Mobile Banking and other different third-party apps have brought the banking activities to your hand. You can perform all the activities like transfer, payments, recharge, etc. through the application. We have experienced the ease of banking and payments with the help of a smartphone and other different apps.

Till now we have experienced the payments by the online mode but what to do in the situation when we do not have access to the internet for the time being or what if we don’t have a smartphone? Well, we need not worry now or face the obstacle because we have USSD Based Mobile Banking now.

This mode of banking runs offline i.e. you do not need the internet or even smartphone to make the payments, transfer and other purposes. You can simply do your task by dialing the USSD Code *99# in your mobile phone from the Dialer Pad and multiple options will be displayed over there from where you can pick the required one.

This mode has covered most of the basic aspects which were covered in the online modes like mobile and telephone bill payments, DTH and Data Card, Electricity Bills, Petrol Pumps, Food Corners, etc.

This mode is developed so that all the people having access to normal feature phone can go to digital payment mode. It can be said one of the great efforts to make a cashless economy. This feature can be said especially developed for the people of rural areas who do not have access to the internet or smartphones.

USSD stands for Unstructured Supplementary Service Data which is operated with the help of GSM Telecom network. You need not worry about the features of the phone or any other aspects, you just need to follow the basic keypad dialer steps to get your task done.

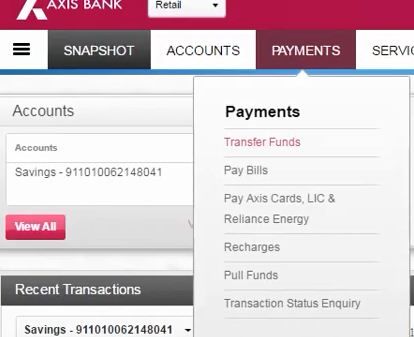

All the major banks assist the USSD payments. The banks like HDFC, SBI, Axis, BOB, PNB, Bank of India, Yes Bank and many other in the list. Let’s know the details about the USSD Banking process and procedure to use the best online mode.

Meaning of USSD

USSD is simply the code generated in the mobile number starting with ‘Asterisk‘ and ending with ‘Hash‘ which works with the mechanism that server of the telecom company communicates with the server of the bank and processes the task as instructed from the dialer pad instructions.

It is a very secure method so only registered mobile number can be used to dial and use the USSD Code and it can only give you the access to your bank account to make any kind of payments or transfer.

Language available for USSD Payments

Different languages are available for availing the USSD code payment so the people of any area/ region or state can use it without any difficulty. Not only educated, but the person with basic knowledge can also use this as they can get the interface in their local language as well.

As the development of this process is going on, so we cannot use all the services in a different language. Only the services like Balance Enquiry, Mini Statement and Funds Transfer can be done in all the available language. Other services like recharge, bills payments and other can be done only in English.

Currently, the languages supported in USSD Payments are with their respective codes are stated below:-

| Language | ussd code | Language | ussd code |

|---|---|---|---|

| English | *99# | Hindi | *99*22# |

| Tamil | *99*23# | Malayalam | *99*25# |

| Telugu | *99*24# | Kannada | *99*26# |

| Gujarati | *99*27# | Marathi | *99*28# |

| Bengali | *99*29# | Punjabi | *99*30# |

| Assamese | *99*31# | Oriya | *99*32# |

Restrictions, Limit and Charges on USSD Banking

- The minimum amount that can be sent is Rs. 1 and the maximum amount will Rs. 5,000 per transaction.

- The charge per transaction will be 0.50 that is added to the mobile bill.

- It works 24 hours in a day and every day of the week.

What’s the procedure to start the USSD Banking?

- The primary stage is to get your number registered to the bank account or in case you have already registered then you can start with the code dial.

- After the successful registration of your mobile number, you need to generate MMID number (Mobile Money Identifier Number) which is a seven-digit number sent by the bank after the successful registration of your mobile number.

Step wise process to use the USSD Banking

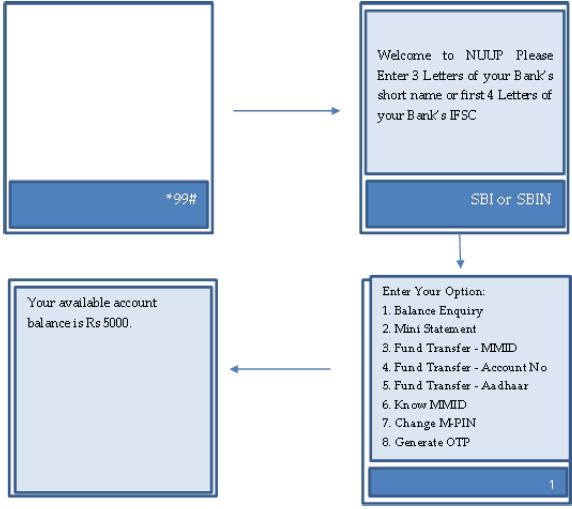

Step 1– Open your dial pad and dial *99# or any other options mentioned above depending on your language requirement.

Step 2– The following options in BOLD will be displayed on the screen which is to be used in the way described. The sub-processes are also included along with their explanation.

