A “Point of Sale” (or POS) transaction is a purchase made through debit cards or credit cards or prepaid cards, or QR scanning, where you are needed to enter your PIN on a keypad. POS transactions are quickly posted to your bank account. You can see a POS transaction on your bank account statement that shows the amount and the name of the merchant. So stay with us to know about POS transactions in debit and credit cards.

What is POS transaction in Debit and Credit Cards?

You should know that as and when a payment is made through a debit card, that transaction will reflect on the customer’s credit card statement, often with the description mentioned as “POS” or “POS debit.” From a technical point of view, a POS transaction goes through the point-of-sale system for every sale.

The mentioning of merchant descriptions is applied to your customer’s bank account statements to help them understand the details of the transactions made. If the transactions related terms are not clear, in that case, it could create doubt that the transaction is a fraud.

When you will understand how the POS or POS Debit transactions process works, you can quickly act in anticipation of future problems, needs, or changes to make your customers feel more confident and free from worry or doubt.

If you often use POS transactions in Debit and credit cards, then you should know more clearly about POS, POS debit, and how the transaction process through Debit and credit cards work for customers and merchants.

Difference Between POS And POS Debit

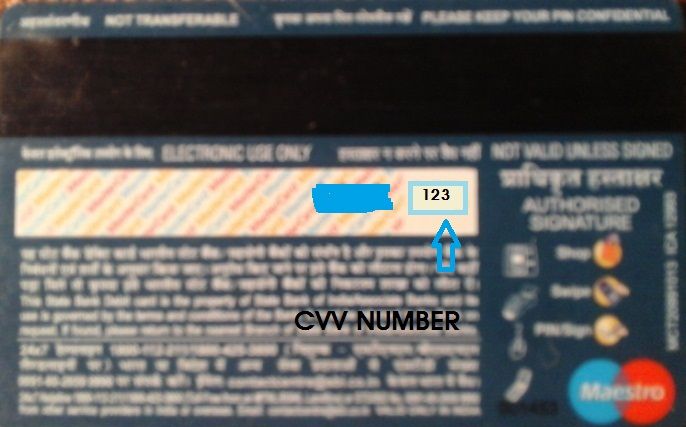

- This is for your information that POS is the point of sale terminal through which transactions can be made with the help of a tap, swipe, chip, or key. Commonly used POS systems include much software like Clover, NCR, Revel, and Toast. According to a set of facts or principles, all purchases should be marked as POS on a credit card statement, but that is not always done.

- On the other hand, POS debit, as compared to POS, refers to a transaction that is made specifically from a debit card, which is sometimes also called an ATM card.

You should know that the use of a debit card along with the POS system is called the POS debit.

Difference Between POS Debit Card And POS Credit Card Transactions

- You should know that when a debit card is used to spend money in a customer’s checking account, then it is considered differently from a credit card transaction.

- Whereas debit cards are connected to money that the customer owns in his bank account, but as a contradiction, credit cards are used to spend money from the credit card network, for which the customer is allowed to pay back later.

- Debit cards and credit cards are two payment types that include different levels of risk factors and card processing with them. Therefore, they are used to charge other fees.

- However, debit/credit card issuer banks and credit card networks mostly prefer credit cards for their income potential, and despite the fact that the risk always remains there that the consumer might not pay the credit card bill, they charge higher fees in compensation.

- On the other hand, comparatively, debit card transactions are pretty straightforward for banks and card networks. Because the money is immediately deducted directly from the consumer’s bank account, which is already available there. Therefore, there are no more checks and balances needed for that transaction.

- However, both debit and credit cards can be issued by a bank or another card issuer, like Mastercard and Visa. But the only difference is in where the money for payment comes from, such as whether the payment money comes from the cardholder’s bank account or the card network’s credit.

So this way, you can quickly learn about What is POS transaction in Debit and credit cards.

The Net Concluding Thoughts

You should also know that it is always worthwhile to encourage debit card transactions. However, the only disadvantage or negative aspect for customers is that it comes out of their main account. For example, they may be charged overdraft fees if they don’t have enough balance in their bank account.

Be the first to comment