RBI has licensed four companies to provide an individual’s credit information in India. Of the four, the Credit Information Bureau (India) Limited ( or CIBIL) is the most popular company that records all your financial activities to prepare a CIBIL credit report. This report suggests what type of borrower you are.

For example, whenever you apply for a loan or any credit card, your financial activities, like whether your repayments are timely made, etc., everything is added to your CIBIL credit report. Then based on the CIBIL credit report, a number is calculated, which is known as the CIBIL credit score.

If you have a higher CIBIL credit score, your possibility of getting an extensive range of credit products increases. But if you have a lower CIBIL credit score, getting a loan from a bank or any financial institution is hard.

However, if you are timely paying your credit card bill and EMI of your loan, still your CIBIL credit score is going lower and lower, then there may be multiple reasons for that. Some of the reasons include the following:

- Suppose you have made only two enquiries, but if too many enquiries are shown on your CIBIL, it impacts your CIBIL score badly.

- Moreover, some third-party banks show such loans against your name, which you have never taken. In that case, it will lower your CIBIL score.

- Or, while you are timely paying your credit card bill and EMI of your loan, but your bank needs to update your repayment details in your CIBIL, your CIBIL score will also lower.

If you face any of the abovementioned problems, you should know the way to remove the inquiry from Cibil. This article will discuss this problem and give you a proper solution. So let us get started.

Check Your CIBIL Score, Credit Report and Remove CIBIL Enquiry Free

Here is an easy and quick guide to help you with checking your CIBIL score and credit report and removing CIBIL enquiry for free. Let us check the process of each one systematically.

A. The Process to Check CIBIL Score

You should know your day-to-day CIBIL score to analyze whether it is increasing or decreasing so that you can make needful efforts to keep it as high as you can. By following the below given simple and quick steps, you can easily do this:

1. Open your web browser and type Cibil check. Alternatively, you can also directly click on the link https://www.cibil.com/freecibilscore.

2. Now, a new site will open before you show the title Get your Free CIBIL Score & Report Instantly. Click on the Orange-coloured tab stating Get your Free CIBIL Score.

3. Now, a new interface will open before you, where you will be asked to upgrade your Subscription plan. Fortunately, you don’t need to pay any subscription and can simply click on the No Thanks option to proceed further.

