HDFC Bank generates bank statements against active HDFC Bank Credit Cards of the cardholders every month and manages to send them to their registered email ID. These monthly statements are very important documents, which officially record all transaction details of the credit card account and contain the billing amount for a particular billing cycle. It is recommended that you regularly check your credit card statements carefully so that you can not only know your dues but also make sure that no unauthorized/fraudulent transaction has been performed on your credit card.

However, if you notice any unauthorized or suspicious transaction carried out on your credit card, you must immediately contact your bank branch to take necessary action in this regard.

This article walks you through detailed critical information to explore the significant features of the HDFC Bank credit card statement, its benefits, needs, and what is the password to open this password-protected credit card statement PDF file. Just stick around with us, and carry on reading continuously to learn more information on the above-talked subjects. So, without wasting any time, we are going to get into the complete post quickly. However, first, let us discuss some important features of the HDFC Bank credit card statement.

Features Of The HDFC Bank Credit Card Statement

The following are the essential features of the HDFC Bank credit card statement:

- HDFC Bank credit card holders are needed to access their registered email account and download the credit card statement received there to view it.

- HDFC Bank credit card statement comes in a PDF File format, which requires Adobe PDF Reader Software or any other suitable PDF Reader to open it.

- The credit card statement PDF file is password protected. So data leakage or misuse can be eliminated. Cardholders are needed to enter an 8-digit unique password to open the statement.

Following are the significant components of an HDFC Bank credit card statement you should know for how to check the billing cycle of the same as described hereunder:

- What is the statement period – The statement period of the credit card statement means the duration for which the credit card payment will be made.

- What is the Payment Due Date – Generally, the payment due date means the deadline by which you will have to pay the amount due to the bank. Otherwise, you will be eligible to pay fees/fines for late payment.

- What is the Total Amount Due – The total amount due means the amount due as of the statement date, which includes the opening balance, new purchases, fees/charges, etc.

- What is the Minimum Amount Due – The minimum amount due means you will have to pay a minimum amount due to the bank every month. Otherwise, you might be eligible to pay a fine as well for not paying less than this amount.

- What is the Closing Balance – The closing balance means the total amount due on the credit card.

- What is the Current Outstanding Balance – The current outstanding balance means the amount you will have to pay to the bank at a certain point of time.

- What is the Transaction History – Transaction history means a quick reference to all the transactions made during the billing cycle.

Steps to Open HDFC Credit Card Statement PDF Password

Suppose you are an HDFC credit card user. You have received a message in your email account regarding your credit card statement. But you don’t know how to open this password-protected PDF file. Don’t worry. Just follow these quick and easy step-by-step instructions hereunder:

Step 1: Open your registered email account on your mobile phone or any other device. Then, search and click to open the latest mail received for your HDFC credit card statement there.

Step 2: Once opened, you will see a message will be displayed on the next screen of your device, stating that your latest credit card statement PDF file is attached to this email. Next, scroll down to the bottom of your mobile/device screen to find the statement PDF file and Click on it.

