Online banking has become an integral part of everyone’s life. With the outbreak of a pandemic, most of the work was shifted online. All the banks started providing online services not to have to take care of banking work.

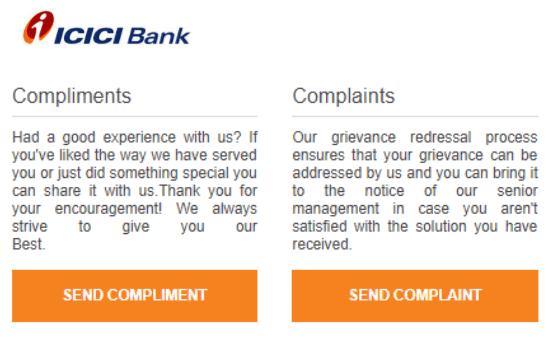

Whenever the services provided online, grievances will be there as machines and control everything. Thus, the banks need to have proper grievance redressal cells to lodge the complaints, and the banks can look after those complaints and make amends accordingly.

RBI formed a committee that suggested IDBI broaden its range of activities and unite the role to develop the finance and other activities by diverting away from the pre-existing conventions of commercial banking and developmental banking.

To stay updated with the reforms in the financial sector with the government’s changes and to develop India’s economy, IDBI restructured its role from a development finance institution to a commercial institution.

Steps to Lodge Complaint in IDBI Bank Online

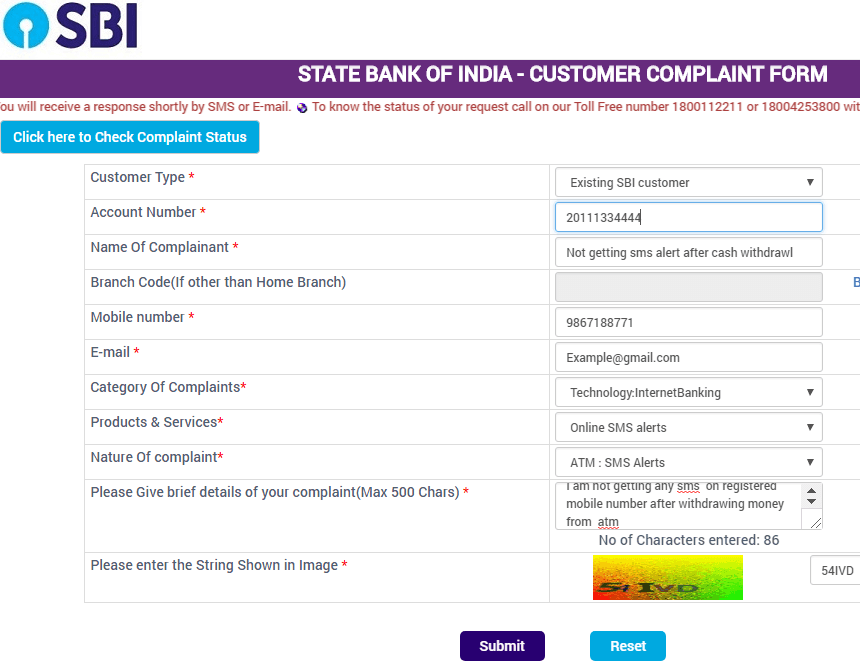

There is a lot in online transactions that can go wrong; therefore, the following levels should be followed to file a complaint online in IDBI Bank.