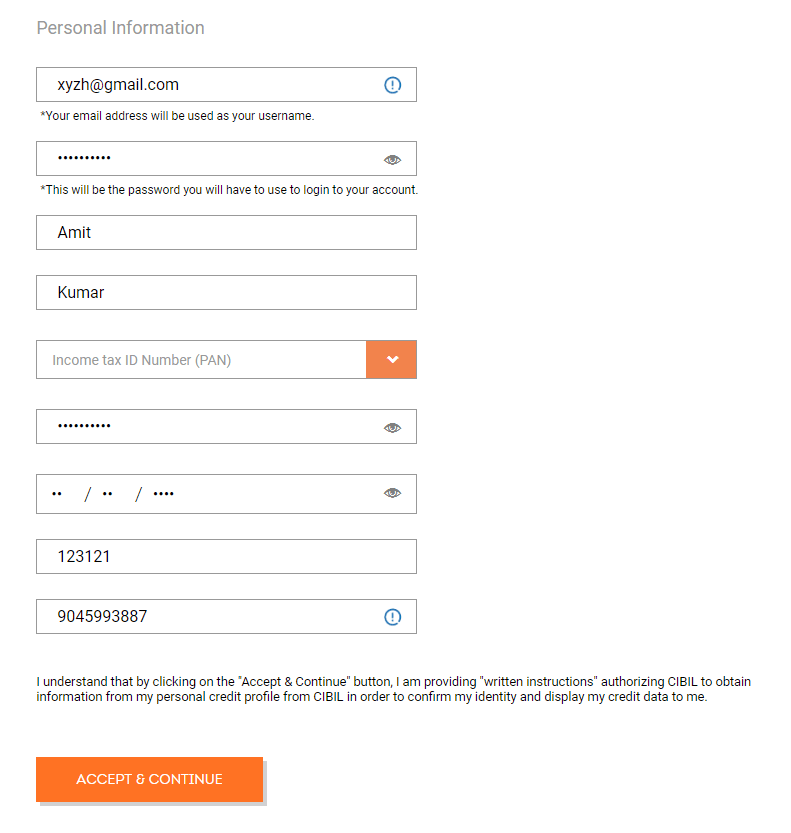

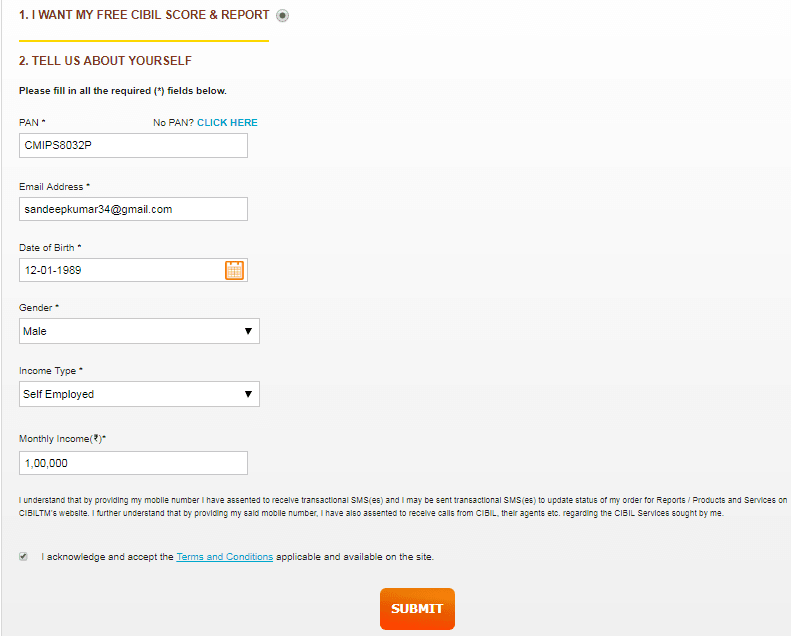

4. Now, a new page will open up before you, where you will have to enter your email ID, create a password, enter your first name and last name, enter your PAN card number as ID proof, your date of birth, your area PIN Code and your mobile number. Click on the Accept & Continue button.

5. After that, once again, you will be asked to pay subscription fees for upgradation. But here also, you may click on the No Thanks option and proceed without paying any subscription.

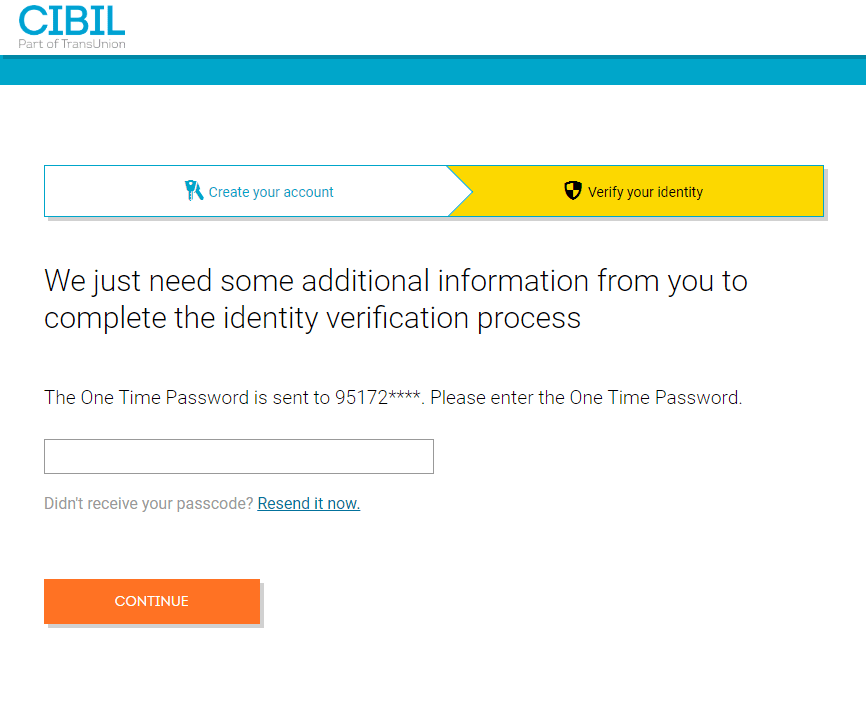

6. Now, you will receive an OTP (One Time Password) on your mobile. Enter the OTP and click on the Submit button. Then you will see do you want to pair the device. Click on the Yes option, and then tap on the Continue button.

