In the recent era of advanced technologies and this fast-moving world, we can see the increasing trend of digital transactions everywhere. And the latest payment technique, like Unified Payment Interface (or UPI), has become the most trending payment mode for money transfers, bill payments, and merchant payments among most people.

While using UPI payments, the money receiver can not know about your bank account details because they can only view your VPA (or Virtual Payment Address). So if you are using a VPA, you should know what is VPA in Google pay.

What Is a VPA in Google Pay?

Virtual Payment Address (VPA) is another name for a UPI ID. Some apps, such as Google Pay, Phonepe, and Payzapp, use the term virtual payment address. As a unique identifier, a Virtual Payment Address (or VPA) helps UPI to track a person’s bank account. However, using the VPA means no need for your bank account number and other details.

For example, you can use a VPA to make payments and request payments through a UPI-enabled app. Therefore, if you make multiple payments, you do need not to fill in your bank account details every time.

VPA in Google Pay Example

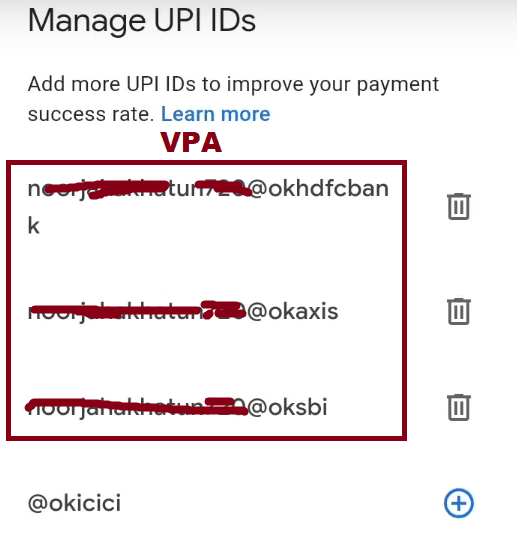

Typically, you can set a VPA like abc@bankname, where the ‘ABC‘ part can be anything. For example, it can be your name, your registered mobile number, or something else.

Moreover, the bank name in the example mentioned above can be the name of the bank with which you have an account. Alternatively, it can also be the name of the bank with which the app is linked or just the word ‘UPI.’

In general, a primary default VPA is set by the UPI app you’re working on. For example, ‘vijay@okhdfcbank,’ ‘Sonali25@Okaxis‘, and ‘123456789@ybl‘ can be different examples of VPA.

| Linked Bank | VPA Example |

|---|---|

| State bank of India | amitk20@oksbi |

| Axis Bank | amitk20@okaxis |

| ICICI Bank | amitk20@okicici |

How to get VPA in Google Pay?

Suppose you want to use a virtual payment address to make payments and request payments through a UPI-enabled app. Then by following some simple and easy steps as described below, you can know what is VPA in Google pay, such as:

Step 1: Firstly, open a Google Pay account on your mobile phone. Select the Profile Icon at the top-right corner of your mobile screen.

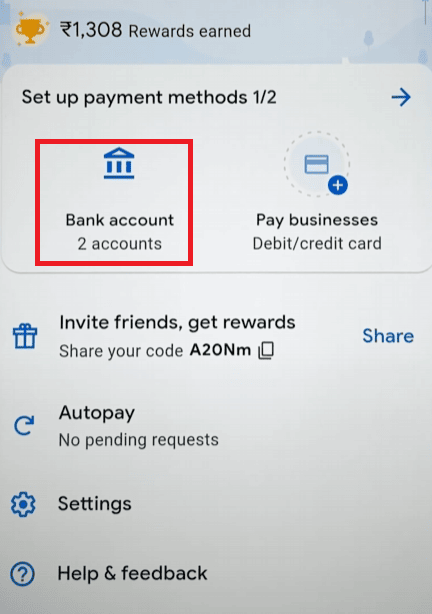

Step 2: Now, a new page will open up before you, showing you the many options, click on the Bank Account option.

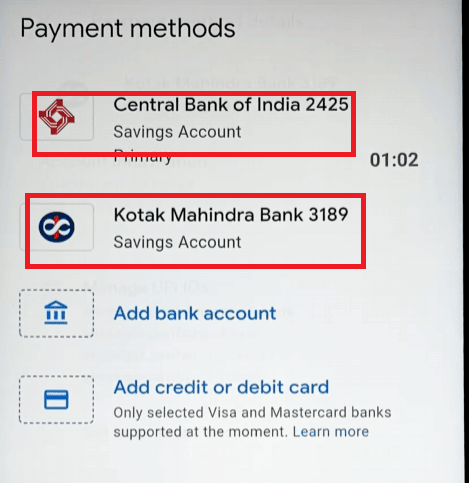

Step 3: Next, a new page will open up before you, showing you the Payment Methods title. Here you will see three options:

Your existing bank name and type of account

Add bank account, and,

Add credit or debit card.

Click on the first option: Your existing bank name and type of account.

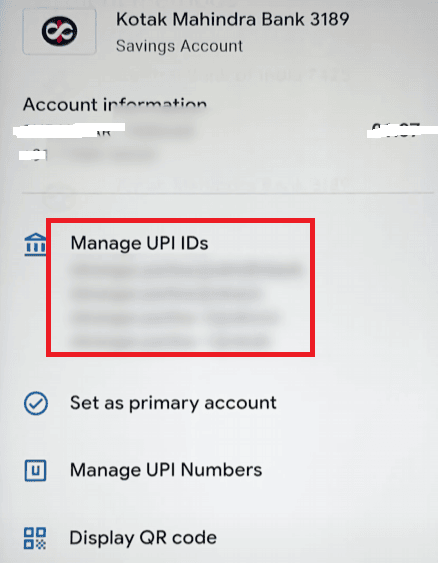

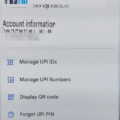

Step 4: Then, a new page will open up before you, showing you the Payment Method details title for Your bank name and type of account. Here you will see four options under the Account information title:

Manage UPI IDs

Display QR code

Forgot UPI PIN, and,

View account balance.

Click on the Manage UPI IDs.

Then, a new page will open up before you, showing you all the UPI IDs for your different bank accounts. These UPI IDs are the same as virtual payment addresses (or VPAs). Select and use your VPA ID for the concerned bank through which you want to make payment.

Then, you’ll receive a message on your Google Pay application to confirm your payment amount. After you confirm the payment, that amount will be deducted from your bank account and deposited to the beneficiary’s account.

So this way, you can know what is virtual payment address in Google pay, and you can easily use VPA for money transfers, bill payments, merchant payments, and more.

Conclusion

To conclude, we hope you have got a clear idea of what is VPA in Google Pay. We have done our best to assist you with insights on VPA and how you can use it on Google Pay. However, you should know that by using a feature under the UPI app settings, you can easily change or edit an existing VPA Number.

If your app supports that feature, you can link an existing VPA to a new one. Additionally, You can link all your bank accounts under a single VPA. You should remember that even if you don’t use Your VPA daily or periodically, it will not get lapsed when not in use.

WHAT IS ADDRESS OF GPAY TO ISSUE THE LEGAL NOTICE AGAINST THE FRAUD EXECUTED