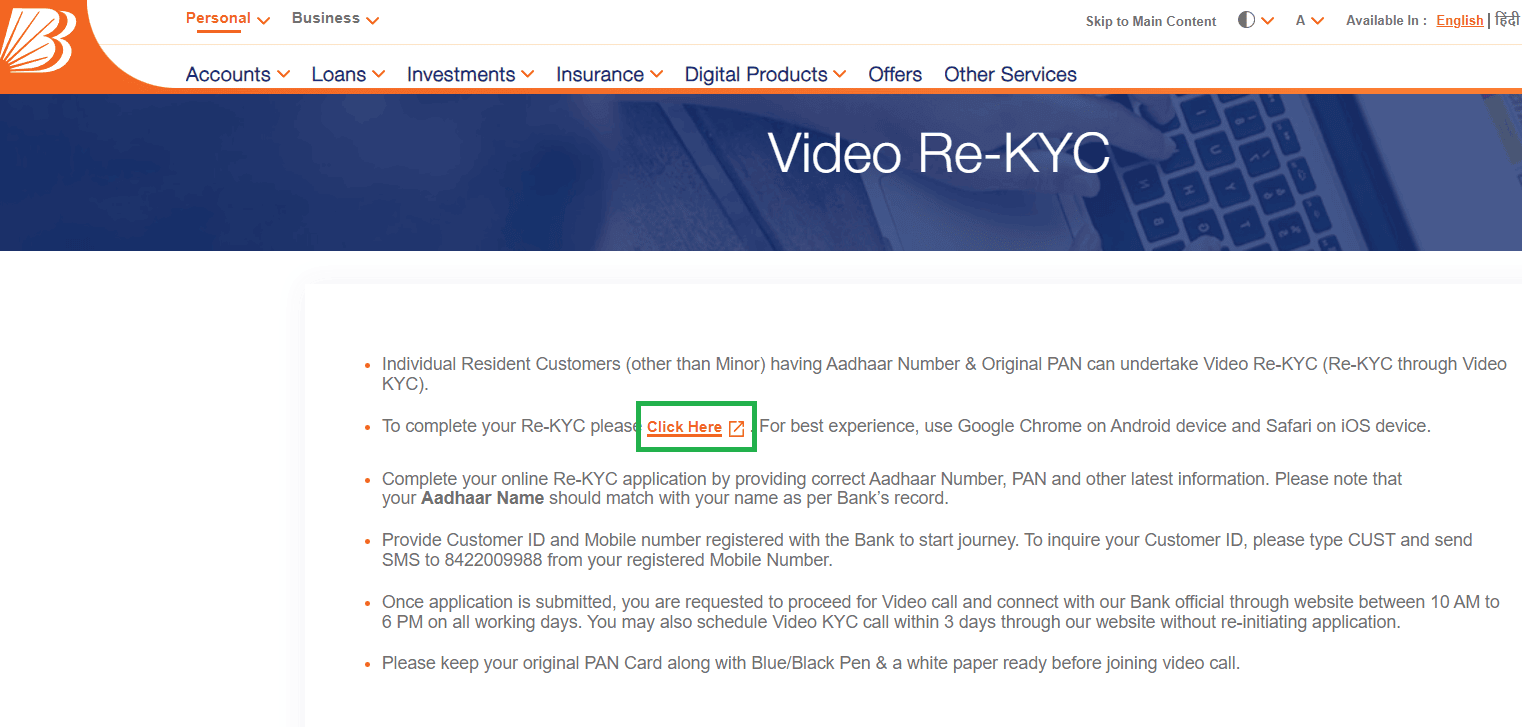

Step 1. Open any secure browser from your mobile or computer. You can directly go to the Google search engine as well. Type “Bank of Baroda video rekyc” and navigate to the first link. From the home page of the website, go to the second point and click on the “Click Here” link. You’ll be redirected to a new portal. If you’re unable to find the link, directly open the link: https://onlinecasa.bankofbaroda.com/rekycvcip/#/core

Note: Mobile users can navigate to the ellipse (⋮) button present on the top-right corner of the screen. By clicking the button, you’ll get a list with the option “Desktop Site“. Check that button to get a better website layout.

