Banks are the backbone of any country. Whether banks are used for savings accounts or any other purpose, the common man always relies on them for the security of their deposits. Generally, the banks ask for maintenance of a minimum amount in the accounts, and in the absence of the same, they levy penalty charges. These penalty charges vary according to the area of operations of the bank. It may also differ from bank to bank.

What is meant by minimum balance?

A customer is required to maintain a said amount in his bank account for receiving service benefits such as keeping the account open or for receiving a said amount of interest. All banks do not ask to maintain this balance. Furthermore, there are many ways such as the utilization of online services, setting up direct deposits, etc. to avoid these charges.

Eligibility for opening a savings bank account in the Bank of Maharashtra:

Any individual is allowed to open a bank account either as a single entity or jointly. However, if the person wishes to open a bank account of a minor then in such a case it can be opened in joint association with a natural or legal guardian. The applicant is required to produce proof of identity along with address proof. In addition to this, two photographs of the individual and PAN Number or form no. 60/61 are also required.

In case the individual is not able to produce the above documents as identity or address proof then the bank asks for an introduction through an existing customer/account holder in the bank. This account holder must have completed the full KYC procedure and must have optimum operations for 6 months with the bank.

Documents Required for opening an account

To open the savings account in the Bank of Maharashtra a person needs any one of the following:

- A Passport.

- A PAN Card or Form no. 60/61 as applicable.

- A voter’s identity card.

- A Driving license.

- Job card signed by the state government officials and issued by NREGA.

- A letter containing aadhar no., name, and address of the applicant issued by UIDAI.

- Letter by a public servant for identity verification and residence proof of the applicant.

Maintenance of a minimum balance in the account

The minimum balance to be maintained in the Bank of Maharashtra is based on a monthly average. In case the monthly balance is not maintained in the bank, certain service charges are levied once in each quarter. A nomination facility is also available with the bank. The bank also pays interest on the daily balance in the account every quarter.

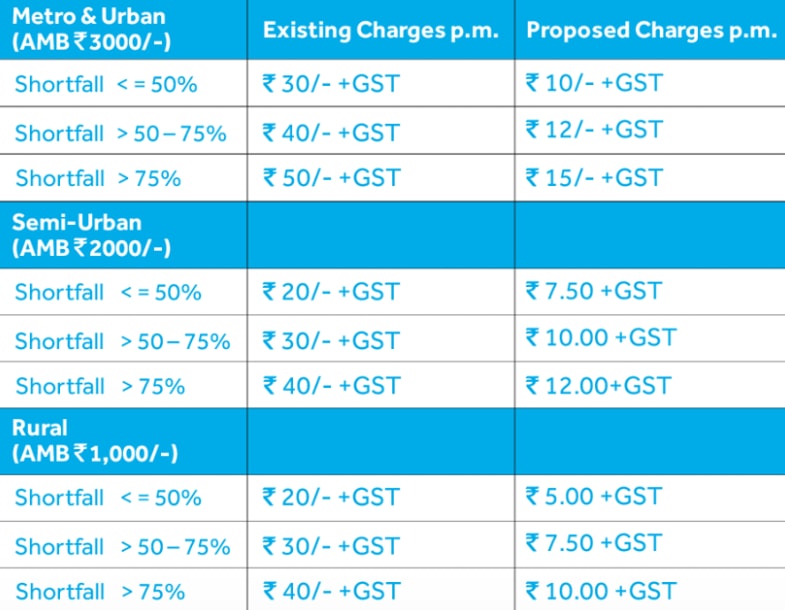

The service charges excluding GST on the deposits are as follows:

| Monthly Average Balance Limit | Charges |

|---|---|

| For Metro/Urban branches monthly average balance (MAB) INR 2000/- |

|

| For Semi-Urban Branches: MAB INR 1,000/- |

|

| For Rural Branches: MAB INR 500/- |

|

The account is closed after giving due notice if the charges are levied for 2 consecutive quarters. However, these penalty charges are not applicable in cases where maintenance of minimum balance conditions is not applicable.

Maintenance of a minimum balance and penalty charges for additional accounts:

For Royal savings bank, INR 1,00,000 is the minimum monthly average balance. In case of non-maintenance of the same INR 1,000 per quarter are levied as penalty charges.

For Purple savings bank, INR 3,00,000 is the minimum monthly average balance. In the case of non-maintenance of the same, no penalty charges are applicable. However, if this condition persists for 2 consecutive quarters then the bank may convert the purple account to a normal savings bank. In addition to this, the benefits as per the merits of the account are also withdrawn.

For CA operative accounts, be it for metro/urban/semi-urban, the MAB is INR 5,000 and the penalty charges for non-maintenance are INR 800 per month. In the case of rural accoy=unts, the MAB is INR 2,500 and the penalty charges are INR 175 per month.

For Diamond CA the quarterly average balance to be maintained is INR 1,00,000 and the penalty charges are INR 2,500 every quarter.

Banks always act as a resource when funds are required. For providing a variety of services banks require the maintenance of a minimum balance in the accounts of the holder. This practice allows the banks to have more deposits and it leads to lending more money by maintaining requirements of regulatory financial ratios. The banks also earn profits by levying fees on the non-maintenance of the required balance. Thus, it is an important aspect of the banking system.

Be the first to comment