What is the beneficiary?

A beneficiary is whoever receives benefits or rewards from anything. A beneficiary in the banking markets usually refers to anyone who is entitled to collect dividends from a foundation, will or health savings policy. Beneficiaries are explicitly mentioned in either these documents or the provisos that make them eligible for whatever allocation is stated have been fulfilled.

A beneficiary is a person who earns a reward which is usually a monetary gain. Any individual or entity can usually be designated as a trusted trustee, will, or life insurance policy. The person who distributes the funds, or the benefactor, may put different provisions on the release of funds, such as the recipient who meets certain age or marries. Tax consequences have also to be met by the beneficiary.

Conditions to be a beneficiary

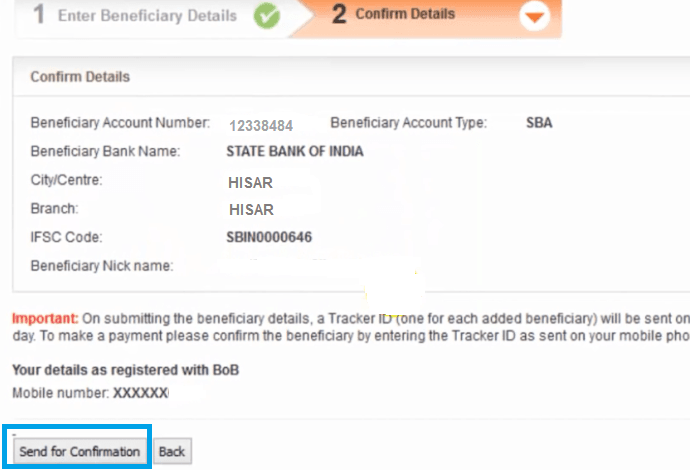

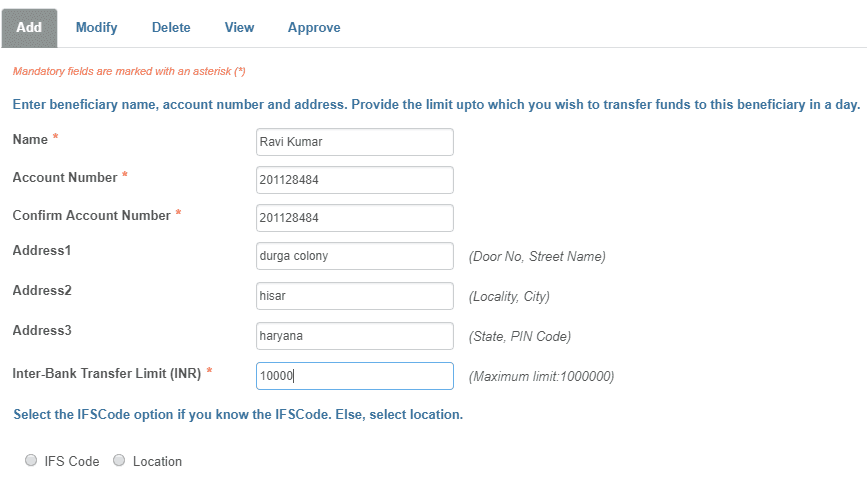

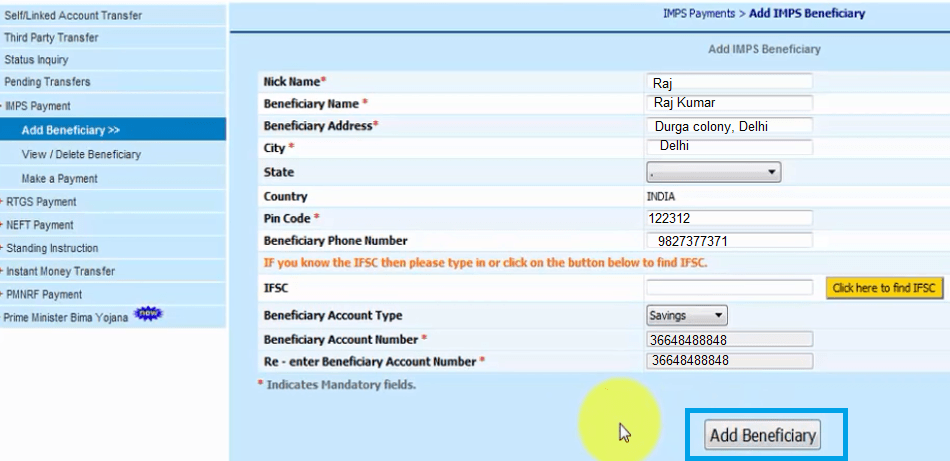

To pass the money, the person to which the payment is to be made must be listed as a ‘beneficiary‘ and his banking account information given. This included the beneficiary account holder’s name, account number, bank and branch name, and the beneficiary bank division’s IFSC code.

A beneficiary account is a person’s Demat account (single or jointly). A Demat account may even be in the name of a corporation, a joint business, a corporation, or a trust. It’s sort of like a savings account. This account shall be used for the exchange of product accounts kept by the account manager in licensed warehouses of the exchange.

