Nowadays, while using the Aadhaar Enabled Payment System (or AEPS), most of the business correspondents (or BC) of any bank or the bank outsourced agencies, which are known as Customer Service Points (or CSPs), receive an error message on their fingerprint device machines. These messages state, “Suspected fraud or Transaction amount exceeds the limit.” However, they fail to withdraw money from the Bank of Baroda.

If you use the Aadhaar Enabled Payment System to make transactions in the Bank of Baroda, then you should know about the Bank of Baroda AEPS suspected fraud solution. Read ahead to know AEPS and CSP and the suspected fraud solution.

What Are the AEPS and CSP

Using the Aadhaar Enabled Payment System (or AEPS) is a profitable business. By using this system as a Customer Service Point (or CSP), which is also called “Grahak Seva Kendra,” you can do the following types of transactions from Bank of Baroda or any other bank for your clients:

- Cash Deposit

- Cash Withdrawal

- Balance Enquiry

- Mini Statement

- Aadhaar to Aadhaar Fund Transfer

- Aadhaar authentication

- BHIM Aadhaar Pay

You get a specific commission amount for providing the services mentioned above. For example, you can increase your income in the form of commission amounts and charge some service costs too from your clients by including multiple benefits. Various benefits include mobile recharge software, money transfer software, utility bill payment, PAN card software, prepaid card, and travel services in your portal.

As these CSPs were helpful to banks, supporting them to do their work quickly, the banks used to provide commissions to them.

Why Did the Indian Govt Start AEPS Service?

The purpose of launching the AEPS service by the Indian government was to provide essential banking services to customers of every sector of society in rural, urban, and semi-urban areas, where banks and ATM machines were difficult to reach customers.

Therefore, the Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI) combined to announce the Aadhaar number-based banking AEPS service.

Instead of a debit/credit card pin, the AEPS machine performs like a Point of Sale (or POS) machine. The merchants will require to use the customer’s biometric data to authenticate the transaction.

What Is the Bank of Baroda AEPS Suspected Fraud Solution

Suppose while using AEPS, you are still facing the suspected fraud problem and fail to withdraw money from the Bank of Baroda. In that case, you should read this article till the end and learn the complete information about Bank of Baroda AEPS suspected fraud solution as follows:

- You should know that you will face this problem while using almost all the AEPS portals of either private companies like Spice money, PayNearby, ROINET, Fino Payments AEPS, and BanKit, etc., or the government bank IDs, like the SBI business correspondent (BC), India Post Payments Bank BC, or Bank of India BC, etc.