7. Now, you will receive a message that you have successfully enrolled, click on the Go to Dashboard button.

8. Now, once again, you will be asked to accept some offer and pay a subscription fee. But you can simply tap on the cross sign at the top right of the mobile screen and move further.

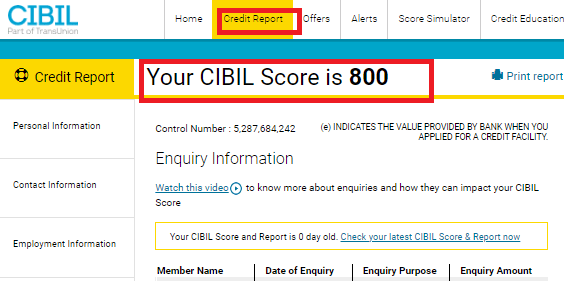

9. Now, you will see your current CIBIL Score on the mobile screen. Once again, you will be asked to upgrade your subscription plan and pay a fee. But you can simply ignore their offers to do so.

B. The Process of Checking Credit Report

After checking your CIBIL score, you can proceed to check the credit report following the below given quick steps.

1. Once you check your CIBIL score, tap on the Credit Report tab at the top bar on the same page to check your credit report.

2. Now, a new interface will open before you, where (at the left pane) you will see a few options like Summary Report, Personal Information, Contact Information, Employment Information, Account Information, and Enquiry Information.

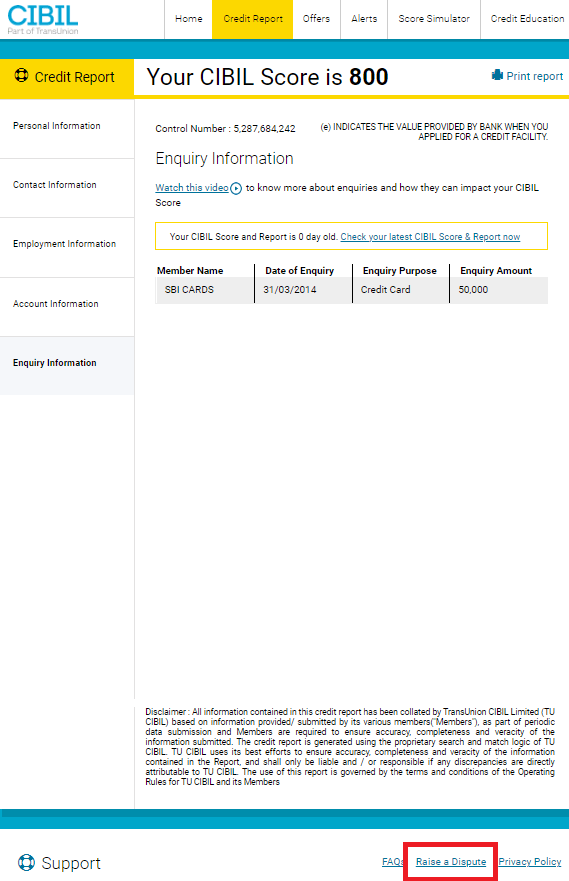

3. Click on the Account Information option, and then you will see all your open/active loan accounts. Then Click on the Enquiry Information option to see all the enquiries here.

C. The Process of Removing CIBIL Enquiry Free

Once you check your credit report and find the listed enquiries that you need to remove, you must proceed with the enquiry removal process. After reviewing the enquiry information and viewing all the listed enquiries, follow the below given quick steps to remove the unnecessary enquiries.

Step 1: Sometimes, third-party banks show such loans against your name, which you have never taken. Other times it may happen that you are timely paying your credit card bill and your loan EMI, but your bank needs to update your repayment details. In such a case, you must click on the Raise a dispute option at the bottom of the page.

