When it comes to the Public Sector Banks, it is really important for the customers and the people to know every single detail about them. This helps them in knowing more about how the different bank procedures work.

That is definitely a good thing. In this particular post that we have in here for you, we are going to talk about one of the most important procedures that you need to know about. Well, we all are familiar with the fact that SBI or the State Bank of India is known for providing different types of loans with the cheapest interest rates.

Whether you want to have a car loan or the house loan or just another personal loan, the interest rates are very cheap in the market. Well, SBI is one of the banks that has been providing such car loans to the people that have very competitive rates of interest.

So, it is important that we know all about it. However, there is another thing that people need to know about. Well, opening the car loan account in one thing but pre-closing the car loan account in the State Bank of India is a whole other thing.

It is essential that people know all that they can about it because they will be more informed. That is exactly what we are going to do in here. We are going to tell you how to close the SBI car loan account that you have.

Important note: You can’t close SBI Car loan account online, you have to branch to complete the process.

Steps to Close the SBI Car Loan Account

Well, when it comes to the closing of the SBI car loan account, turns out that it is not really that easy. There are certain steps that you need to follow in order to make sure that the process is complete without any difficulty.

So, it is recommended that you visit the branch manager of the SBI near you in order to have all the details. However, we are going to mention the steps for you in here as well so you might as well just have a look at it.

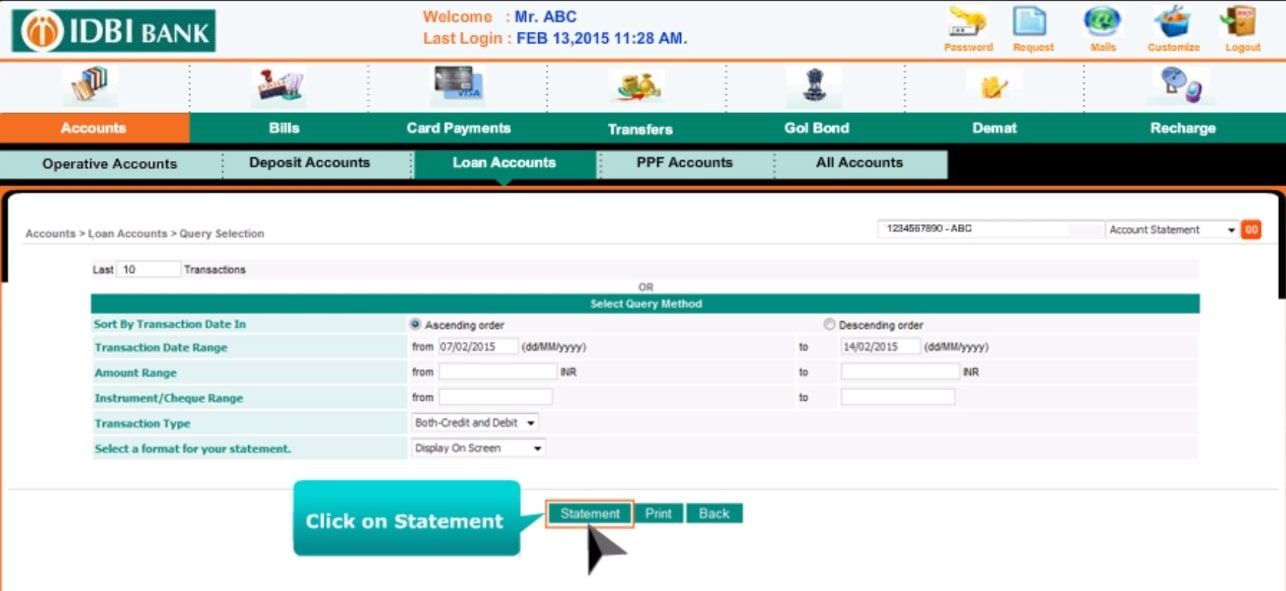

- One of the most important things that you absolutely need to have is the Statement of Account and also the Foreclosure Statement as well. This is required in order to tell the bank about the breakup of loan amount principal repaid. The Outstanding Principal, Interest Repaid, or the overdue charges are along with the monthly interest.

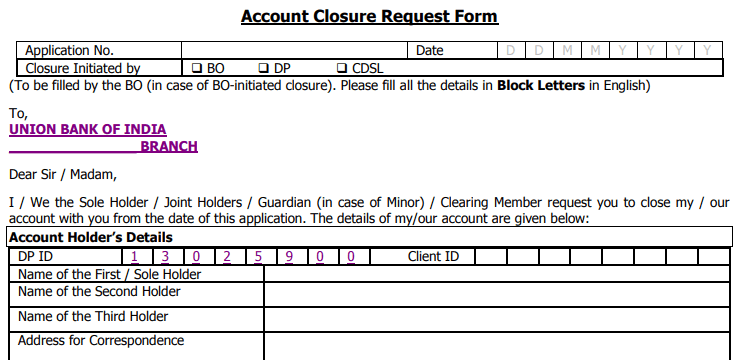

- The next thing to do in here would be to submit the application letter along with the ID proof, RC Photo so that you can pre-close the loan. You also need to attach a demand draft in there as well.

- After that, you will be able to get the receipt for the collection of the amount that comes during the closing of the account.

- After the clearance of the funds is complete, the loan account will be completely closed and it takes about one week to ten days in order to complete the whole process. After that, you can get the NOC or the No Objection Certificate.

So, that is all that you need to know about closing the car loan account in SBI.

sir.Iam k.mohanreddy.car loan ac no 3299437136.loan amount clear.3/9/2020.so i wanted n o c .loan closer certificate.

you have to visit your car loan branch with documents -adhar card,pan card , car loan reg certificate other and request to bank please close my car loan account