Recently, the RuPay credit card was launched by the National Payments Corporation of India (NPCI) on the Unified Payments Interface (UPI) facility. This linkage enables the customers of several banks to use their credit cards for payments by scanning QR codes without carrying their cards with them anywhere all the time.

However, at the present time, this facility is available in some selected banks only, wherein only the RuPay credit card users can make use of it. However, a Visa or MasterCard credit card user is not allowed to use this facility for UPI payments so far.

In the recent past, UPI payments were allowed to link with Debit Cards only. But nowadays things are changing. Now, the UPI apps, such as GPay, PhonePe, and Paytm, will enable bank customers to add both their credit and debit cards to their UPI accounts. It means that just like a Debit Card, one can also add a Credit Card and make UPI payments. But there is a slight difference between the two: by linking the RuPay credit cards with UPI, the cardholders can avail of the short-term credit facility rather than spending funds from their savings account as in the case of the Debit Cards.

This blog post will help you with detailed information to provide you with straightforward guidance on how to add a credit card in the Phonepe app, how you can pay on PhonePe using a credit card, and what are the benefits of adding a credit card to PhonePe. Just stay with us and continue reading until the last word of this article. Let’s have a closer look at the deeper details for a good understanding. So proceed ahead with us without wasting any time.

Steps To Add Credit Card in Phonepe For UPI Payment

Suppose you want to add your credit card to the PhonePe app and make payments. But you have no idea how to do it. Don’t worry. Just follow some more information, easy step-by-step guidance, and the effortless process to help you as follows:

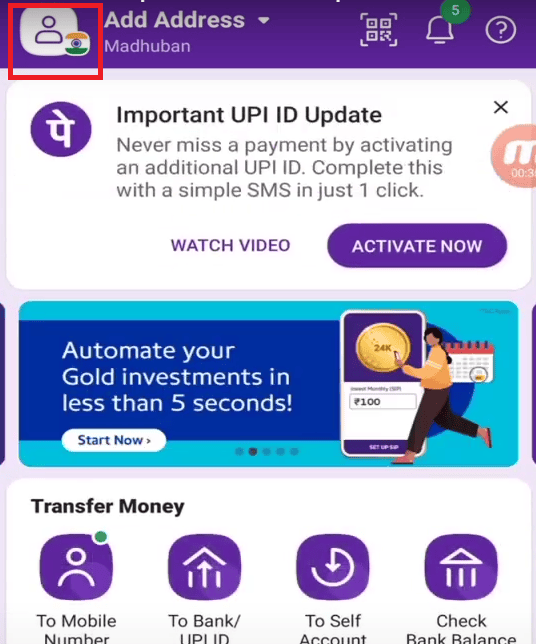

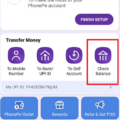

Step 1. Open the PhonePe application on your mobile phone. Click on the “Check Balance” option. Here, you will see the name of your bank. But you will not see the bank’s RuPay credit card. Go back to the home page and click on the “Profile” at the top left corner of the next screen.

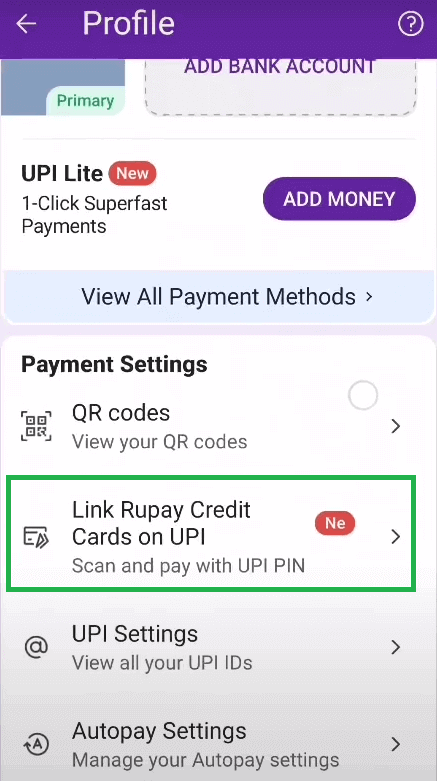

Step 2. Click on the “Link Rupay Credit Card on UPI” option on the next screen.