Level 1

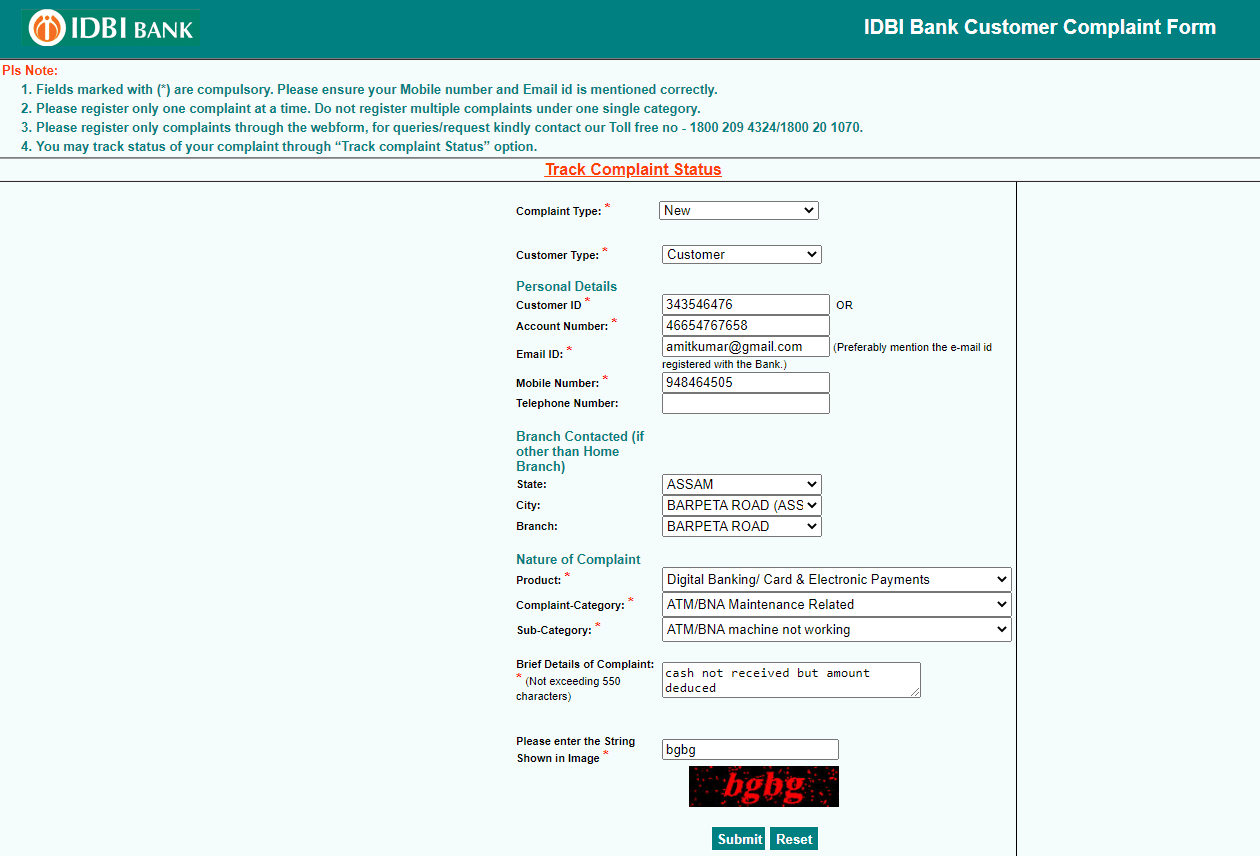

- First of all, you need to fill out the complaint form online on the IDBI online CRMS portal.

- Or you can write to them in the email id provided on the IDBI customer care site if you are not satisfied with the reply. Email Id: [email protected].

- Even if after 8 working days you don’t get the registration Id, then track your complaint in the link provided on the site. The grievance redressal cell is very efficient at getting back to you in the stipulated time.

- However, if anything goes wrong, you always have the option to call the authorities at toll-free numbers 1800-209-4324/1800-22-1070 who are in charge of resolving the issues. They will also help you lodge the complaint online and make the process smooth if something goes wrong.

