If you are an earning individual then it is highly necessary for you to maintain a savings bank account. Without a properly maintained savings bank account, all your hard-earned money can vanish one day. So, it is important to save and thus there are numerous numbers of banks in the market to help you with that.

In this case, Canara bank needs a special mention. Canara bank is one of the famous and largest public sector banks owned by the Government of India. Also, a noteworthy point here is that the savings account in Canara bank is very easy to maintain as well.

Opening A Savings Bank Account in Canara Bank

Here are some important points that you need to know before deciding to open a savings bank account in Canara bank.

- Almost all types of savings bank accounts can be opened in the bank. Individual accounts, joint accounts, minor accounts, government bodies, semi-government departments, non-corporate bodies, capital gain accounts, associations, schools are some of the few examples of the types of accounts one can have in this bank. So, in terms of eligibility, one can say that Canara bank is quite dynamic!

- The only documents you require for opening a savings bank account are proof of identity, address proof, and a passport size photograph.

- The interest rate of the bank is quite good actually. For a deposit of up to Rs 50 lakhs, you get an interest of 3.25% p.a. And for an outstanding balance of above Rs 50 lakh you will get an interest of 3.75% p.a.

- The interest is payable quarterly in the bank. And it entirely depends on the balance maintained daily in your respective account.

- Although you must keep in mind that the loan against the deposit in your bank is not allowed in Canara bank.

- Some of the other features of the bank are that special rate for senior citizens, bulk deposits, TDS, is not applicable.

- Also like any other baking institution, the nomination facility is available here as well.

- Other facilities like ATM cards, debit cards, credit cards, checkbooks, etc are very much available in Canara bank.

| Type of Account | Required Minimum Balance (Semi-Urban / Urban / Metro Braches) | Required Minimum Balance (Rural Branches) |

|---|---|---|

| Saving Account | Rs. 1000 | Rs. 500 |

| Current Account | Rs. 5000 (Urban/Metro Branches only) | Rs. 1000 (Rural/Semi-Urban Branches only) |

What Is the Minimum Balance You Need to Maintain in The Savings Account of Canara Bank?

When it comes to the minimum balance maintenance, the limit of Canara bank is actually very low. For metro, urban and suburban regions, you have to maintain a bank balance of Rs 1000 only. And for the rural branches, the amount is Rs 500.

Also, you have to note that depending on the amount of minimum balance maintained in your Canara bank savings account for the previous month, you can purchase two DDs free of charge in the current month. For the balance of Rs 10000, Rs 15000, Rs 20000, Rs 25000 and above, you can get 2 free DDs up to the amount of Rs 10000, Rs 15000, Rs 20000, Rs 25000 and above respectively.

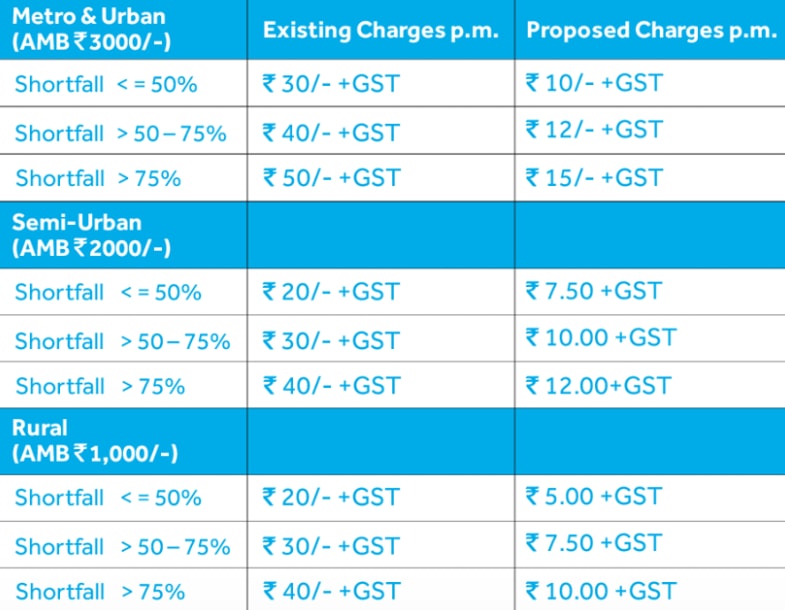

Canara Bank Non-maintenance of Minimum balance charges For Saving account

| Metro/Urban/Semi-urban Branches ( If balance Below Rs. 1000) | Charges |

|---|---|

| Rs. 999 to Rs. 700 | Rs. 25 + Service Tax |

| Rs. 699 to Rs. 400 | Rs. 35 + Service Tax |

| Rs. 399 and below | Rs. 45 + Service Tax |

| Rural Branches ( If balance Below Rs. 1000) | Charges |

|---|---|

| Rs. 499/- to Rs. 350 | Rs. 25 + Service Tax |

| Rs. 349/- to Rs. 200 | Rs. 35 + Service Tax |

| Rs. 199/- and below | Rs. 45 + Service Tax |

Canara Bank Non-maintenance of Minimum balance charges For Current account:

If you are not maintaining an average monthly balance of Rs. 5000 (Urban/Metro Branches) and Rs. 1000 (Rural/Semi-Urban Branches), then you will be charged Rs. 60 per day and Max: Rs. 400 per calendar month.

Conclusion!

The minimum balance of the Canara bank is very convenient to maintain and there are also special features attached to it as well. Thus, you must consider having a savings account in Canara bank ASAP!

what is the minimum monthly balance to maintain in Canara Bank, Mangalore city, saving bank account

what is Minimum balance in Canara Bank current account

Canara bank deducted my money and zero my bank balance.

chor bank

I AM interested current account minimum balance

अब तो बैंक में भी पैसे रखना सेफ नहीं हैं

ये बैंक वाले जब मन होता है अपनी मर्जी से कुछ न कुछ चार्ज लगा देते है इससे अच्छा तो पैसे अपनी जेब में रखना ही सेफ है

सब से अपील है इन चोर बैंक से बचो इससे अच्छा तो अपने पैसे की हिफाजत खुद करो वो ज्यादा अच्छा है

सही कहा चोर बैंक हो गये हैं खुले आम डकेति करते है… और पब्लिक… बनी रहती हैं

mat kholo account in bank me kha jayege aapka paisa

Why is Canara Bank is cheap it’s Too bad

Every month Bank deduct my balance like 790rs And This Today 590rs

While opening an account not sharing the penalty and now demanding for a penalty which is very bad for all, I hate this

This bank acct cut my money by rs 250 every month. I hate this bank

When sbi does insist on minimum balance why Canara bank. You will get an account opened within hours whereas Canara bank requires 2 to 4 days. Snail pace.

No credit rs by pmjdy

Does Canara Bank also offer a Zero balance Savings Account?

Canara Bank debited annual debit card charges twice from my saving account one in the month of January and another is in July in this same year

What happens when i do not maintain the minimum balance of 1000 rs saving account and we have zero balance

how much is Canara Bank minimum balance in current account

Sir, In our Canara bank my current account is activated due to lock down my Tours & Travels businesses is low, As per the govt. rules to National Lockdown covid-19 period any govt. bank are not taken any interest and minimum balance charges collected the customer, it is true, if, it is true how and which amount is taken to bank charges minimum balance amount in between of COVID-19 lockdown. pl. suggestion