Like any other bank in India, the transaction history in the SBI, also known as the State Bank of India, is the detailed information on a financial statement. It offers a complete overview of your financial activities, such as income, spending, and savings, during any given period of time. It is advisable to regularly monitor your bank account to check money in and money out so that the risk of a bounced check can be minimized or possible fraud can be detected.

All changes to your bank account are recorded in the transaction history, and passive activities, such as deduction of fees/charges and interest payments, etc., are also included in it. In addition, by regularly checking it, you can look at the factors that directed how your total account balance was calculated. In fact, regularly reviewing your transaction history can help you make sure that your account balance is accurate.

Let’s get started with the quick four methods to check your transaction history in SBI Online. Keep reading this post for more information and further details.

4 Ways To Check SBI Transaction History Online

Suppose you have a Savings or Current account with the State Bank of India. You want to view and check the transaction history/activity of your bank account. In case you don’t know how to do it, don’t worry. This article walks you through the effortless four methods for the same. Just follow these methods as described here under:

1. Check Transaction History in SBI Using the YONO Lite SBI Mobile Banking App

TO USE THIS METHOD, the SBI YONO Lite, a mobile banking application, must be active on your mobile phone. Follow the steps as follows hereunder:

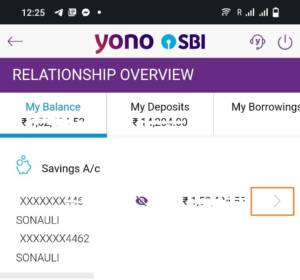

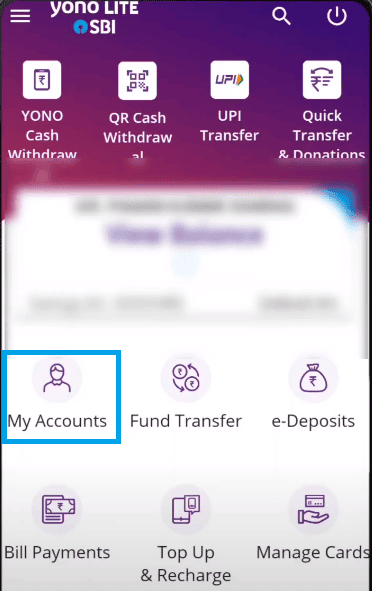

Step 1. Download and open the SBI YONO Lite mobile banking app on your mobile device and log in. Then click on the “My Accounts” option.

Step 2. After that, you will see three options on the next screen. Click on the “Mini Statement” option to check the last ten transactions history in your bank account. Click on the “mPassbook” option to check the complete transaction history of your account. And click on the “View/Download Statement” to check the account transaction history of the last 12 months.

2. Check SBI Transaction History Through YONO SBI Mobile Banking App

For using this method, the YONO SBI mobile banking application should be active on your mobile phone. Follow these quick steps:

