It is necessary to know what IPO is before jump into the topic of how to apply for it. IPO is the full form of Initial Public Offerings announced by the unlisted companies in the stock market, trying to sell their shares to the public for the first time. IPO refers to the first invitation for the public to the stock exchange and purchases the shares and securities through the stock market.

The retail investors can claim ownership in the company they have invested in to participate in the offering. This process is vital for the private investors to obtain as there are the premium shares included. It’s an offering that occurs a procedure that transforms a private company into a public company to raise funds.

Now applying for IPO, you need to have a Demat account in the bank that provides the stock insurance processings. SBI is the biggest bank, and as a financial institution, one of the facility providers of IPO in India offers to open a Demat or trading account. State Bank of India gives this facility with the online application system via the YONO app- You Only Need One.

The YONO lite is for digital banking by the State Bank of India to process every banking-related works like insurance, money transactions, shopping needs, bank information, and investments. SBI YONO lite is here also provides the facility of participating in IPO investments. To apply for IPO through the SBI YONO app, you have to follow some steps.

Procedure to apply for IPO in the SBI YONO App

You can open a new Demat account on the YONO app or link the existing one. The following points are to apply for IPO on the SBI YONO app just after the account opening.

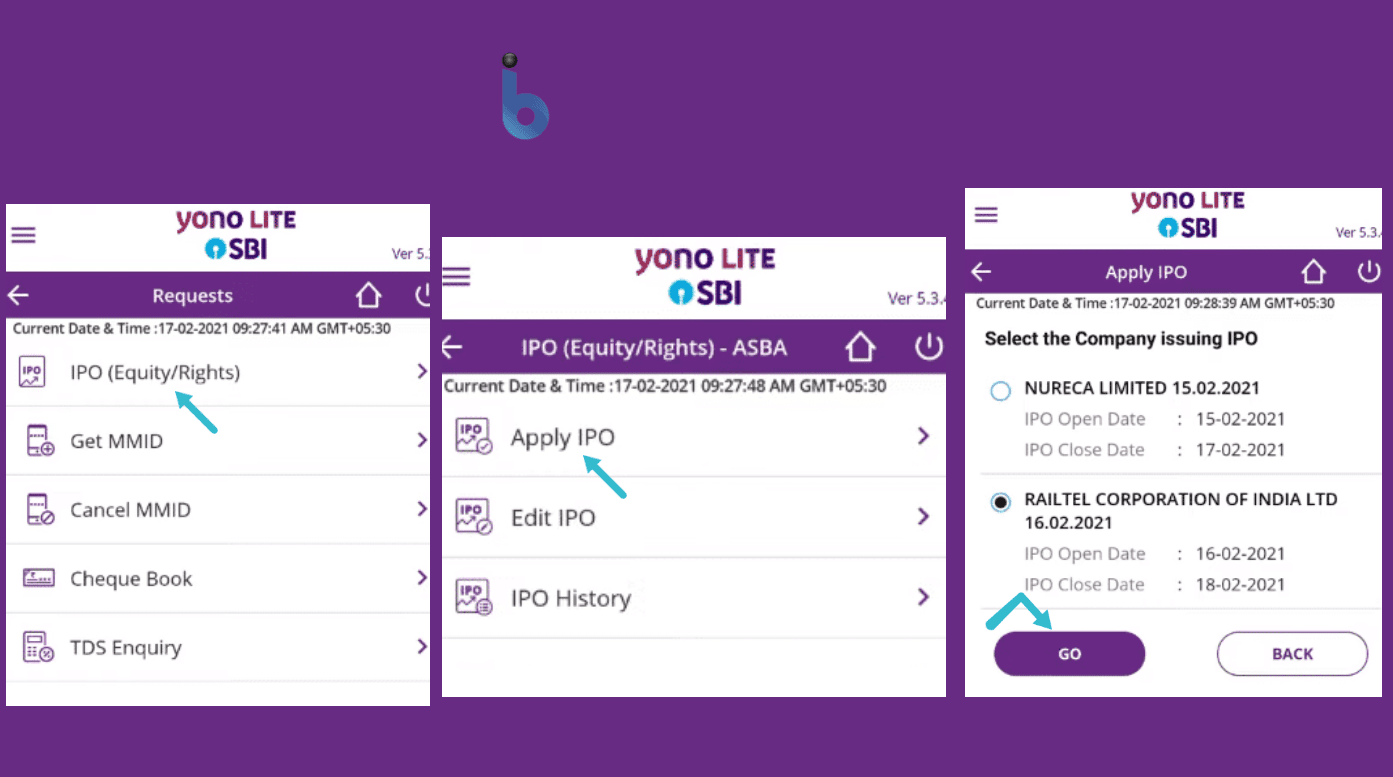

Step 1: Log in to the YONO app by giving the password installed on your phone. After that, the main page will appear, where you will see the “Requests” option.

Step 2: Click on that option, and there you will see 5 options to click. You have to click on the first option called “IPO(Enquiry/Rights)” to enter the next page.

Step 3: There are 3 options, including “Apply IPO” with other IPO histories.

Step 4: After clicking on the option, a terms and conditions page will appear that indicates this application form is meant only for eligible ASBA (Application Supported by Blocked Amount) bidders.

Step 5: Click on the button “Accept” below the page if you are an ASBA bidder.

Step 6: After clicking the button, the companies that issued IPO will appear instantly. Select the company option in which you want to invest for IPO and click the “Go” button.

Step 7: There, an application will appear, and you have to scroll down to get the “Accept” button to click on it.