#Send Money

This option is to be used for sending money to any person. You need to go to the further option by pressing 1 and send button to make the choices which are briefed below-

- Mobile Number: This option can be used to send the money by using the receiving party’s mobile number. Enter 1 in the option and send then mention the mobile number of the beneficiary and click send. After that, you will be asked to put the UPI PIN for the security and entering the PIN No. you need to click send. The money will be successfully transferred which will be notified in the further screen.

- Payment Address: This option is used to send money using the registered address of the beneficiary. Just enter to the option 2 and enter the beneficiary payment address and click send. Then enter the amount in the next screen and enter the UPI PIN for the security. The money will be successfully sent and notified on the next screen.

- Saved Beneficiary: This option is used to send the money to those beneficiaries who are already saved. Enter the 3 number and send. Mention the serial number of the added beneficiary and send. Then after entering the amount and click the send button. Then after entering the UPI PIN No. and click send. The money will be successfully sent and notified on your next screen.

- IFSC, Account No: This option is chosen to transfer the money using Account Number and IFSC Code. Enter 4 number and send. Then enter the beneficiary bank’s IFSC Code then enter Account No. after clicking send. Then enter your UPI PIN No. to make the secure transfer from the next screen. The successful delivery will be notified on the next screen.

- MMID, Mobile Number: This can be used to send the money to send the money using the mobile number and MMID Number. Enter 5 and mention the beneficiary mobile number and then click send. After that enter the MMID Number and enter the UPI PIN No. then money will be successfully transferred after clicking send. Same will be notified on the next screen.

#Request Money

You can request money through this USSD Code. The step is very basic and you just need to enter 2 appearing in the first option displayed after dialling *99#. Then enter the mobile number or VPA of the person to whom you are intending to send the request. Post that step enters the amount to be requested and click send. The request will be successfully delivered and you will be notified the same in the next screen.

#Check Account Balance

This USSD Banking channel can be used to check your account balance as well. You need to enter 3 to the first page after dialing *99# and press send. Then after you need to enter your 3 letters of Bank’s short anme or first 4 letters of your Banks’s IFSC and sending that again your account balance will be displayed on the next screen.

Process of Checking SBI account balance USSD Code:

My Profile

This option is used to change the details of your bank account like address, language and much more. You need to press 4 and then following options will be displayed as indicated in number sequence along with their explanations-

- Change Bank Account: Enter 1 in the page displayed after pressing 3 and send. Then mention your bank name, first four letters of IFSC Code, Bank’s three letter short name and Bank’s two-digit numeric code in the menu appeared and send. The list will be displayed which is linked to your mobile number. Choose your preferred account by entering the serial number provided and send. The account will be changed.

- Change Language: Enter 2 in the menu displayed and then select the further number displayed in the option i.e. 1 for English and 2 for Hindi and click send. You will have your preferred language for operation. Currently, Hindi and English are only available.

- My Details: This option is used to see the details of own name or address, payment address, etc. Just press 3 and click send, the details like linked bank account, UPI PIN and other payment address will be displayed on the next screen.

- Payment Address: This option can be used to see and make changes to your primary payment address. Enter 4 in the menu appeared and click send. The primary address will be displayed which you can change by entering 1 again to the further menu. The list will be displayed on the screen regarding the payment address and you need to enter the serial number of desired payment address and click send to make it the primary payment address in your list.

- Manage Beneficiary: This option will be used to make changes i.e. edit, delete and add a beneficiary to your account. Enter the number 5 and then three option will be displayed 1 (For Add Beneficiary), 2 (For Delete Beneficiary) and 3 (For View Beneficiary). Select the desired option as per your requirement by clicking the number and send. You can make changes to your beneficiary list. The changes will be notified on your next screen.

Pending Request

It is quite clear from the option that it will be used to see the transactions that are pending. You need to enter 5 in the main menu option and the list of pending transactions will be displayed on the screen.

Transaction

This option is used to see the transaction that has been performed by you. Enter the number 6 in the main menu option and the list of transactions performed by you will be displayed on the screen.

UPI PIN

This option is used managing your UPI PIN i.e. you can change or reset the PIN through this option in case you have forgotten your PIN. Enter 7 in the main menu and send it. The two option will be available on the screen which is ‘Setting/ Resetting your PIN’ and next ‘Change UPI PIN’.

- Set/Forget UPI PIN– After pressing the 7, press 1 on the next option displayed. Enter the expiry date and last 6-digits of your debit card and click send. Mention your new UPI PIN and send it. Confirmation for the same UPI PIN will be asked, enter your UPI PIN again and send. The PIN will be reset.

- Change UPI PIN– You can also select the option 2 in case you want to change your PIN. Press 2 and send it. Then enter your old PIN and send it. Then after entering your new PIN and confirm it. The PIN will be changed.

Here the list of facilities is done that you can use through USSD Banking. It seems to be very effective and easy way to different types of transactions. Lot more features are in the process of development along with the USSD Banking along with more language added to the system. In spite of being so much useful service, I have noted some of the basic limitations with the USSD banking service. They are listed below-

- Though it does not require the internet for performing the transaction it is a quite lengthy process to perform the task.

- You have to respond quickly to the notification pop-up or else it will be cancelled and you will have to start from the beginning.

- As this system is not developed effectively, many times it has been found ERROR while performing the task.

- It cannot be used to make all types of payments like that available in the apps with internet access.

We have completed the detailed process for USSD Banking along with their features and limitations. Let us know your USSD banking experience through comment box. Keep in tune for more updates.

Be the first to comment