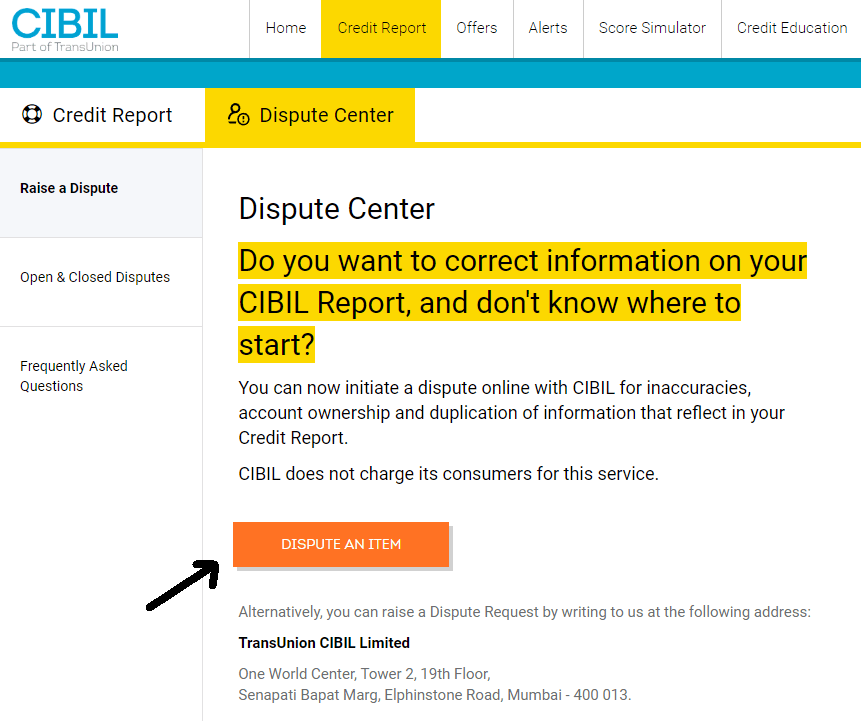

Step 2. Now, a new page will open before you, showing you do you want to correct information on your CIBIL Report and don’t know where to start. Then click on the Orange-color DISPUTE AN ITEM button.

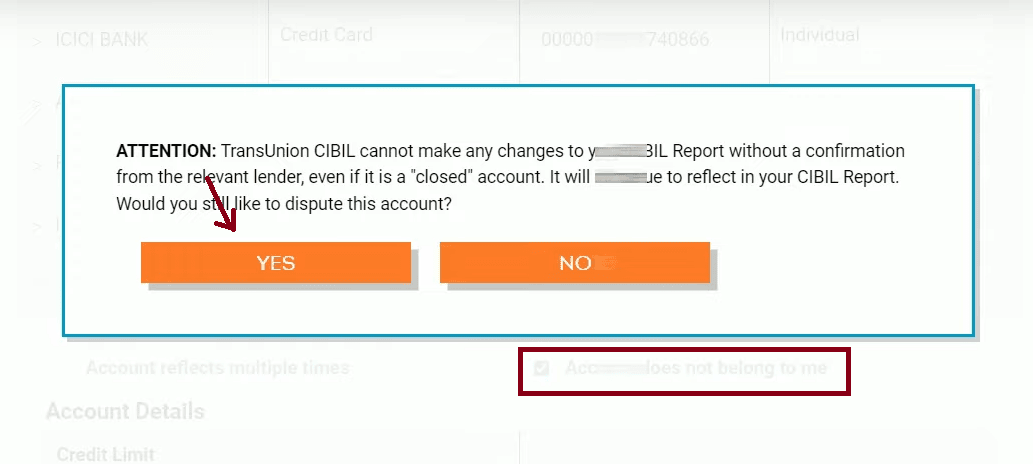

Step 3. Now, a new page will open before you, showing you multiple options like Personal Information, Contact Information, Employment Information, Account Information, and Credit Application History ( Enquiries). Click on the Account Information option and sort out undesirable accounts you have never taken and want to remove from your Credit Report.

In addition, sort out such loan payments which you have made timely, but your bank is showing as late payments or non-payments. Click on the Account does not belong to me option. Then click on the Yes button, and then click on the SUBMIT DISPUTE button.

Then a new page will open up before you, showing you Dispute Summary, where you will see Dispute submitted successfully via **********. After some time all the unwanted loan accounts will be removed from your Credit Report.

Click on the Credit Application History ( Enquiries) option, where you will see all the enquiries. Sort out the undesirable enquiries you have never made and want to remove from your Credit Report. Now tick those sorted enquiries in their related box, click on the Yes button, and then click on the SUBMIT DISPUTE button.

Then a new page will open up before you, showing you Dispute Summary, where you will see Dispute submitted successfully via **********. After that, all undesirable enquiries will be removed from your Credit Report.

So this way, you can remove unwanted loan accounts and enquiries from your CIBIL Credit Report.

Conclusion

Suppose you don’t want to lower your CIBIL score unnecessarily. In such a case, we are pretty sure that after reading this article and following some simple and easy steps described above, you must have learned to remove CIBIL enquiry free.

Be the first to comment