| Services | contact |

|---|---|

| Complaint Toll-free Number | 1800-209-4324 or 1800-22-1070 |

| Non-Toll Free Number | 022-67719100 |

| NRI Complaint Number | +91-22-67719100 |

| Complaint through SMS | SMS “IDBICARE” to 9220800800 |

| [email protected] |

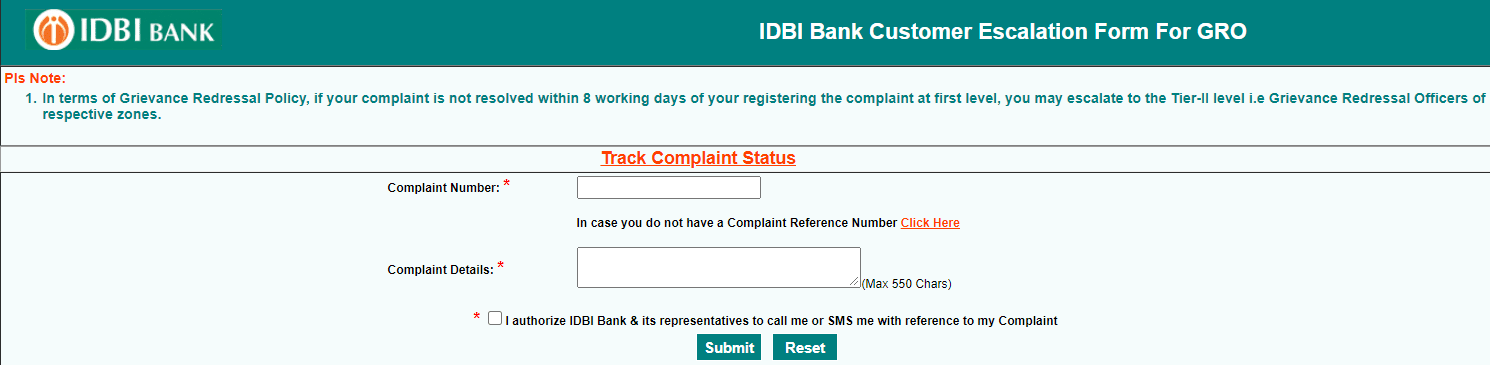

LEVEL 2: Complaint to Grievance Redressal Officers

If your complaint is not resolved within 8 working days, you may approach the Grievance Redressal Officers in IDBI bank office timing.

- To escalate the issue there, visit the official GRO link https://crmsonline.idbibank.com/grocomplaintform.aspx.

- Enter the Complaint number and complaint details, then click the submit button.

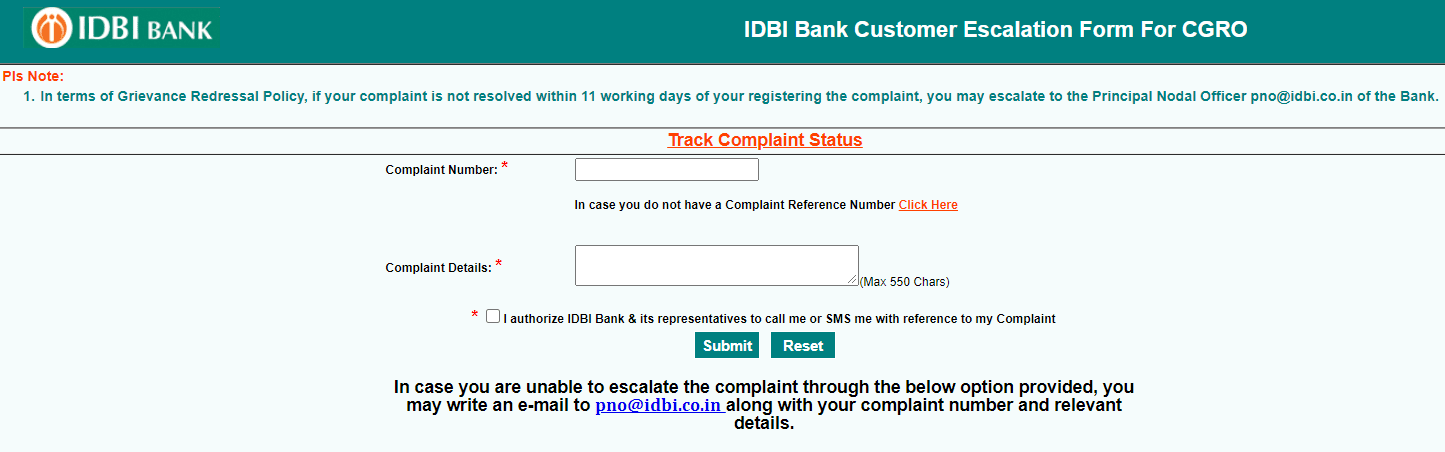

LEVEL 3: Complaint to Principal Nodal Officer

If your complaint is not resolved within 11 working days of your registering the complaint to GRO, you may approach the Principal Nodal Officer. You can email at [email protected] directly or submit online by following below steps:

- Visit the PNO link https://crmsonline.idbibank.com/cgrocomplaintform.aspx.

- Enter your complaint number and complaint details.

- Accept the terms and click the submit button.