The bank wants 12-24 hours to authenticate the beneficiary’s information. A current beneficiary account is enabled after this, and the money may be moved to the specified account.

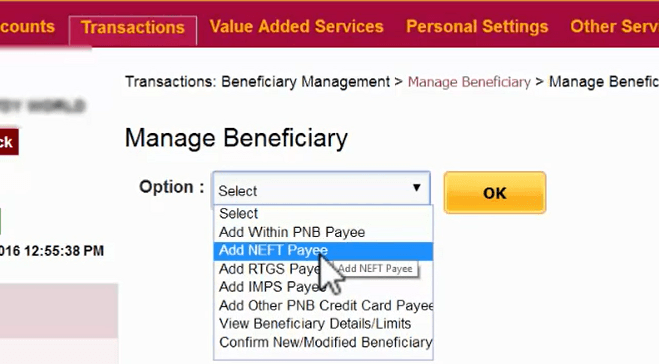

Types of beneficiary money transfer

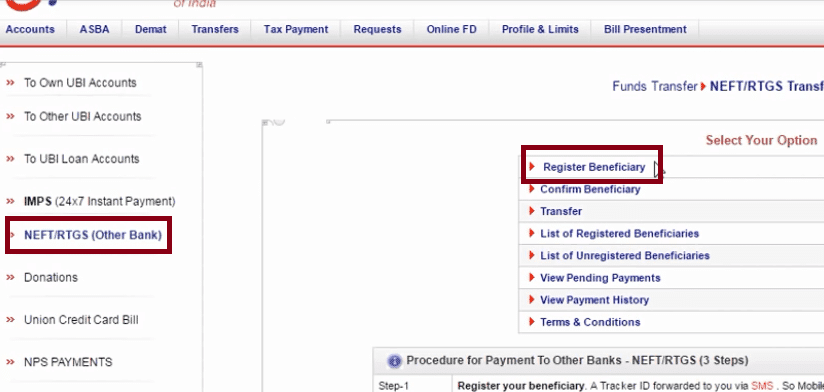

There are two types of transfer as one is NEFT, and the other one is RTGS. The NEFT transfer takes place in installments, whereas the RTGS is a real-time transfer of money.

The following are the required things for transfer purposes. Determine the way of transfer method (NEFT or RTGS), the title of the beneficiary, the number, and the conversion reason/description. The conversion instruction is issued after delivery of the information and the password of the authentication transaction.

The least sum which RTGS can transfer is Rs 2 lakh. For transition through NEFT, there is no such limitation. At moments the RBI describes NEFT as settling in batches. RTGS accounts are continuously resolved as when they have been transferred. Transferring funds through NEFT and RTGS could also be achieved by sending the money form to the bank branch of the remitter.

In this article, we tried to provide you with in-depth knowledge of the term beneficiary. Hope you have cleared your quarry.

Be the first to comment