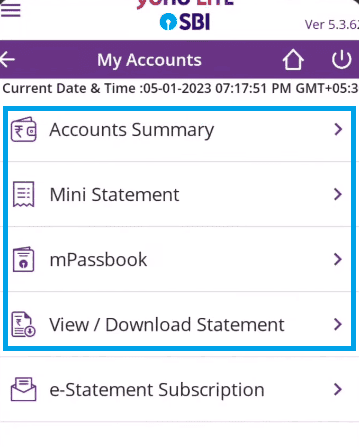

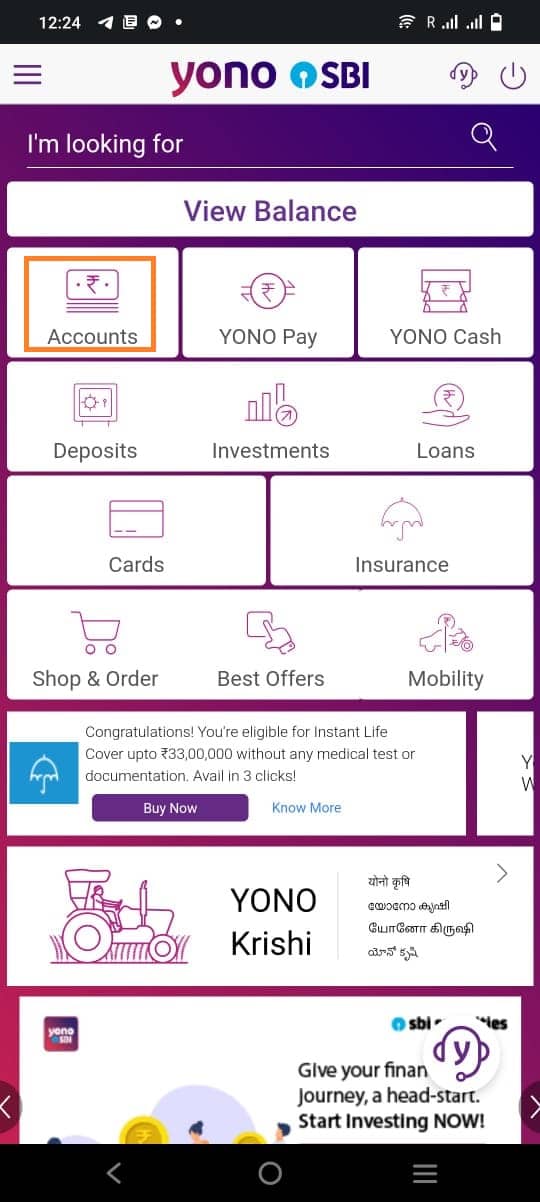

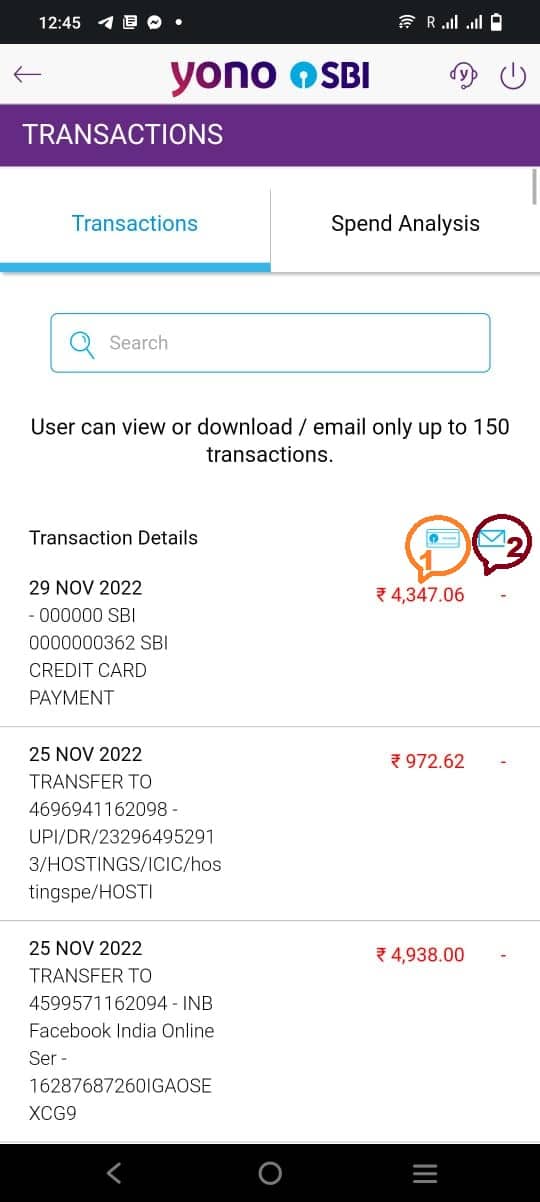

Step 1. Open the SBI YONO mobile banking application on your mobile device and log in. Then click on the “Accounts” option.

Step 2. After that, click on the account number or balance on the next screen.

Step 3. Now, a new interface will appear before you. Here, you can view and check the last 150 transaction history. This transaction activity can be saved on your mobile phone.

You can also download your transaction activity and easily send it to your registered email address by clicking on the blue color icon for the email in front of “Transaction Details.”