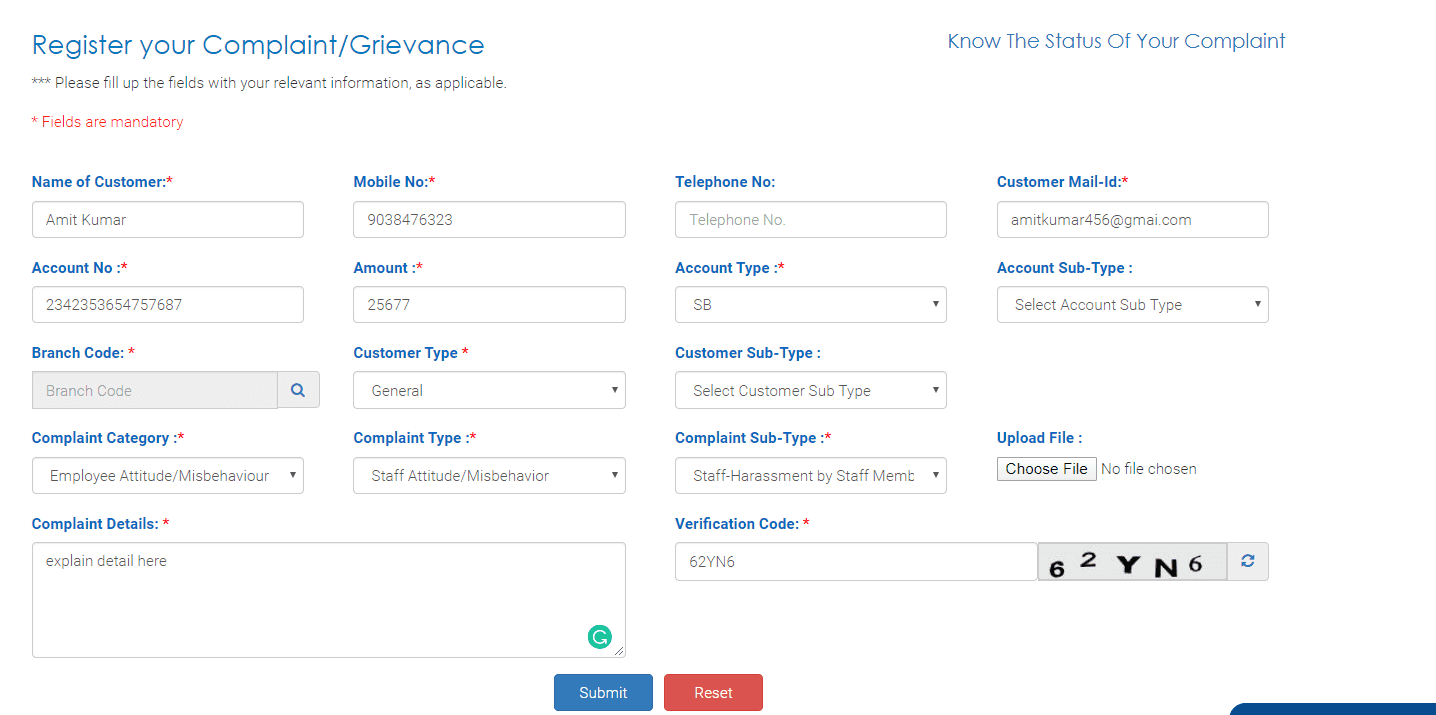

In case none of the methods works or satisfies you, you can always escalate the issue by filling the form in the Reserve Bank of India site that requires your personal details, transaction Id, and contact details that give a personalized experience and help resolve the problems better.

Follow: How To File Complaint Against Bank in RBI Online

Once you decide to fill-up the form for escalation of the issue, you have to fill up the following information like i.e., your account number/customer, ID, contact details (address, telephone number, and e-mail), the Reference number of Transaction/Complaint.

Conclusion

With the unresolved grievances, the bank’s goodwill can be affected, which cannot be good for any bank. The customer’s faith is really important for the banks as they trust their life savings and hard-earned money.

Thus, it cannot be seen with a light eye as it builds trust and brings goodwill to the bank’s name. It helps them build an empire on trust and faith. Thus, any scratch on it can hamper their market base immensely.

Therefore, the grievance redressal must be strong enough so that the customers face no problems when they are amidst a pandemic, and it’s not easy to handle problems offline.

Is bank ki sabse badi kami timing hai, itni jaldi kaun sa bank band hota h. other Pvt.banks bhi itni kam timing nhi h.Dur rehne waale aur service waalo k liye badi pareshaani h.