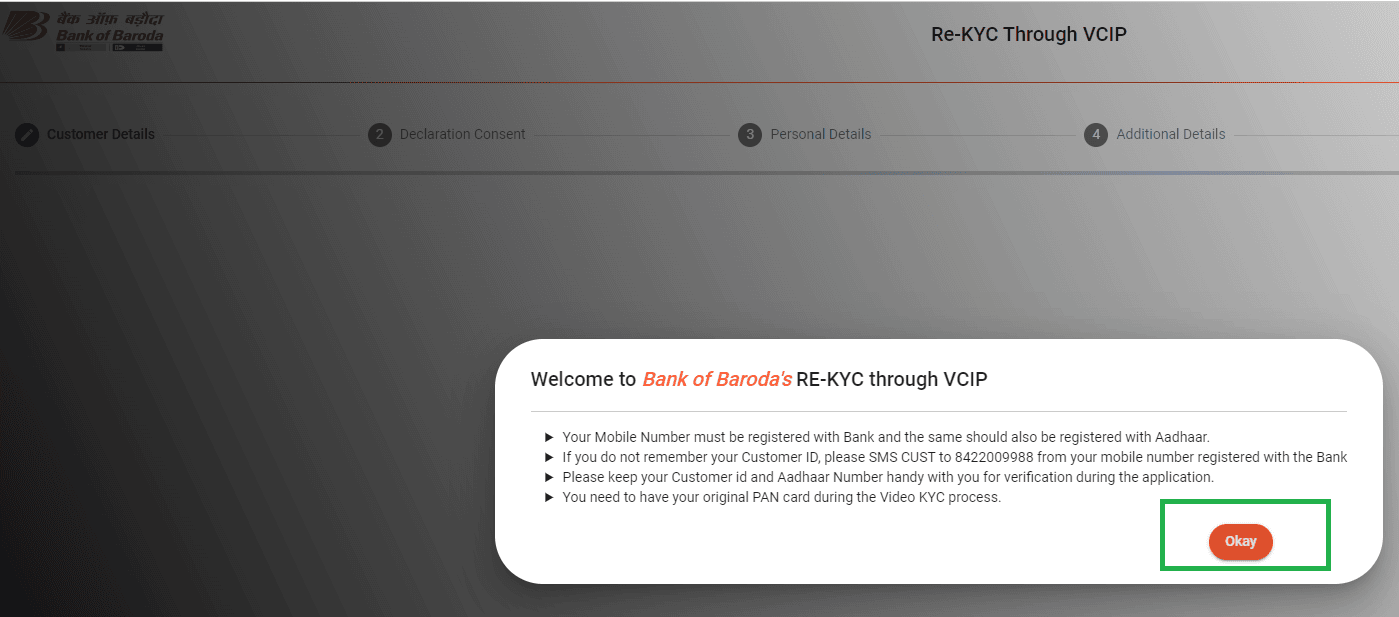

Step 2. Click the “Okay” button if you get a pop-up with the title “Welcome to Bank of Baroda’s RE-KYC through VCIP“.

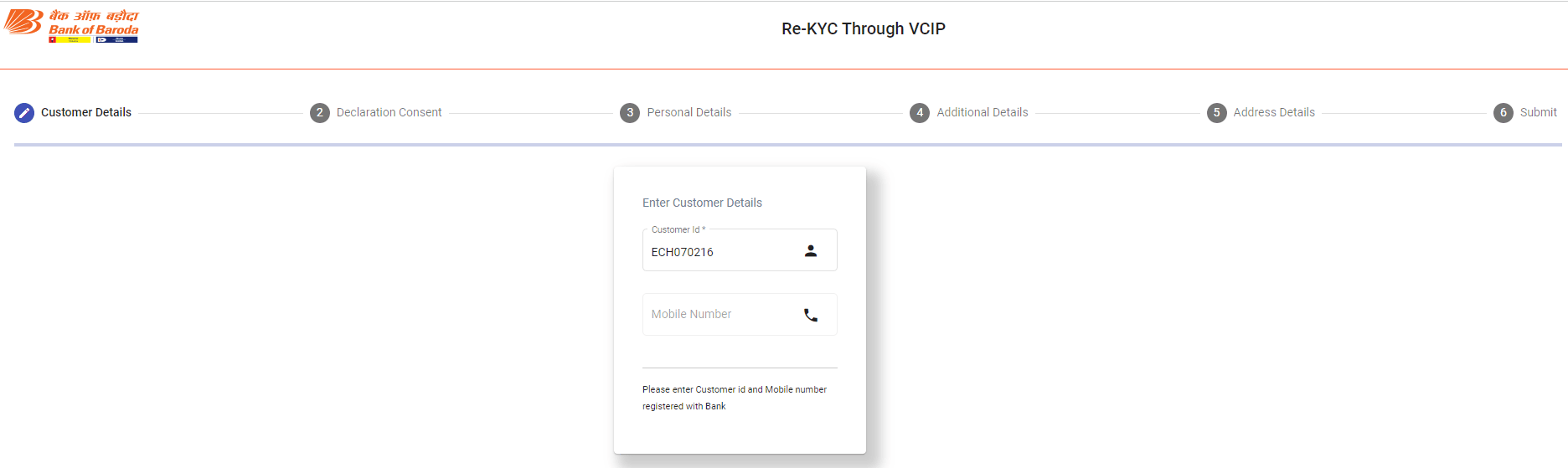

Step 3. From the Customer Details tab, navigate to the form and fill out your customer ID and registered phone number. Click on the “Generate OTP” button and get an OTP in your registered mobile number. Submit it to proceed to the next step. You’ll be moved to the next tab “Declaration Consent“. Accept the form to continue.

Step 4. On the next “Personal Details” tab, fill out all the required fields with the correct information. Make sure there are no spelling mistakes for the name or mistake in the Date of Birth.

Fill out “Additional Details” and “Address Details” in a similar manner. Make sure you provide your permanent address details. If there is any change in your address, enter the current address details. Click on the “Submit” button to apply.

Within the next three working days, you can expect your call anytime between 10 AM to 6 PM for the video re-KYC. After a successful re-KYC, you’ll get an instant update on your mobile number and email address, confirming the same.

Conclusion

As you get any message from the Bank of Baroda regarding re-KYC, do not delay to complete the process. The video re-KYC would not take more than 15 minutes to complete, provided you are ready with all the required documents and have a smooth internet connection.

Your transactions may get frozen if your re-KYC is long overdue. To ignore any such issues, follow all the steps and guidelines mentioned in the previous section. If you’re concerned about any fake message, just make sure you do not click on any link sent with the message.

Directly go to the official website of the Bank of Baroda and check the status of your KYC.

Be the first to comment