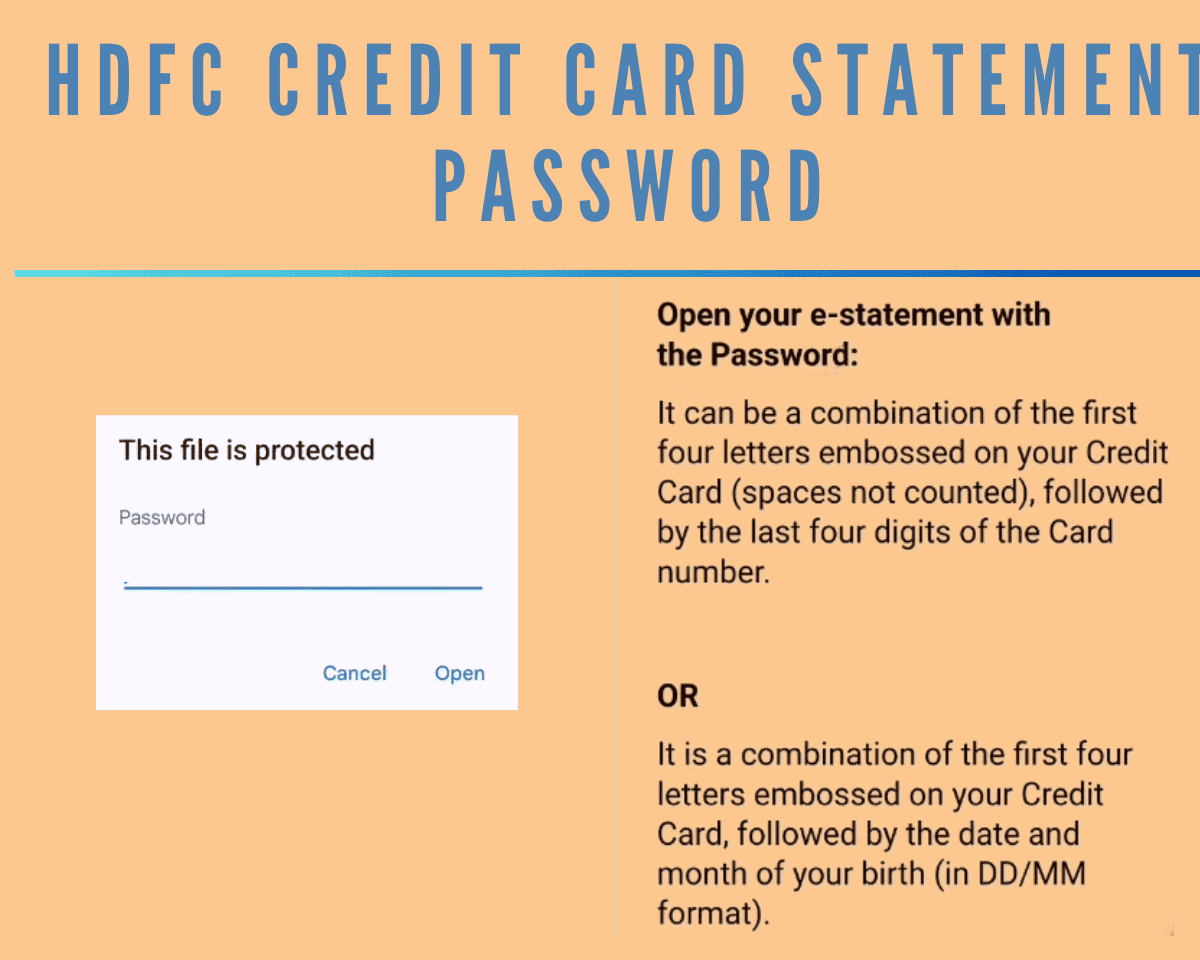

Step 3: After that, a pop-up message will be displayed on your device, stating that the credit card statement file is password protected. So, you will have to enter the correct password here to open it.

Please note: Your credit card statement PDF file can be opened and viewed by entering a password set by using any of the two methods:

1st method to HDFC credit card statement PDF password

Your required password is a combination of your name and date of birth. It requires the first four letters of your name (in capital letters), as embossed on your credit card statement, followed by the date and month of your date of birth in DD MM format, ignoring spaces and periods, if any.

For example, suppose your name is Sushil Yadav, and your date of birth is 17/11/1999, your password will be “SUSH1711“.

2nd Method to HDFC credit card statement PDF password

The required password can also be a combination of the first four letters of your name in capital letters, as embossed on your credit card statement, followed by the last four digits of your credit card number.

For example, suppose your name is Ramakant Dixit, and the last four digits of your credit card number are xxxxxxx3457; your password will be “RAMA3457“.

Step 4: Enter any of the two types of passwords in step 4 (listed above). Then click on the “Open” option.

Step 5: After that, your credit card statement will be opened and displayed on your device’s screen, wherein you can see all the details of it.

That’s it. By going through the above-discussed detailed information and following the easy, stepwise, effortless process, you can quickly learn about password for hdfc credit card statement.

To Wrap Up

We can expect that after enjoying going through this blog post, you will have a piece of good knowledge about the significant features of the HDFC Bank credit card statement, its benefits, and its needs, and what the password is to open this password-protected credit card statement PDF file.

Be the first to comment