Everybody loves a secured future. However, to make the future secure it is always advisable by the financial experts to invest in a variety of sources. By investing in a variety of options the risk of bearing the loss at the same time is reduced, thereby creating more opportunities for increasing the profits. The share market has always been a lucrative option that tops the list of potential investments.

Nowadays, with the use of electronic platforms, trading has become more common and a lot of people have started investing their money in it. As easy as it may seem, for a common man it is not always that simple to get the tactics of the share market. Therefore, it is better to take the help of potential and popular electronic trading platforms while making entry into the share market. Zerodha broking limited is one of the Indian financial services companies which offer institutional and retail brokerage, e currencies, and commodities training along with mutual funds and bonds.

Zerodha is an online discount brokerage model which works on providing online trading services to its customers. It relies heavily on the usage of technology to give potential benefits to its customers. However, it is designed for people who can do the trading part by themselves and do not need the help of a broker. Being a beginner may become crucial for the customer to handle trading information all by himself. Despite this fact If the beginners take it as an opportunity for learning the stock market along with the use of trading tools, Zerodha can turn out to be a good option for them.

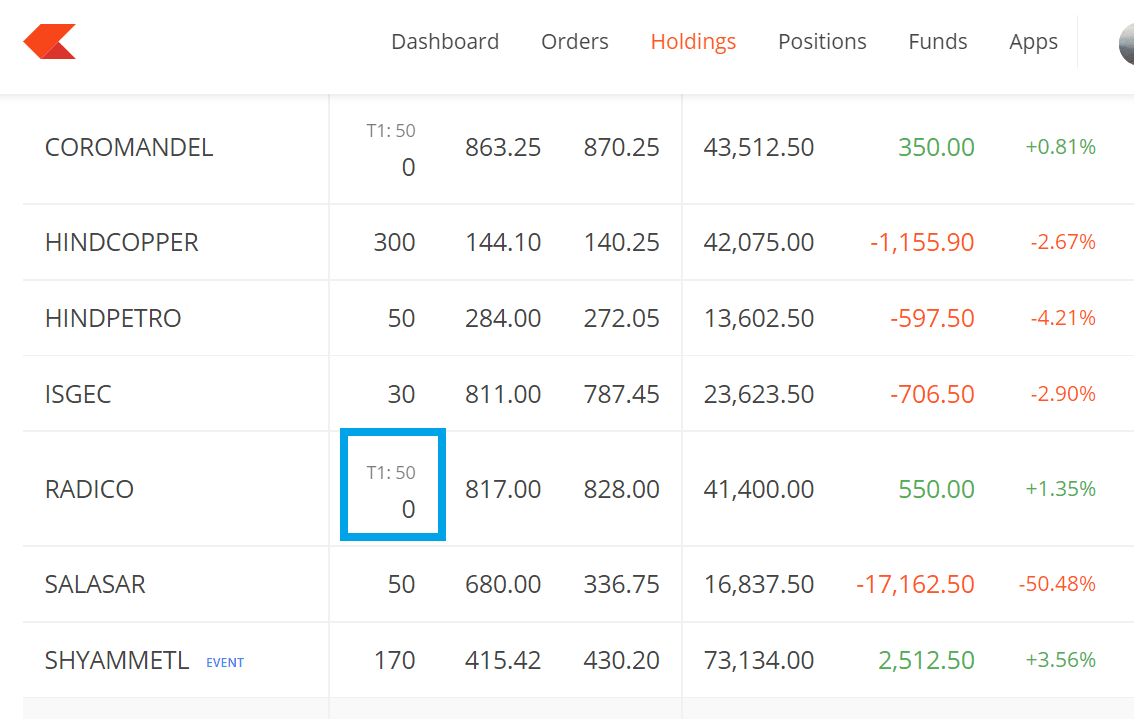

Zerodha holdings refer to the holding summary of the shares bought by the customer but they have not yet been credited into their Demat account. In India, a settlement cycle of t + 2 is followed. It means that when a buyer gets his shares on T, they will receive it in their Demat account only on T+2 later that evening. Therefore, even if the buyer has purchased a particular stock, they cannot claim the entire quantity of the stock until it is T+2. In case the buyer wants to sell this stock before the T+2 situation, they may run a risk of shortage thereby creating a short delivery.

For maintaining the simplicity of the process Zerodha segregates the holding of the customer in two menus so that it can be easily tracked. One is called T1 Holdings, while the other is called Holdings or T2 shares. T1 Holdings represent the stock that is unsettled and for which the delivery is being awaited. On the other hand Holdings or T2 shares represent the confirmed stock in the buyer’s possession. The shares which are purchased get reflected in T1 Holdings on T day, T+1, and T+2 day. As soon as the buyer receives these shares in their Demat account on the evening of plus two, T + 2 automatically gets moved to holdings after t + 2.

A short example will make things clear in a better way. For example, if the buyer has bought a thousand shares of XYZ Limited on Friday (T day), these shares will get reflected in T1 Holdings till Tuesday (which is T+2). After Tuesday, these shares will move to holdings.

Trading can be a crucial affair. However, the popularity of Zerodha makes it a fact of being a popular electronic platform for trading. It also accounts for about 15% of India’s real trade volume and offers discounted rates, along with reliable platforms and authenticity to its customers. So if you are also looking for a reliable electronic platform for your trading activity then Zerodha can turn out to be the best option.

Be the first to comment