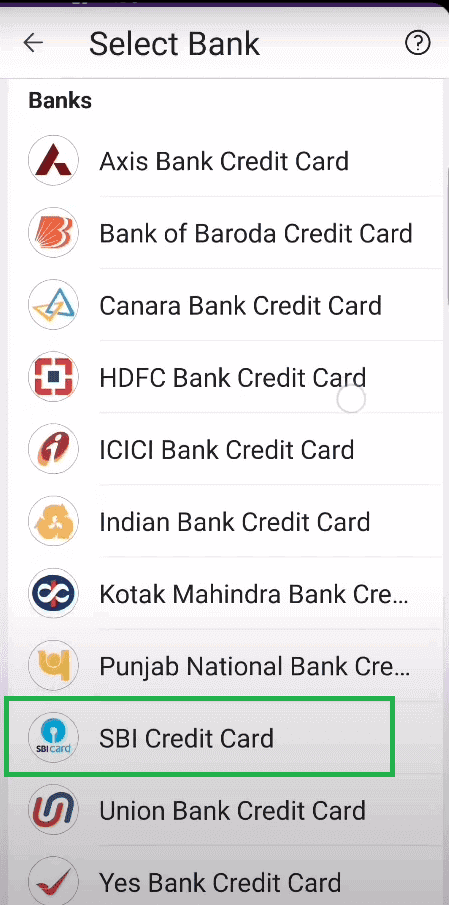

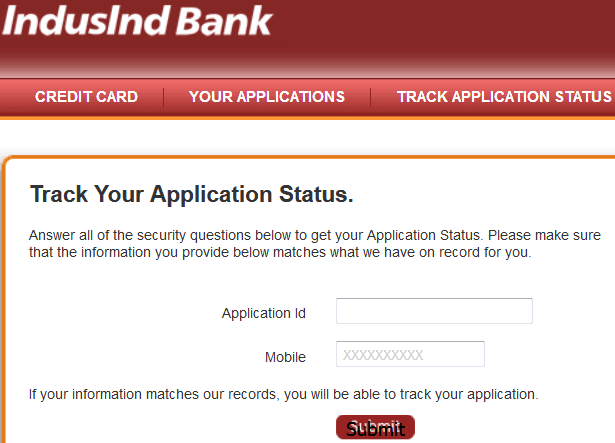

Step 3. Now, a list of various credit card issuer banks will appear on the next screen. If you have a RuPay credit card from any of the issuer banks shown in the given list, you can select the credit card issuer bank linked with. Otherwise, you will not be able to add it.

Suppose you have a RuPay credit card from the State Bank of India. Then click on the “SBI Credit Card” from the given list of the issuer banks.

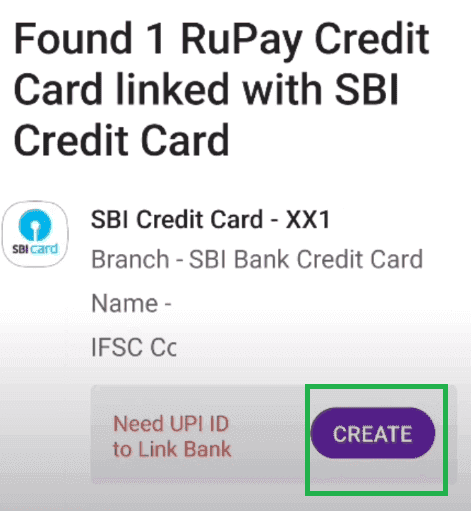

Step 4. After that, you will see the details of your SBI RuPay credit card on the next screen. Tap the “Create” button to make a new UPI ID.

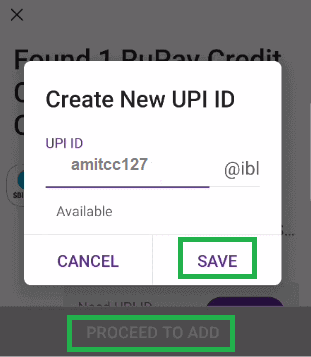

Step 5. Now, create a new UPI ID as required. Then click on the “Save” button followed by click on the “Proceed To Add” button.