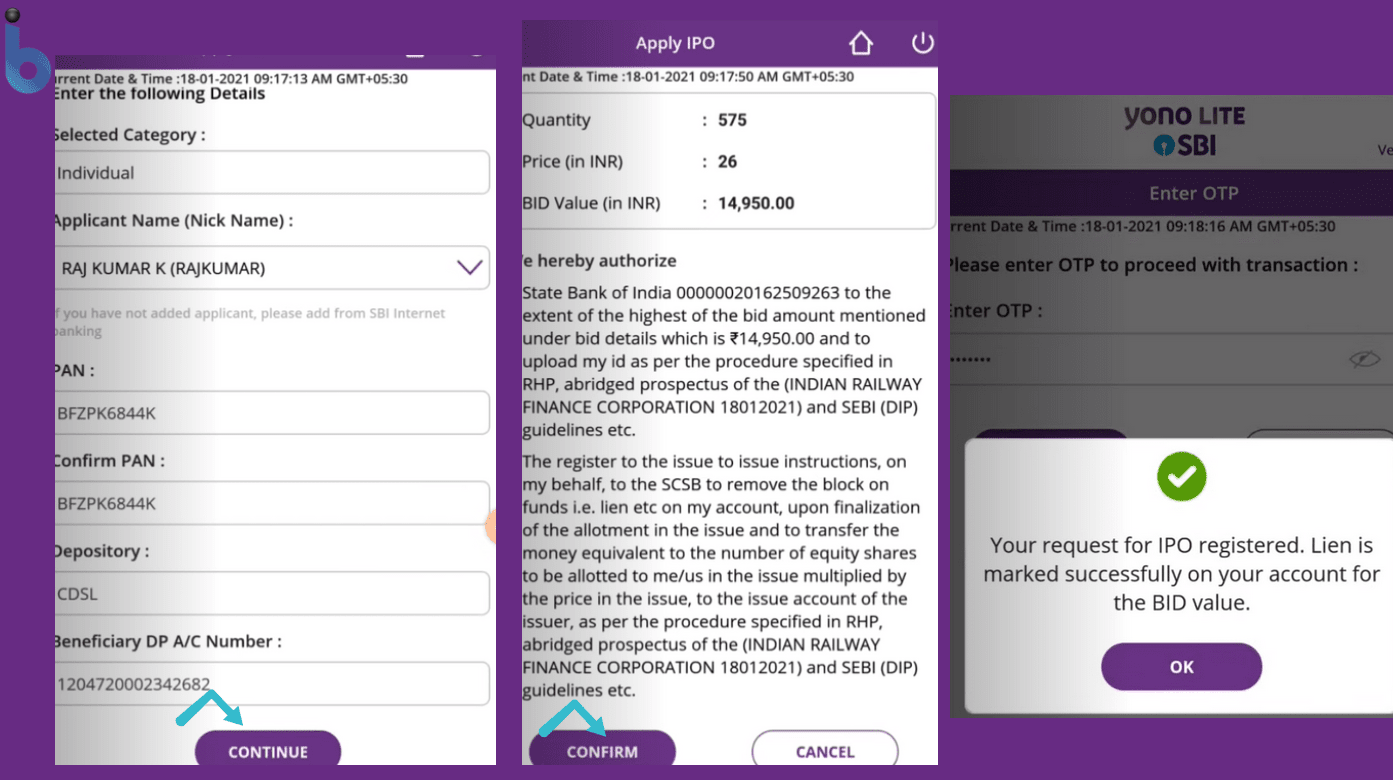

Step 8: Then the category selection page will come, and there you have to select your category for yourself.

Step 9: Two selection category options for “Employee” and “Individual” are there. The employee option is for those who are staff of the company, and the Individual option is for those who are not.

Step 10: Select accordingly, and then details of the issue page will pop up where you will see everything about the issued company, including minimum bid quantity.

Step 11: Here below, you will see an “Applicant Name” box. You can register already with all your details beforehand, or you can also register at the time of investing.

Step 12: Now, you have to fill up all the boxes given here with your proper and original documents and click on the “Continue” button.

Step 13: You have to fill the boxes and click beside the “Cut of price” option. Put down your every correct information in the boxes carefully. You will find the matches on the previous company info page.

Step 14: Fill in the “Debit from account” with your account. When you type your IPO account, other information related to your account will automatically be filled up in the other boxes. You have to scroll down to click on submit.

Step 15: The confirmation page will come right after submitting the previous form, and you have to “Confirm” it.

Step 16: After the confirmation, one OTP number will send to your registered mobile number, and you have to put the OTP in the given box.

Step 17: Once you have submitted the OTP, it will show your application for IPO is successfully registered.

Eligibility to apply for IPO online

There are some eligibility requirements to apply for an IPO online.

- According to SEBI guidelines, the individual should be an Indian resident.

- As per SEBI, the investor can be from any of the categories that are approved to be eligible for IPO application.

- The Demat account should be with NSDL or CDSL.

- The investor can have internet SBI savings or a current account.

- The investor only can apply depending upon the cut of price or highest bid amount.

Conclusion

Registering IPO through the SBI YONO app is easy, only if you have the eligibility as per the SEBI norms. We have clearly explained to you every single step so that you only have to fill up the boxes carefully. Once you have completed the application process, download the form of the company details and IPO registration so that you can keep it safely to yourself.

Remember one thing you can not use the application amount as it has been blocked against the funded deposit account and that demarcated funds are used for ASBA applications. Therefore, you have to have a sufficient balance in your savings or current bank account. We hope you will be helpful in this writing. For more information about the IPO, contact us right away.

Be the first to comment