You never know when an emergency comes up, and you feel helpless about money as you might not even have the chance to move to any local ATM to draw money. In such scenarios having a mobile banking facility is something like a real blessing.

SBI Mobile banking offers you 24 x 7 banking service at any point in India. You just need to have an Android or a device with Java. However, you can connect as well through WAP (wireless application protocol).

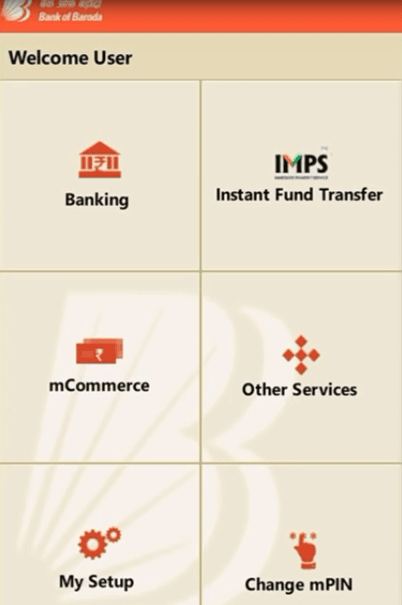

You can enjoy mobile payment, fees transfer, balance check, checkbook, etc through the facility. Let’s have a look at the steps you need to follow for enjoying SBI mobile banking.

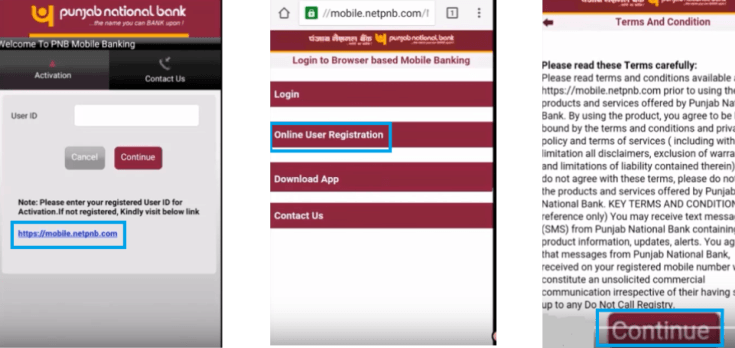

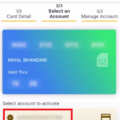

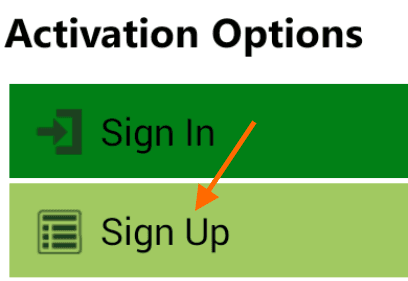

First, you need to be registered through a Mobile banking service. To be registered with mobile banking, first, you have to perform registration through a handset, and the next step has to be performed at the SBI branch or ATM.

Registration Process through your device

- First, you need to have the User ID and default MPIN. You just have to send an SMS “MBSREG” to 9223440000 / 567676 to get the User ID and MPIN through text on your mobile.

- Then, you have to send one more SMS through the device for having a mobile banking application download.

- Now have the application on your handset, and as it becomes available you can now log through the ID and Password provided.

- As the first part of the registration is finished, you have to move to the SBI ATM or native branch where the account has been created.

- Upon going through the SBI ATM, first go through the Mobile Registration option, and next the Mobile Banking. Now, go with the registration option and put your mobile number, and then press yes as it asks. After confirming the entire process, get the transaction slip of mobile banking registration completed.

- Then the customers will be getting texts about the mobile banking service getting activated. Those who go for another way will have to ask SBI branches for completing the necessary forms.

These specific forms will be put inside the system and the Mobile banking accounts will be made functional the next regular day. You can now transfer money of about fifty thousand rupees regularly through SBI mobile banking. However, you can only transfer two lakh fifty thousand rupees or less in a single month through the facility.

Sir pls give me my sbi account no. Very urgent 8003811 it’s my registered mobile in sbi

I want to registration of sbi mobile banking and sms alerts

Sir How to transfer money by ATM without account number. It is possible or not.

Sir

I want to know how to Register SBI account my no 9102738574 name Vincent Hansda.

Your incoming calling is locked

Dear sir

I am mohammad murtuza ansari

My nre acount siwan branch my passbook old no mentoin cif namber please help me

from where to download sbi mobile banking registration form.

Sbi bank siwan branch

Dear sir

I am send mail siwan branch update mobaile namner and need costemar id but no replay to branch please help and give cif namber by mail

Thank you sbi branch siwam

WHere to download sbi mobile banking application form

Sir,i have forget customer ID and password of net banking. pls help how to login.

I need registration form for mobile banking in sbi.

How i activate my bank details in online. plz help.

Can we transfer money from sbi atm to other bank account??? Is it necessary to have a same atm card to transfer money??

Dear sir, please provide us to mobile banking password and id.

Contact at your bank branch.