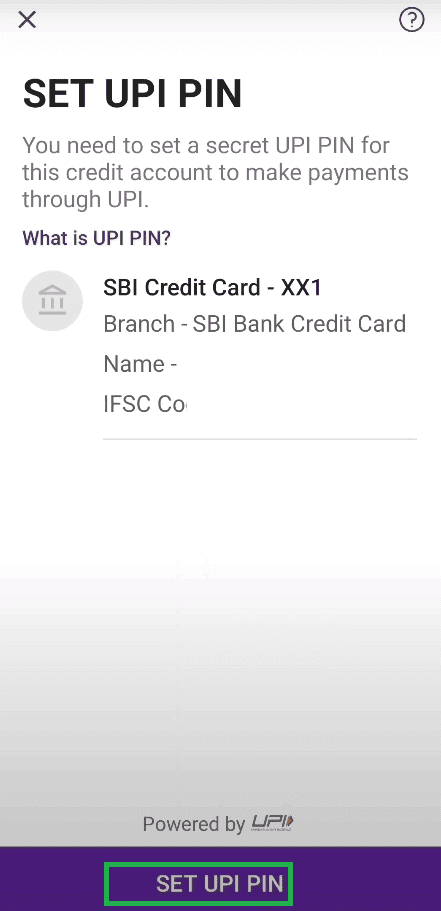

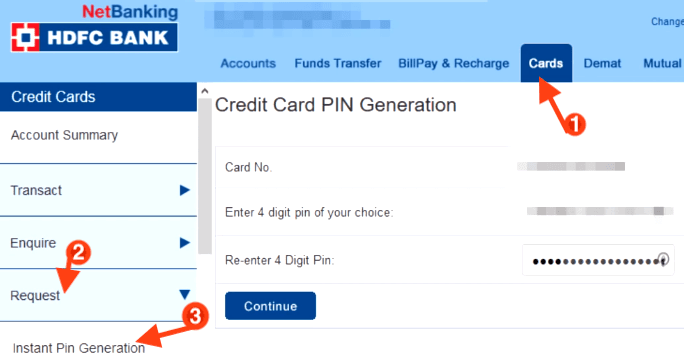

Step 6. After that, click on the “Set UPI PIN” button on the next screen.

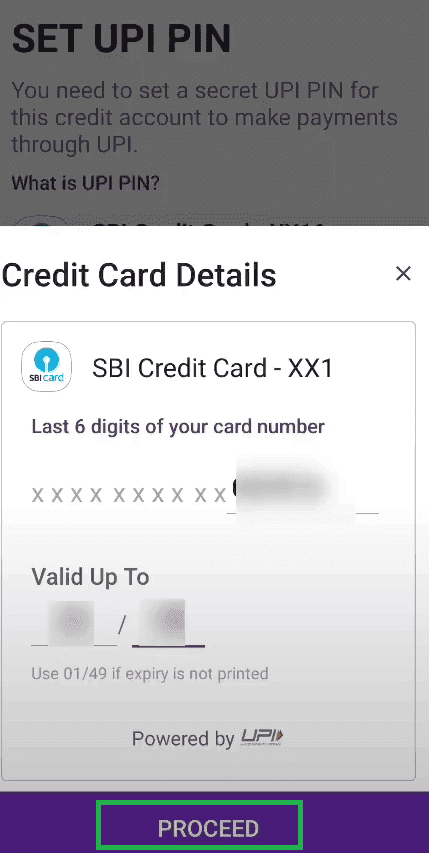

Step 7. Now, you will have to enter the last six digits of your SBI RuPay credit card and the month and year of its expiry as required. Then click on the “Proceed” button.