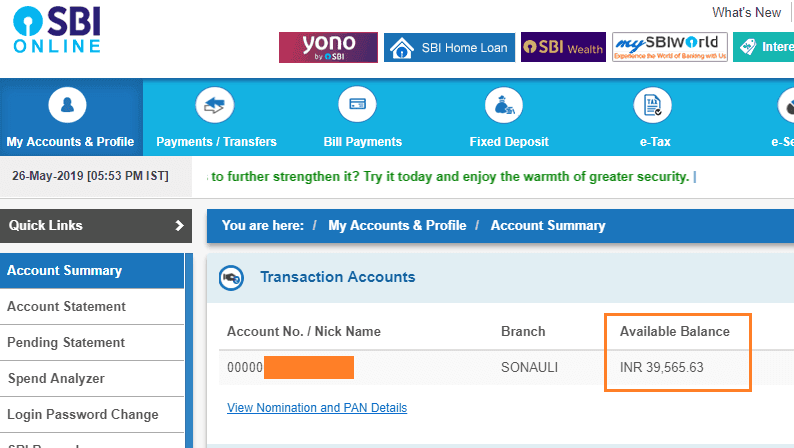

3. Check SBI Account Transaction History Using Net Banking

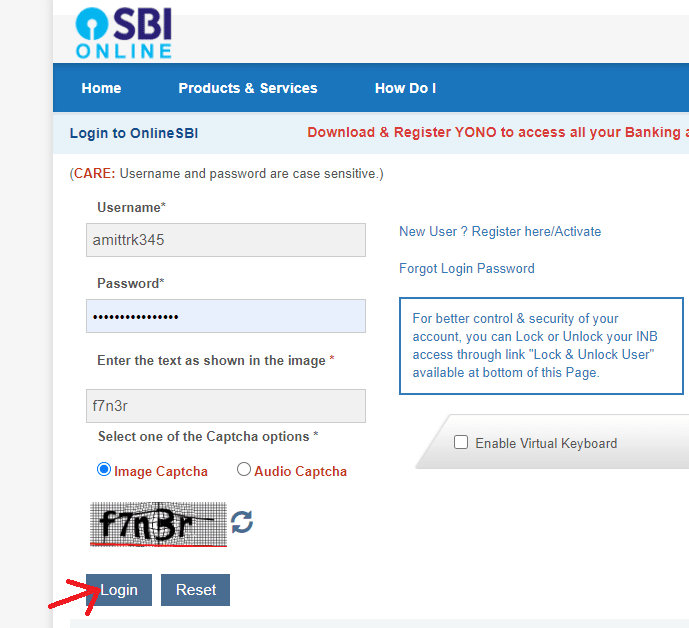

This method can also be quickly used to view and check the transaction history of your SBI account. Follow these easy steps as described hereunder:

Step 1. Open SBI net banking on your mobile phone and enter your username and login password to log in.

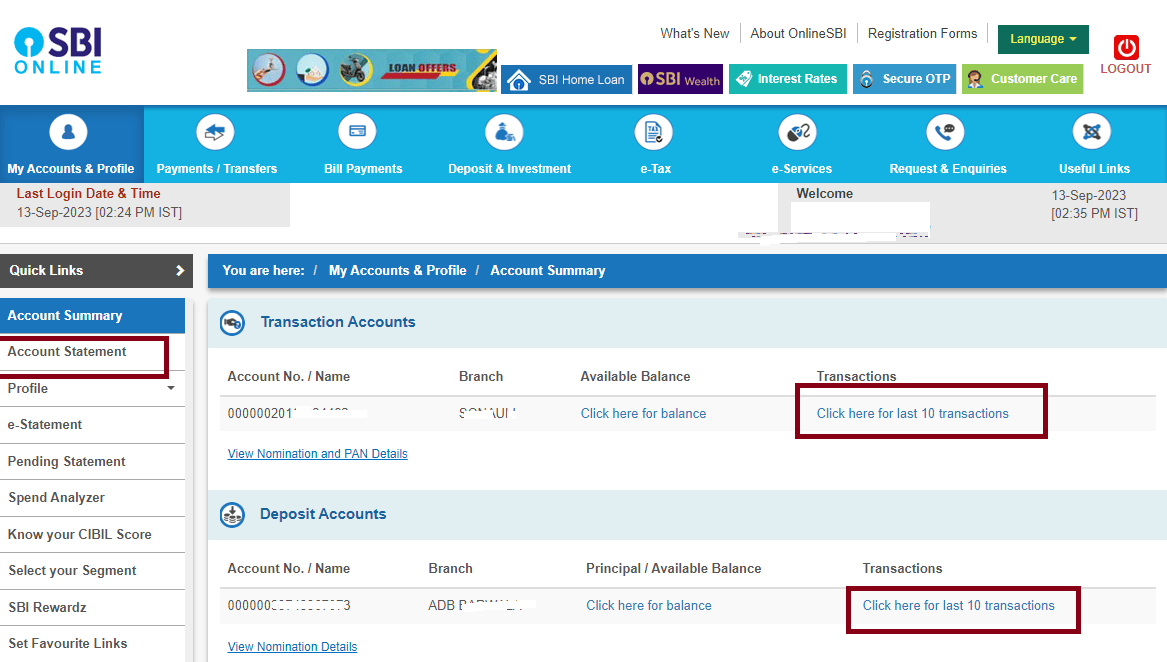

Step 2. After logging in, you can click on “Click here for last ten transactions” on the right side of the next screen and check the last ten transaction history.

