Banks often offer great tools to their valuable customers to stand out in the banking market. Usually, these tools aid the customers to keep a track of their funds with the bank. In addition to this, the users can also identify any errors in transactions, recognize their spending habits, and keep a track of their finances by using these services.

Account-holders are often issued a bank statement by their respective banks, which shows a detailed activity of their accounts. Through this statement, they are enabled to see the process of their transactions and can keep easy track of it. Usually, the statements are issued for a specific period. In this article, we are going to tell you about ICICI bank Statement and its pdf password.

The bank statement issued by the ICICI contains 3 parts which are as follows

- Details of the account holder.

- Details of the account.

- Transaction history.

Details related to the account holder’s information are mentioned on the top portion of the bank statement. These mention details as; Name of the account holder, mobile number registered with the bank, type of the account, total balance available, any ICICI Bank FD if available. Both debit and credit transactions are shown in detail along with other details as amount, date, description of the payee and payer. However, the customer does have the option to choose for the period he requires the ICICI bank statement.

Process of viewing ICICI bank statement online

The valuable account holders of ICICI bank can also download the bank statement online. Customers can get this via mobile by downloading a simple ICICI bank application. The customers can also make use of the ICICI net banking portal for making the transaction.

Following are the steps that can be followed for generating and viewing ICICI bank statements via making use of the net banking portal of the bank:

- Firstly the customers need to log in to the corporate Internet banking portal of ICICI bank. Then they need to click on the “Continue to login” tab.

- Then the user needs to enter a few details like Corporate ID, user ID, and password. Thereafter the user needs to click on the “Login” tab.

- A page occurs on the screen as soon as the login tab is clicked, the user needs to click on “E-statement” on the page.

- Then the user needs to select the respective account number, the period for which the statement is required.

- Thereafter, the user needs to click on the “PDF” option for generating the statement.

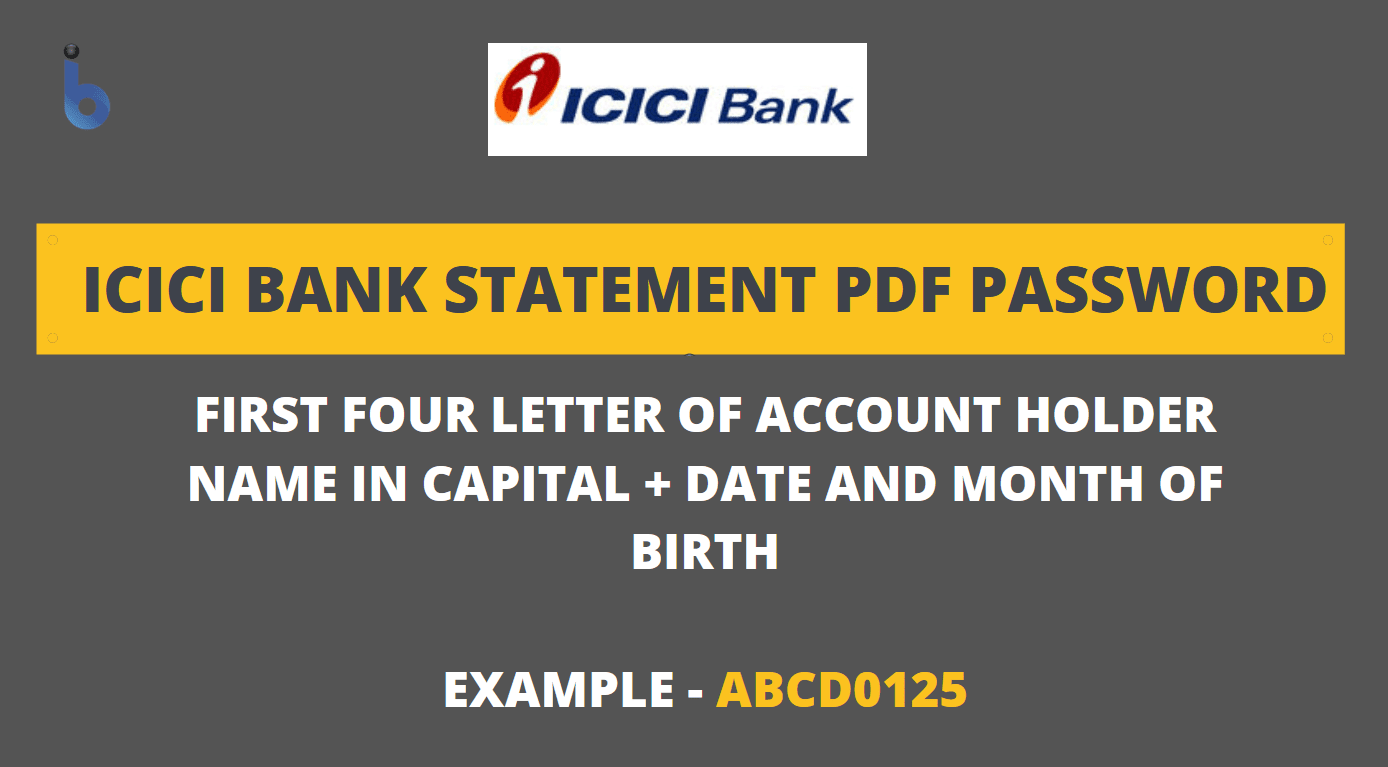

Steps to open ICICI bank statement PDF password

As soon as the mail ID of the customer is registered with ICICI bank they can avail the bank statement on email. The bank also offers a one-month subscription where customers are eligible for receiving the bank statement in the first week of every month.

The customers can avail these statements in electronic form for free and the same can be accessed anywhere. The benefit of these statements is that the customers need not visit the branch to avail the same.

ICICI bank statement in PDF format is secured with a password which is a combination of the user’s name and their date of birth. The first four letters of the account holder’s name in the CAPITAL letter are utilized for this purpose. For example, if the user’s name is Suresh Kumar and his date of birth is 02 January 1983, then his password for the ICICI bank account statement will be SURE0201. This will enable the user to get his statement in PDF format along with a secured password.

A few banks add interest payments, penalties, or even fees to the user’s account for providing a plethora of services to the users. Moreover, these services in the form of monthly bank statements assist the account holders in keeping a track of their regular transactions.

ICICI bank statement also helps in verifying the bill payments and charges if any applicable for making use of debit cards. Thus, it proves beneficial for the users and PDF format is accessible anytime on their mobile phones, thereby creating a track record for their statements.

ICICI Bank statement password not working

How to remove password from ICICI bank statement PDF

Yogesh mandavkar password not working

what are you doing now your Bank e-statement Pwd is not working what happened

my statement is not opening

How to remove password from ICICI bank statement PDF

I am not able to open ICICI bank statement

My statement is not opening

Please give me a statement

1 June se till date

ICICI Bank statement password not Working

How to remove password from ICICI bank statement PDF

ICICI Bank statement password is not working

ICICI Bank statement password not Working

Please send my e-statement password to my email

मुझे a/c- xxxxxX1340 का statment भेजे pdf