State Bank of India is the leading financial company in the public banking sector of India. If you have an account with SBI, you definitely must be enjoying the banking facilities and services offered by the bank.

SBI offers excellent banking services with an aim to satisfy its customers. You must be using the debit card provided by the bank for different financial transactions. SBI also offers flexible opportunities to use the debit card globally!

You can enjoy cashless shopping abroad with SBI Global International Debit Card. You can use the debit card for making payments online as well as withdraw cash easily.

Applicable extra charges for, using debit card globally

For using the Global SBI Debit Card, you need to pay extra fees. You need to have proper info about the additional charges applicable for debit card usage globally.

- If you make a Balance inquiry at an ATM in Aboard, the bank will charge Rs 25 + GST which will get automatically deducted from your account every time.

- If you withdraw cash from ATM, you have to pay Rs 100 min. + 3.5% of Txn. amt. + GST.

- For Point of Sale (PoS)/eCom transactions, you have to pay 3% of transaction amount + GST.

SBI Global Debit Card Withdrawal Limit Internationally

| SBI Global International | Minimum | Maximum |

|---|---|---|

| Daily Cash Withdrawal Limit at ATMs | Varies from ATM to ATM | Maximum of foreign currency equivalent of Rs. 40000 |

| Daily Point of Sales/ Online Transaction Limit | No Limit | Maximum of foreign currency equivalent of Rs. 75000 |

Annual Maintenance Charges

| Issuance Charges | Zero |

| Annual Maintenance Charges | Rs 175/- plus GST |

| Card Replacement Charges | Rs 300/- plus GST |

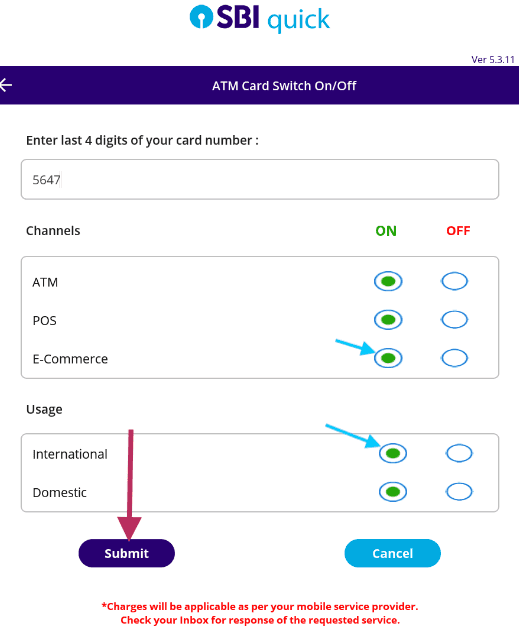

SBI offers different types of SBI Debit Card with unique specifications. If you are traveling abroad, you may require using the debit card under any circumstances. You can’t use normal debit card internationally! You need a SBI global debit card for making successful transactions, withdrawals and payments. Also, you need to enable International transaction on sbi Debit card to use it internationally.

Earn additional benefits

Using the Global Debit Card, you will earn SBI Rewardz! You will earn 1 point on a purchase of Rs 200 every time which will get credited to your Rewardz account. You will receive the bonus points whether you shop, dine out or fill fuel.

If the card’s issuance term has not yet reached one month, you will be able to earn 50 bonus points on the first purchase transaction. If you continue the purchase for the second time, you will receive 50 bonus points more. But if you purchase for the third time, you will earn 100 bonus points.

Make sure to obtain the Global Debit Card to use abroad!

Being a student, which visa card is suitable for me to do transactions abroad? I need a Visa card debit card for the application fee submission while applying to different universities. Also, I am unemployed currently but have enough amount in my account. Can I be eligible to apply? I have an account in Allahabad Bank. Can my bank give me this Visa debit card or do I need to open a new account in some private bank?

which SBI international Card has no charges to withdraw money from UK ATM and what is the Max amount one can withdraw.

Your own money if you have to withdraw you have to pay. A not small amount – 3.5% of the amount you withdraw plus GST.

Why SBI Global Debit Card restricted to withdrawing cash in Nepal & Bhutan?