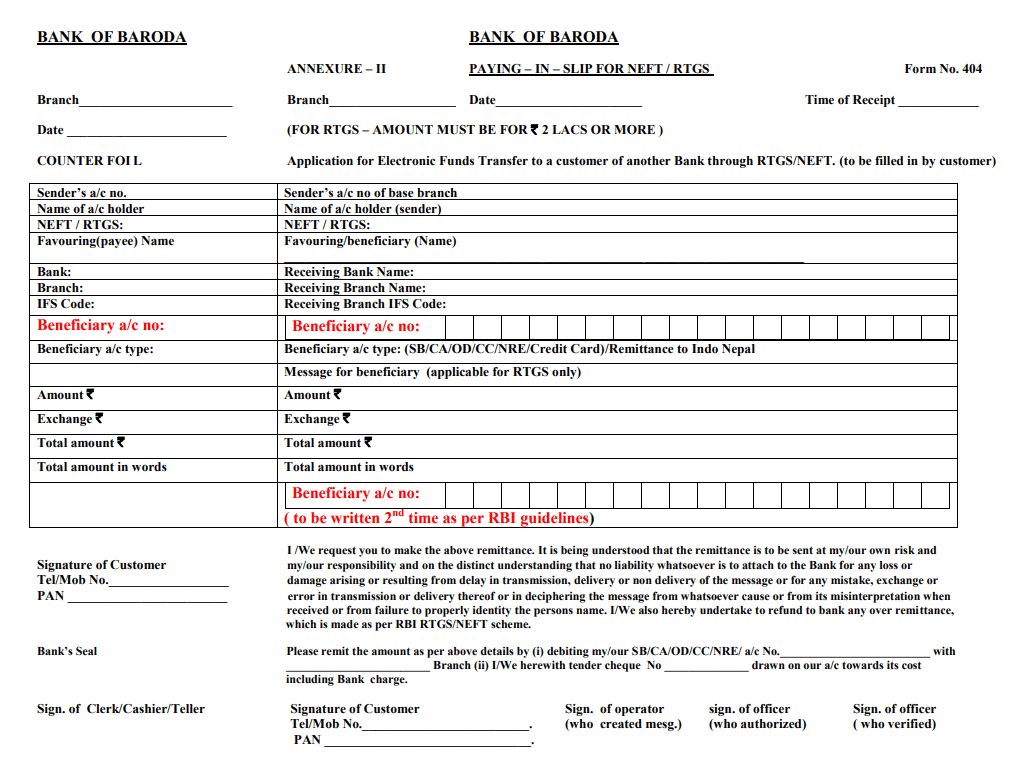

- Bank of Baroda allows maximum transactions of INR 2,000 per day through AEPS, which can be for a maximum 10 number of times per day, up to a maximum limit of INR 20,000 per day. If you exceed these transaction limits, your AEPS ID will be blocked by the Bank of Baroda. You will receive an error message stating, “Transaction amount exceeds the limit.”

- When a merchant CSP overcharges a customer, Bank of Baroda sends an error message, showing him “Suspected fraud.” After that, his ID being used for a fingerprint identification device is blocked. For example, when he withdraws INR 1010 for a customer’s payment of INR 1000 or INR 2020 in place of INR 2,000.

- So, if you are receiving the error mentioned above and continue to fail to withdraw money from Bank of Baroda through AEPS, change your device, which is generally Morfo or Mantra fingerprint biometric sensor with UIDAI. And also, change your AEPS ID. For example, if you use the ROINET ID, you can buy Fino Payments AEPS ID.

- Next time, you should start withdrawing money in multiples of INR 100 only. If you still try to withdraw a split amount, such as INR 1010 or INR 2020, then again, the Bank of Baroda will treat this practice as “Suspected fraud,” and your AEPS ID will be blocked.

- Similarly, you should not exceed the Bank of Baroda maximum withdrawal limits. So you can easily withdraw money.

This way, you can quickly learn about Bank of Baroda AEPS suspected fraud solution.

Conclusion

If you have an iota of doubt regarding the Bank of Baroda AEPS suspected fraud solution, we have provided you with the apt solution. Using AEPS, merchants can use the customer’s biometric data to authenticate the transaction and withdraw money from the Bank of Baroda for their clients.

So we hope you can now trace the Bank of Baroda AEPS suspect fraud and know its solution.

SIR I COULDNOT DOING ANY FRAUD TRANSUCTION BUT MY ID SHOWING SUCPECTED FRAUD.BUT WHY .

REPLY

Bank of Baroda suspected fraud

CSP 162052

yea system se bhee aeps not working

sir, I am suffering from the same problem. no error or split transaction from me. new id and new biometric but the same problem. why?

bank of Baroda is harassing in this way. According to rbi directions if anybody withdraws an amount other than multiples of 100 then his ID will be blocked. but Only the Bank of Baroda and the Central bank of India are showing Suspected fraud errors.

YEAH, ME ALSO DO NOT SPLITTING TRANSACTIONS BUT THE SITUATION ARE SAME MY DEVICE ALSO BLOCKED. THAT DEVICE PREVIOUS LAST MONTH’S PURCHASE. AT MEAN 1 DEVICE 1 MONTH. SO CRITICAL PLZ FIX THIS SOLUTION & ACTION TAKING BY THOSE SPLITTING TRANSACTION DO.

SIR I COULDNOT DOING ANY FRAUD TRANSUCTION BUT MY ID SHOWING SUCPECTED FRAUD.BUT WHY .

SIR MENE NEW ID PURCHES KI USKE BAD BHI SUSPECTED FROUD AARA HAI.MENE 1010 2020 JESE TRANSTATION NAHI KIYA 1000 2000 HI KARTA HU