If you want to view and check the detailed transaction history of your account, click on the “Account Statement” option on the left side of the same interface.

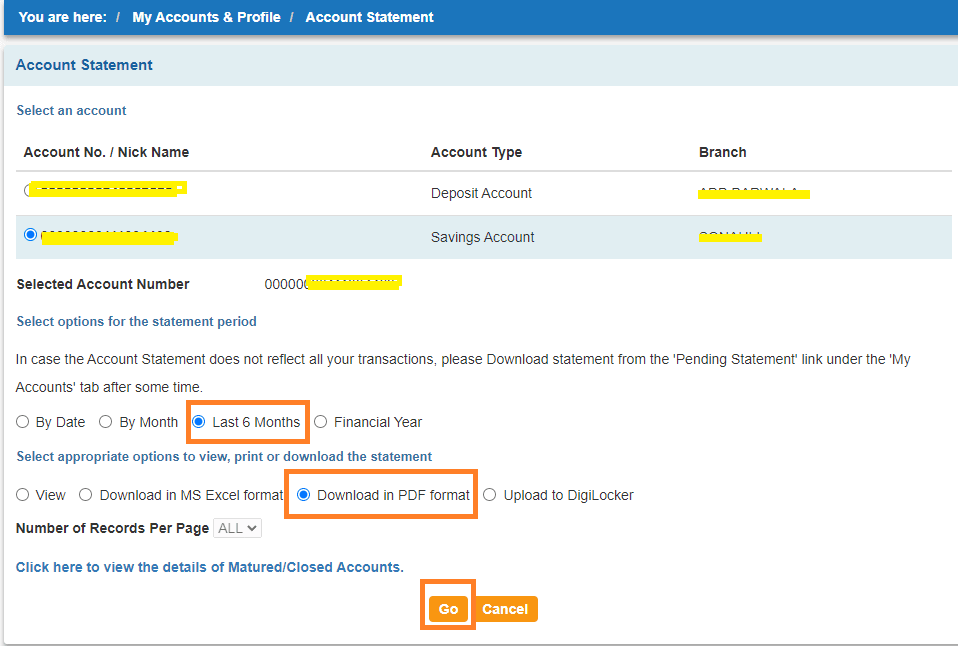

Step 3. After that, a new page will open up before you. Here, select a time frame option for which you want to check your account transaction history, such as: “By Date,” “By Month,” “Last Six Months,” and “Financial Year.” Then select the “View” option and click on the “GO” button.

Now, you can view and check your detailed account transaction history on the next screen.

According to method 4 and method 5, you can view and check your account transaction history through SMS and Call using the SBI Quick missed call banking service. For using this method, please ensure to register your bank account number for the SBI Quick missed call banking application. Otherwise, you will not be able to check your account transaction details using SMS and Call methods. Follow these effortless instructions as given hereunder:

- Open the message box on your mobile phone and send an SMS from your mobile phone number registered with the State Bank of India. The format of the SMS will be as given below:

You should type “REG Account number” and send it to 072089 33148. - After the registration process for the SBI QUICK application is successfully completed, your SBI account transaction history can be viewed and checked by SMS and Call. Let’s check how:

4. Check Transaction History in SBI through SMS

You should type “MSTMT” in your mobile phone’s message box and send it to 919223766666. After that, you will get the details of your bank account transaction through SMS.

5. Check SBI Account Transaction History By Calling

You should make a call at 919223766666. After that, you will get your account transaction history through SMS. Please note that your mobile number is essentially required to be registered/linked with the SBI. Otherwise, you can not check your account transaction history using SMS and call.

That’s all. By following the above-described four methods, you can quickly learn how to check your account transaction history in SBI Online.

The Bottom Line

Your account transaction history can help you to keep track of your transactions for spending and savings so you can be aware of your financial status at times and manage it accordingly.

However, your habit of checking the transaction history can also help you to perceive or notice any errors a vendor/retailer or any individual may commit when charging you for something. We expect you will find this blog post helpful for you.

Be the first to comment