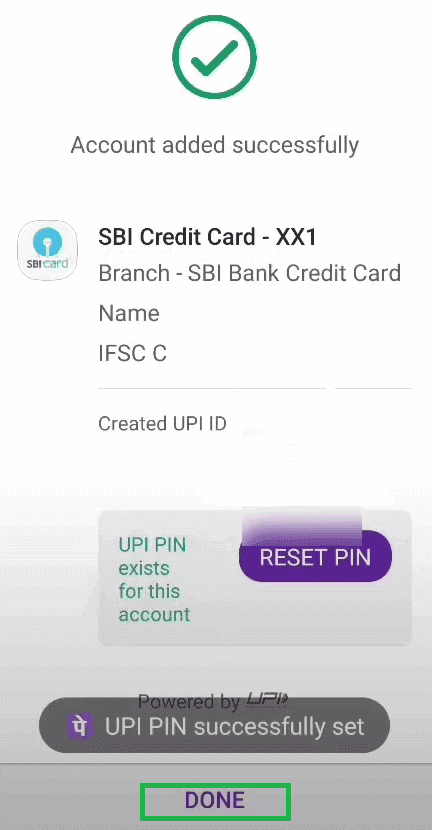

You will now receive an OTP on your registered mobile phone number. Enter the OTP as required. Create and enter a six-digit UPI PIN. Re-enter the UPI PIN to confirm it. After that, you will receive a message on your mobile phone that your UPI PIN is successfully set. Click on the “Done” button.

Now go back to the “Check Balance” option. This time, you will see both your SBI RuPay credit card and the name of your bank here. It means that your credit card is linked to the PhonePe application.

Click on the “SBI Credit Card – xxxx.” Enter your UPI PIN. After that, you will see the available balance and the outstanding dues with the credit card. Now, your SBI RuPay credit card is ready to pay on the PhonePe application.

Steps to use Credit Card in PhonePe For UPI Payment

Let’s check how your SBI RuPay credit card can be used for payments in the UPI payments application. Follow these easy steps hereunder:

Open the PhonePe application on your mobile phone. Click on the QR code icon at the top of your mobile screen. After that, scan the QR Code shown on the next screen. Now, you will see the name of the shop you want to pay for.

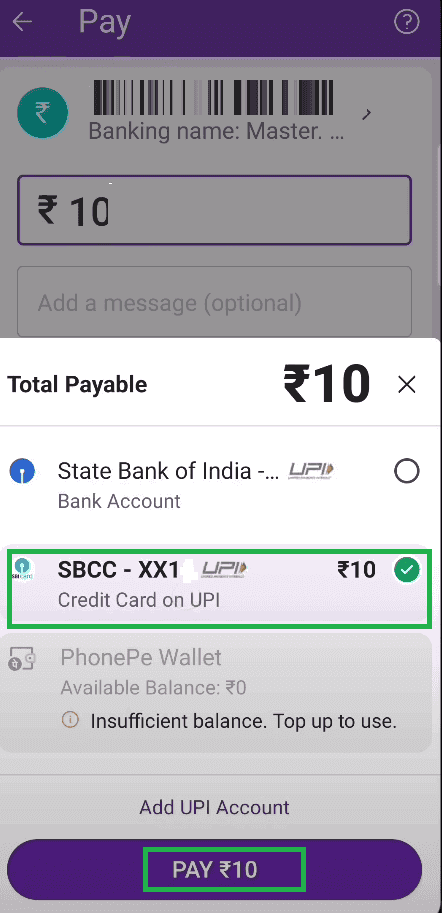

Enter the amount (for example, Rs. 10) you want to pay. Then click on the “Proceed To Pay” button. Now you will see your “SBI bank account – Rs. 10” and SBI Credit Card – Rs. 10“. It means that you can pay from both options.

Suppose you click on the “SBI Credit Card – Rs. 10” to pay. Click on the “Pay Rs. 10” button. Then, enter your UPI PIN as required. Finally, you will receive a message with details of your credit card that you have spent Rs. 10 on it, dated xx/xx/xxxx.

That’s it. By following the above processes and easy step-by-step guidance, you can quickly learn how to add a credit card to Phonepe and make UPI payments without any hassle.

To Wrap Up

You should know that by adding your credit card to the Phonepe application for UPI payments, you can only scan QR codes and use them for merchant payments. However, you cannot pay with regular bank accounts using your credit card for UPI payments.

After going through this article, hopefully, you will know how to add a credit card to the Phonepe application for UPI payments, how you can pay on PhonePe using a credit card, and what are the benefits of adding a credit card to PhonePe.

Be the first to comment